Are you considering venture debt for your company’s financial strategy? It’s a smart choice for many growing businesses, but it’s important to understand the ins and outs of this financing option before making a decision.

Venture debt can provide the necessary capital to take your business to the next level without giving up equity. However, this type of financing comes with its own set of risks and considerations. In this article, we’ll explore whether venture debt is right for your company’s financial strategy.

Would venture debt suit my company’s financial strategy?

Understanding Venture Debt

Venture debt is a form of financing that involves borrowing money from a lender, usually a venture debt firm, with the expectation of paying it back with interest. Unlike traditional bank loans, venture debt is typically provided to startups and early-stage companies that have not yet reached profitability. This type of financing is often used to fund growth and expansion initiatives, such as hiring new employees, developing new products, or expanding into new markets.

Venture debt is a popular option for companies that have already raised venture capital funding. It can provide additional capital without diluting the equity of existing shareholders. Unlike equity financing, venture debt does not require the company to give up ownership or control. Instead, the lender receives interest payments and may also receive warrants or equity options as part of the deal.

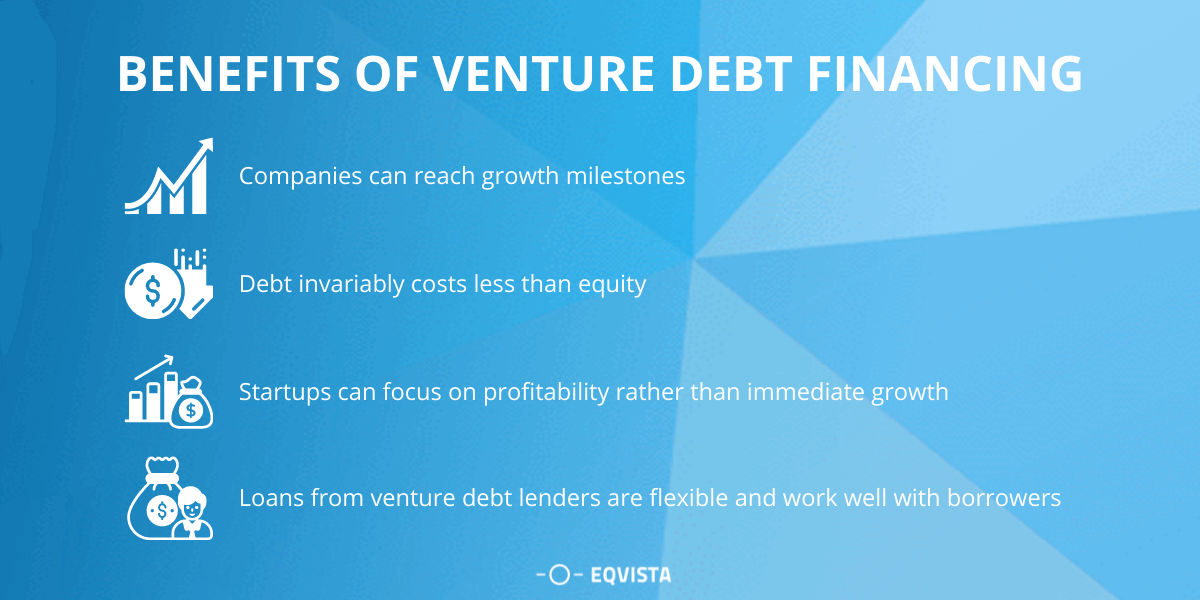

The Benefits of Venture Debt

There are several benefits to using venture debt as part of your company’s financial strategy. First, it can provide additional capital without diluting existing shareholders. This can be especially important for startups and early-stage companies that may not be able to raise additional equity financing without giving up a significant stake in the company.

Second, venture debt can be a more flexible form of financing than traditional bank loans. Lenders may be more willing to provide financing to companies that have not yet reached profitability or have limited assets to use as collateral. Additionally, venture debt can often be customized to meet the specific needs of the borrower, such as offering flexible repayment terms or allowing for partial prepayments.

Finally, venture debt can be a useful tool for managing cash flow. By providing additional capital, it can help companies avoid running out of cash during periods of rapid growth or unexpected expenses. This can be especially important for startups and early-stage companies that may not yet have established revenue streams.

The Drawbacks of Venture Debt

While there are many benefits to using venture debt as part of your company’s financial strategy, there are also some drawbacks to consider. First, venture debt can be more expensive than traditional bank loans. Lenders may charge higher interest rates or require additional fees, such as warrant coverage or equity options.

Second, venture debt can also be riskier than traditional bank loans. Because it is often provided to startups and early-stage companies, there is a higher risk of default. Lenders may require the borrower to provide personal guarantees or other forms of collateral to reduce this risk.

Finally, venture debt can be more complex than traditional bank loans. It may involve negotiating more complicated terms, such as covenants or restrictions on future financing. This can require more time and resources than a traditional bank loan.

Is Venture Debt Right for Your Company?

Whether or not venture debt is right for your company depends on a variety of factors. First, you need to determine whether or not you have already raised venture capital funding. If you haven’t, you may need to consider other financing options, such as traditional bank loans or equity financing.

Second, you need to consider your company’s financial position. Are you profitable, or do you expect to be in the near future? If so, venture debt may not be necessary. However, if you are still in the early stages of growth and expansion, venture debt may be a useful tool for managing cash flow and providing additional capital.

Finally, you need to consider the risks and benefits of venture debt. While it can be a flexible and useful form of financing, it can also be more expensive and risky than traditional bank loans. You need to weigh these factors carefully before deciding whether or not to pursue venture debt financing.

The Benefits of Venture Debt vs. Equity Financing

In addition to considering the benefits and drawbacks of venture debt, it’s also important to compare it to other forms of financing, such as equity financing. While both options can provide additional capital, there are some key differences to consider.

First, venture debt does not dilute the equity of existing shareholders. This can be especially important for startups and early-stage companies that may not want to give up control or ownership of the company.

Second, venture debt can be a more flexible form of financing than equity financing. It can often be customized to meet the specific needs of the borrower, such as offering flexible repayment terms or allowing for partial prepayments.

Finally, venture debt can be a useful tool for managing cash flow. By providing additional capital, it can help companies avoid running out of cash during periods of rapid growth or unexpected expenses.

The Drawbacks of Venture Debt vs. Equity Financing

While there are many benefits to using venture debt as part of your company’s financial strategy, there are also some drawbacks to consider compared to equity financing. First, venture debt can be more expensive than equity financing. Lenders may charge higher interest rates or require additional fees, such as warrant coverage or equity options.

Second, venture debt can be riskier than equity financing. Because it is often provided to startups and early-stage companies, there is a higher risk of default. Lenders may require the borrower to provide personal guarantees or other forms of collateral to reduce this risk.

Finally, venture debt can be more complex than equity financing. It may involve negotiating more complicated terms, such as covenants or restrictions on future financing. This can require more time and resources than equity financing.

Conclusion

Overall, venture debt can be a useful tool for managing cash flow and providing additional capital to startups and early-stage companies. However, it’s important to carefully weigh the benefits and drawbacks before deciding whether or not to pursue this type of financing. By considering factors such as your company’s financial position, whether or not you have already raised venture capital funding, and the risks and benefits of venture debt compared to other forms of financing, you can make an informed decision about whether or not venture debt is right for your company.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of financing that is typically offered to startups and early-stage companies. It involves borrowing money from a lender, usually a venture debt firm, with the expectation of paying back the loan with interest over a set period of time. Unlike traditional debt financing, venture debt usually comes with less restrictive covenants and may also offer the option of converting the loan into equity.

How does venture debt differ from equity financing?

While equity financing involves selling ownership in the company in exchange for capital, venture debt is a loan that must be repaid with interest. Equity financing is often used by startups and early-stage companies to raise funds without incurring debt, while venture debt can be a useful tool for companies looking to preserve equity or extend their runway.

What are the advantages of using venture debt?

One advantage of venture debt is that it can provide a source of capital without diluting the ownership of the company. Additionally, venture debt can be used to extend the runway of a company, allowing it to reach key milestones without needing to raise additional equity. Venture debt may also come with less restrictive covenants than traditional debt financing, giving companies more flexibility in how they use the capital.

What are the risks associated with venture debt?

One risk of venture debt is that it can be more expensive than other types of debt financing, with higher interest rates and fees. Additionally, if a company is unable to make payments on the loan, the lender may have the option to convert the debt into equity, which can dilute the ownership of existing shareholders. Finally, because venture debt is typically offered to early-stage companies, there is a risk that the company may not be able to generate enough revenue to repay the loan.

How can I determine if venture debt is right for my company?

Deciding whether venture debt is the right choice for your company will depend on a number of factors, including your financial strategy, growth plans, and risk tolerance. It may be helpful to consult with a financial advisor or accountant who can provide expert guidance on the best financing options for your business. Additionally, researching and comparing different types of financing, including venture debt and equity financing, can help you make an informed decision.

In conclusion, deciding whether venture debt is the right fit for your company’s financial strategy requires careful consideration. While this type of financing can provide valuable capital without diluting equity, it also comes with higher interest rates and strict covenants.

Before pursuing venture debt, it’s important to assess your company’s financial health and growth potential. If you have a solid business plan and a clear path to profitability, venture debt may be a viable option for achieving your goals.

Ultimately, the decision to pursue venture debt should align with your overall financial strategy and long-term objectives. By carefully evaluating your options and seeking expert advice, you can make an informed decision that sets your company up for success.