Venture debt is a type of financing that is becoming increasingly popular among startups and emerging businesses. This type of debt is usually provided by specialized lenders who offer loans to companies that are not yet profitable or have limited assets. But why are more and more companies choosing venture debt as a financing option? In this article, we’ll explore some of the key reasons why venture debt is becoming the go-to choice for many businesses looking to raise capital.

Why Do Companies Choose Venture Debt?

Venture debt is a type of financing that is becoming increasingly popular among startups and growing businesses. While traditional equity financing is often the go-to option for early-stage companies, venture debt offers a number of benefits that make it an attractive alternative. In this article, we will explore the reasons why companies choose venture debt and how it can help them achieve their goals.

1. Access to Capital Without Dilution

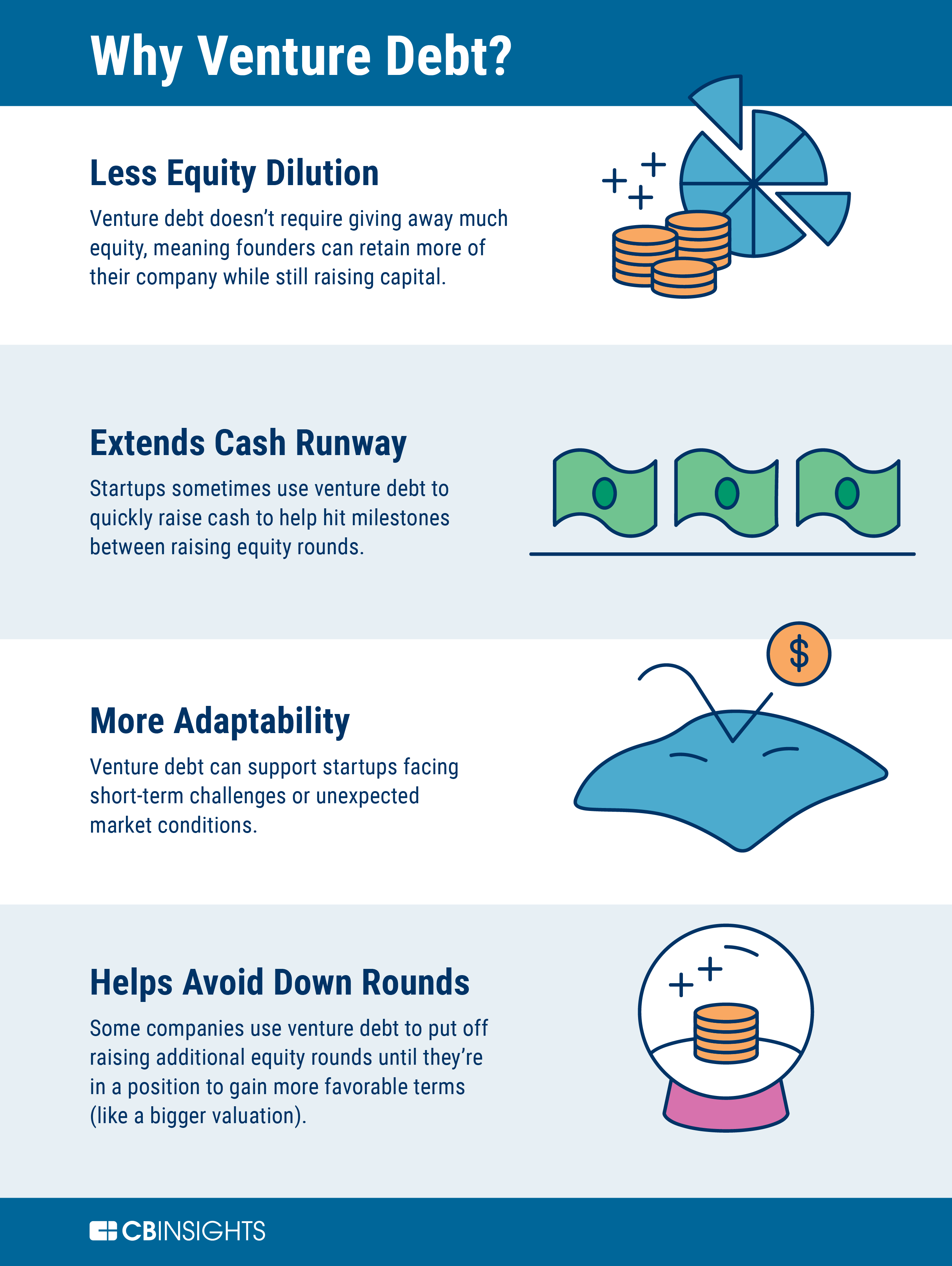

One of the primary benefits of venture debt is that it allows companies to raise capital without giving up equity. Equity financing requires companies to sell a percentage of their ownership in exchange for funding, which can dilute the founder’s stake in the company. Venture debt, on the other hand, is a loan that is secured by the company’s assets and future cash flow. This means that companies can access the capital they need without sacrificing ownership.

Another advantage of venture debt is that it can be obtained quickly and with less paperwork than equity financing. This can be particularly helpful for companies that need to move quickly to take advantage of an opportunity or to fund a project that has a tight deadline.

2. Lower Cost of Capital

Another reason why companies choose venture debt is that it is often less expensive than equity financing. Equity investors expect a high rate of return on their investment, which can result in a higher cost of capital for the company. Venture debt, on the other hand, typically has a lower interest rate than equity financing, which can result in a lower cost of capital overall.

Additionally, venture debt often comes with fewer fees than equity financing, which can further reduce the overall cost of capital. These fees can include things like legal and due diligence costs.

3. Flexibility in Repayment Terms

One of the benefits of venture debt is that it can be structured to meet the specific needs of the company. This means that repayment terms can be flexible and tailored to the company’s cash flow projections and other financial needs.

For example, some venture debt lenders offer interest-only repayments for a period of time, which can help companies manage their cash flow in the early stages of growth. Other lenders may offer deferred payments or balloon payments, which can help companies manage their debt service over time.

4. Additional Leverage for Equity Raise

Another reason why companies choose venture debt is that it can be used in conjunction with equity financing to provide additional leverage. This can help companies negotiate better terms with equity investors and reduce the amount of equity they need to sell.

For example, a company may use venture debt to fund a portion of a project, reducing the amount of equity they need to raise. This can help them negotiate better terms with equity investors, as they will have demonstrated their ability to manage debt and minimize risk.

5. Ability to Fund Growth Initiatives

Venture debt can also be an attractive option for companies that are looking to fund growth initiatives, such as expanding into new markets or launching new products. These initiatives can be costly, and traditional equity financing may not provide enough capital to fund them.

Venture debt can provide the additional capital needed to fund growth initiatives without diluting ownership or requiring the company to sell more equity. This can be particularly helpful for companies that are still in the early stages of growth and need to conserve their equity.

6. More Attractive to Venture Capitalists

Another reason why companies choose venture debt is that it can make them more attractive to venture capitalists. Venture capitalists often prefer to invest in companies that have a mix of equity and debt financing, as it can demonstrate that the company has a solid financial plan and is managing risk appropriately.

Additionally, venture debt can help companies extend their runway and reduce the need for additional equity financing. This can be attractive to venture capitalists, as it can reduce the dilution of their ownership and increase the potential return on their investment.

7. Control Over Financing

When companies choose venture debt, they retain control over the financing process. This means that they can negotiate the terms of the loan and ensure that it meets their specific needs.

Equity financing, on the other hand, often requires companies to give up control over the financing process and can result in a loss of control over the direction of the company. Venture debt allows companies to retain this control and ensure that they are making the best decisions for their business.

8. Limited Dilution for Founders

Another benefit of venture debt is that it can limit the dilution of the founder’s ownership. This can be particularly important for founders who have a strong vision for their company and want to retain control over its direction.

Equity financing can result in significant dilution for founders, which can reduce their stake in the company and limit their ability to make strategic decisions. Venture debt allows founders to retain more ownership and control, which can be important for the long-term success of the company.

9. Lower Risk for Investors

Venture debt is often considered lower risk than equity financing, as the loan is secured by the company’s assets and future cash flow. This can make it a more attractive option for investors who are looking for a lower risk investment.

Additionally, venture debt can provide investors with a steady stream of income through interest payments, which can be particularly attractive for investors who are looking for a consistent return on their investment.

10. Increased Valuation for the Company

Finally, venture debt can help increase the valuation of the company. By demonstrating that the company has a solid financial plan and is managing debt appropriately, venture debt can help increase the perceived value of the company.

This can be particularly important for companies that are looking to raise additional equity financing, as it can help them negotiate better terms and increase the amount of equity they are able to sell.

Conclusion

Venture debt is an attractive financing option for companies that are looking to raise capital without giving up equity. It offers a number of benefits, including lower cost of capital, flexibility in repayment terms, and increased control over the financing process. Additionally, venture debt can be used in conjunction with equity financing to provide additional leverage and increase the perceived value of the company. Overall, venture debt is a powerful tool that can help companies achieve their goals and grow their businesses.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of financing that combines elements of debt and equity. It is typically structured as a loan, but with several features that align with the needs of early-stage and high-growth companies. Venture debt can offer a way for companies to obtain additional capital without diluting the ownership stake of existing shareholders.

Unlike traditional debt, venture debt is often unsecured and can include warrants or equity kickers that give the lender the option to purchase equity in the company at a later date. The interest rates on venture debt are typically higher than traditional debt, but lower than equity financing.

How does venture debt differ from other types of financing?

Venture debt is different from other forms of financing, such as equity financing or traditional debt financing, in several ways. Unlike equity financing, venture debt does not involve the sale of ownership in the company. Instead, it is a loan that is structured to provide additional capital to the company while minimizing dilution for existing shareholders.

Unlike traditional debt, venture debt is often unsecured and can include equity kickers or warrants. This allows the lender to potentially benefit from the future growth of the company, while also providing additional capital to the company in the short term.

What are the advantages of using venture debt?

There are several advantages to using venture debt financing for companies. One of the main advantages is that it allows companies to obtain additional capital without diluting the ownership stake of existing shareholders. This can be especially important for early-stage companies that are looking to grow quickly.

Another advantage of venture debt is that it is often structured to include covenants that are less restrictive than traditional debt financing. This can provide companies with more flexibility in managing their cash flow and other financial obligations.

What are the risks of using venture debt?

As with any type of financing, there are risks associated with using venture debt. One of the main risks is that the interest rates on venture debt are typically higher than traditional debt financing. This can make it more expensive for companies to use venture debt as a financing option.

Another risk of using venture debt is that it can include equity kickers or warrants that give the lender the option to purchase equity in the company at a later date. This can potentially dilute the ownership stake of existing shareholders if the lender chooses to exercise these options.

When is venture debt a good option for companies?

Venture debt can be a good option for companies that are looking to obtain additional capital without diluting the ownership stake of existing shareholders. It can also be a good option for companies that have a strong growth trajectory and are looking for a financing option that allows them to maintain flexibility in managing their cash flow and financial obligations.

However, venture debt may not be the best option for all companies. It is important for companies to carefully consider their financial needs and goals before deciding whether to use venture debt as a financing option.

In conclusion, venture debt has become an increasingly popular option for companies looking to raise funds while maintaining control over their equity. By providing a flexible and less dilutive financing option, venture debt can be an attractive alternative to traditional equity financing.

Additionally, venture debt can be a good option for companies with strong growth potential but may not be quite ready for a larger equity round. Venture debt provides an opportunity to bridge the gap and continue to fuel growth without giving up too much equity.

Lastly, venture debt can also provide companies with access to valuable resources and networks through the lending firm. This can include introductions to potential customers, partners, and investors, as well as strategic advice and support. Overall, venture debt can be a smart choice for companies looking to grow and scale while keeping their equity ownership intact.