Venture debt has become an increasingly popular form of financing for startups and other high-growth companies. But what motivates lenders to issue this type of debt? In this article, we’ll explore the reasons why lenders are drawn to venture debt and what benefits it offers for both borrowers and lenders.

From providing an alternative to equity financing to offering the potential for higher returns, there are several key reasons why lenders are willing to take on the risk associated with venture debt. By understanding these motivations, you can gain a better understanding of how venture debt fits into the overall landscape of startup financing and whether it might be a viable option for your own business.

Why Lenders Issue Venture Debt

Venture debt, also known as growth debt, is a form of debt financing that is commonly used by startups and growing companies. Unlike traditional debt financing, venture debt typically involves lending money to companies that have already raised equity capital, rather than lending money in exchange for equity. In this article, we will explore the reasons why lenders issue venture debt to startups and growing companies.

1. Enhancing Capital Efficiency

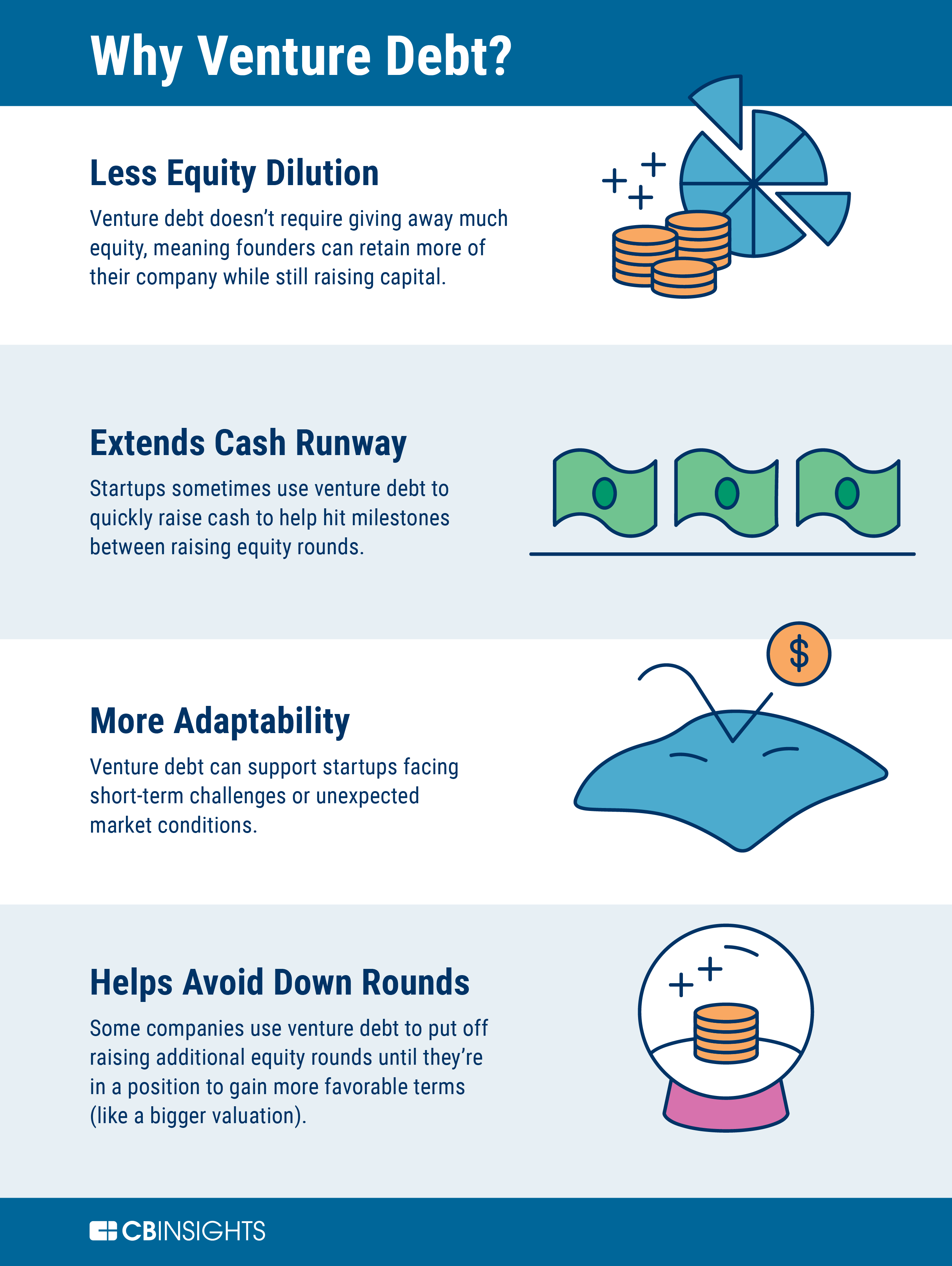

Venture debt is often used to enhance capital efficiency. By combining equity and debt financing, companies can achieve a higher return on invested capital. Venture debt can also help companies extend their cash runway, which can be critical to achieving growth milestones. In addition, venture debt can be less dilutive than equity financing, which allows companies to preserve ownership and control.

For example, let’s say a startup has raised $10 million in equity capital and is looking to raise an additional $5 million in debt financing to fund its growth. If the startup raises the $5 million through equity financing, it would have to give up additional ownership and control. However, if the startup raises the $5 million through venture debt, it can preserve ownership and control while still achieving its growth objectives.

2. Providing Growth Capital

Venture debt can also be used to provide growth capital to startups and growing companies. This capital can be used to fund product development, expand marketing efforts, or hire additional staff. Venture debt can be particularly useful for companies that are not yet cash flow positive but are rapidly growing their revenue base.

For example, let’s say a company is growing its revenue at a rate of 100% per year but is not yet profitable. In order to continue its growth trajectory, the company needs to invest in additional product development and marketing efforts. By raising venture debt, the company can fund these growth initiatives without diluting its ownership or control.

3. Mitigating Risk for Equity Investors

Venture debt can also be used to mitigate risk for equity investors. By providing additional capital through venture debt, companies can reduce their reliance on equity financing, which can be dilutive and risky for equity investors. Venture debt can also help companies achieve their growth objectives, which can ultimately increase the value of equity holdings for investors.

For example, let’s say a venture capital firm has invested $10 million in a startup that is looking to raise an additional $5 million in growth capital. If the startup raises the $5 million through equity financing, the venture capital firm’s ownership and control will be diluted. However, if the startup raises the $5 million through venture debt, the venture capital firm can preserve its ownership and control while still achieving its growth objectives.

4. Offering Flexible Financing Terms

Venture debt can also offer flexible financing terms that are tailored to the needs of startups and growing companies. Unlike traditional debt financing, which typically involves fixed interest rates and repayment schedules, venture debt can offer more flexible terms that are better suited to the cash flows and growth trajectories of startups and growing companies.

For example, venture debt can offer interest-only payments, which can be particularly useful for companies that are not yet cash flow positive. Venture debt can also offer warrants or other equity kickers, which can align the interests of lenders and borrowers and provide additional upside potential for lenders.

5. Providing a Non-Dilutive Financing Option

Venture debt can also provide a non-dilutive financing option for startups and growing companies. Unlike equity financing, which involves selling ownership and control in exchange for capital, venture debt involves borrowing money in exchange for interest payments and repayment of principal. This can be particularly useful for companies that are looking to preserve ownership and control.

For example, let’s say a startup has a high valuation but is not yet cash flow positive. By raising venture debt, the startup can preserve its ownership and control while still accessing the capital it needs to achieve its growth objectives.

6. Helping Companies Achieve Liquidity Events

Venture debt can also help companies achieve liquidity events, such as mergers and acquisitions or initial public offerings (IPOs). By providing additional capital to fund growth initiatives, venture debt can help companies achieve the scale and profitability necessary to attract potential acquirers or go public.

For example, let’s say a startup is looking to go public but needs additional capital to fund its growth initiatives and achieve profitability. By raising venture debt, the startup can access the capital it needs to achieve these objectives and increase its chances of a successful IPO.

7. Offering a Lower Cost of Capital

Venture debt can also offer a lower cost of capital than traditional debt financing or equity financing. This is because venture debt typically involves higher interest rates than traditional debt financing, but lower interest rates than equity financing. This can make venture debt an attractive option for companies that are looking to optimize their cost of capital.

For example, let’s say a startup is considering raising $5 million in growth capital. If the startup raises the $5 million through equity financing, it may have to give up significant ownership and control in exchange for the capital. If the startup raises the $5 million through venture debt, it can access the capital it needs while preserving ownership and control, and at a lower cost of capital than equity financing.

8. Providing a Source of Capital in Challenging Market Conditions

Venture debt can also provide a source of capital in challenging market conditions. During periods of economic uncertainty or market volatility, equity financing can be difficult to secure, and traditional debt financing can be more expensive or less available. Venture debt can provide a more stable and reliable source of capital during these periods.

For example, during the COVID-19 pandemic, many startups and growing companies faced challenges securing equity financing or traditional debt financing. Venture debt provided a valuable source of capital for these companies to continue their growth trajectories.

9. Offering a Faster and More Efficient Financing Option

Venture debt can also offer a faster and more efficient financing option than traditional debt financing or equity financing. Venture debt lenders typically have a streamlined due diligence process and can provide capital more quickly than traditional banks or equity investors. This can be particularly useful for companies that need to move quickly to capitalize on growth opportunities.

For example, let’s say a startup has a time-sensitive growth opportunity, such as a potential partnership or acquisition. By raising venture debt, the startup can access the capital it needs more quickly than if it had to go through a traditional bank or equity financing process.

10. Providing Access to Industry Expertise and Networks

Finally, venture debt lenders can provide access to industry expertise and networks that can help startups and growing companies achieve their growth objectives. Venture debt lenders typically have a deep understanding of the industries and markets in which they invest, and can provide valuable insights and connections to help companies achieve their growth objectives.

For example, let’s say a startup is looking to expand into a new market or vertical. By raising venture debt from a lender with expertise in that market or vertical, the startup can access valuable insights and connections that can help it achieve its growth objectives more quickly and efficiently.

In conclusion, venture debt can be a valuable financing option for startups and growing companies. By combining the benefits of both debt and equity financing, venture debt can provide flexible and efficient capital that can help companies achieve their growth objectives while preserving ownership and control.

**Frequently Asked Questions**

Here are some frequently asked questions about the reasons why lenders issue venture debt:

What is venture debt and why is it important for startups?

Venture debt is a type of debt financing provided to startups that have already raised equity financing from venture capitalists or angel investors. This type of debt is important for startups because it allows them to obtain additional financing without diluting their equity. Venture debt can be used to fund growth initiatives, such as expanding into new markets, hiring additional staff, or developing new products.

What are the benefits of venture debt for lenders?

Lenders issue venture debt because it provides them with an opportunity to earn a higher rate of return than they would with traditional debt financing. Venture debt typically has a higher interest rate and comes with warrants or options that give the lender the right to purchase equity in the startup at a discounted price. If the startup is successful, the lender can earn a significant return on their investment.

What are the risks of venture debt for lenders?

While venture debt can be a lucrative investment for lenders, it also comes with a higher level of risk than traditional debt financing. Startups are inherently risky, and there is a chance that the company may fail or be unable to repay the debt. If this happens, the lender may lose their investment or only be able to recover a portion of it.

How do lenders evaluate startups before issuing venture debt?

Lenders typically evaluate startups based on a variety of factors, such as their revenue growth, market size, competitive landscape, and management team. They also look at the startup’s existing capital structure and the terms of any existing equity financing. Lenders may require startups to meet certain financial or operational milestones before issuing debt financing.

What are the different types of venture debt?

There are several different types of venture debt, including senior debt, subordinated debt, and convertible debt. Senior debt is the most common type and is secured by the company’s assets. Subordinated debt is junior to senior debt and is typically unsecured. Convertible debt can be converted into equity if certain conditions are met, such as the startup raising a subsequent round of equity financing.

The Value of Venture Debt Explained – Trinity Capital Inc.

In conclusion, lenders issue venture debt for several reasons. Firstly, it allows them to provide financing to startups and emerging companies that may not have the collateral required for traditional loans. This not only benefits the borrower but also allows the lender to diversify their portfolio and potentially earn a higher return on investment.

Secondly, venture debt can provide more flexible terms than traditional loans, allowing borrowers to better manage their cash flow and invest in growth opportunities. This can be particularly valuable for startups that are still in the early stages of development and need capital to scale their business.

Finally, lenders also issue venture debt as a way to establish relationships with promising startups. By providing financing and support, lenders are able to build trust and potentially secure future business with these companies. In this way, venture debt can not only provide immediate benefits but also lay the groundwork for long-term partnerships.

Overall, venture debt can be a valuable tool for both lenders and borrowers, providing access to capital, flexible financing terms, and opportunities for growth and development.