Are you an entrepreneur or startup founder looking for alternative funding options? Venture debt may be a viable option for your company’s growth, but where can you learn more about it? In this article, we will explore the various resources available to help you understand the ins and outs of venture debt financing. From online guides to industry experts, we’ll cover everything you need to know to make informed decisions about your company’s financial future. So, let’s get started on your journey to venture debt success!

Where can one learn more about venture debt?

Venture debt is a type of financing that provides capital to early-stage companies in exchange for debt. It’s a popular option for startups because it allows them to access funding without giving up equity. If you’re interested in learning more about venture debt, there are several resources available.

1. Online Venture Debt Resources

Online resources are a great place to start when learning about venture debt. There are several websites that offer comprehensive information on the subject. One of the best resources is the National Venture Capital Association (NVCA) website. The NVCA is a trade organization that represents the venture capital industry and provides information on venture debt.

Another great online resource is the Venture Debt Summit. This annual conference brings together venture debt providers, investors, and startups to discuss the latest trends and best practices in the industry.

2. Books on Venture Debt

There are several books that provide in-depth information on venture debt. One of the most popular books is “Venture Deals” by Brad Feld and Jason Mendelson. This book provides a comprehensive overview of venture capital and venture debt and is a must-read for anyone interested in the industry.

Another book to consider is “The Art of Venture Debt Financing” by Jerry Pollio. This book provides practical advice on how to structure venture debt deals and is a great resource for startups looking to raise capital.

3. Venture Debt Providers

Venture debt providers are companies that specialize in providing debt financing to early-stage companies. These providers can be a great resource for startups looking to learn more about venture debt.

Some of the top venture debt providers include:

– Silicon Valley Bank

– Hercules Capital

– TriplePoint Capital

– Square 1 Bank

– Bridge Bank

4. Venture Capital Firms

Venture capital firms are another great resource for learning about venture debt. Many venture capital firms also offer venture debt financing to their portfolio companies.

Some of the top venture capital firms that offer venture debt financing include:

– Bessemer Venture Partners

– Accel Partners

– Battery Ventures

– NEA

– Greylock Partners

5. Industry Conferences

Attending industry conferences is a great way to learn more about venture debt. These conferences bring together venture debt providers, investors, and startups to discuss the latest trends and best practices in the industry.

Some of the top industry conferences to consider include:

– Venture Debt Summit

– NVCA Annual Meeting

– Venture Capital Journal Summit

– Money 20/20

– Finovate

6. Business Schools

Many business schools offer courses on venture debt and other forms of alternative financing. These courses can be a great way to learn about the industry and network with other professionals in the field.

Some of the top business schools that offer courses on venture debt include:

– Stanford Graduate School of Business

– Harvard Business School

– Wharton School of the University of Pennsylvania

– Kellogg School of Management at Northwestern University

– Booth School of Business at the University of Chicago

7. Industry Associations

Industry associations are another great resource for learning about venture debt. These organizations represent the interests of venture debt providers, investors, and startups and provide valuable information on the industry.

Some of the top industry associations to consider include:

– National Venture Capital Association (NVCA)

– National Association of Small Business Investment Companies (NASBIC)

– Small Business Investor Alliance (SBIA)

– Angel Capital Association (ACA)

– Seed Stage Capital Association (SSCA)

8. Newsletters and Blogs

Keeping up with the latest news and trends in the industry is important when learning about venture debt. There are several newsletters and blogs that provide valuable information on the subject.

Some of the top newsletters and blogs to consider include:

– VentureBeat

– TechCrunch

– Crunchbase

– CB Insights

– Venture Capital Journal

9. Social Media

Social media can be a great way to learn about the latest trends and best practices in the industry. Following venture debt providers, investors, and startups on social media can provide valuable insights.

Some of the top social media accounts to follow include:

– Silicon Valley Bank

– Hercules Capital

– TriplePoint Capital

– Bessemer Venture Partners

– Accel Partners

10. Networking

Networking is a crucial part of learning about venture debt. Attending industry events and conferences, joining industry associations, and connecting with professionals on social media can all help you build valuable connections in the industry.

In conclusion, there are many resources available for those looking to learn more about venture debt. From online resources to industry conferences, there are many ways to gain valuable insights into this important form of financing. By taking advantage of these resources, you can gain a deeper understanding of venture debt and how it can benefit your startup.

Frequently Asked Questions

What is venture debt and how does it work?

Venture debt is a type of debt financing that is designed for startup companies. It provides companies with access to capital that they can use to grow their business without diluting their ownership. Venture debt works by providing companies with a loan that is secured by their assets or revenue. Unlike traditional bank loans, venture debt is often provided by specialized lenders who understand the unique needs of startup companies.

In addition to providing capital, venture debt lenders may also offer additional support such as introductions to potential investors or guidance on financial planning.

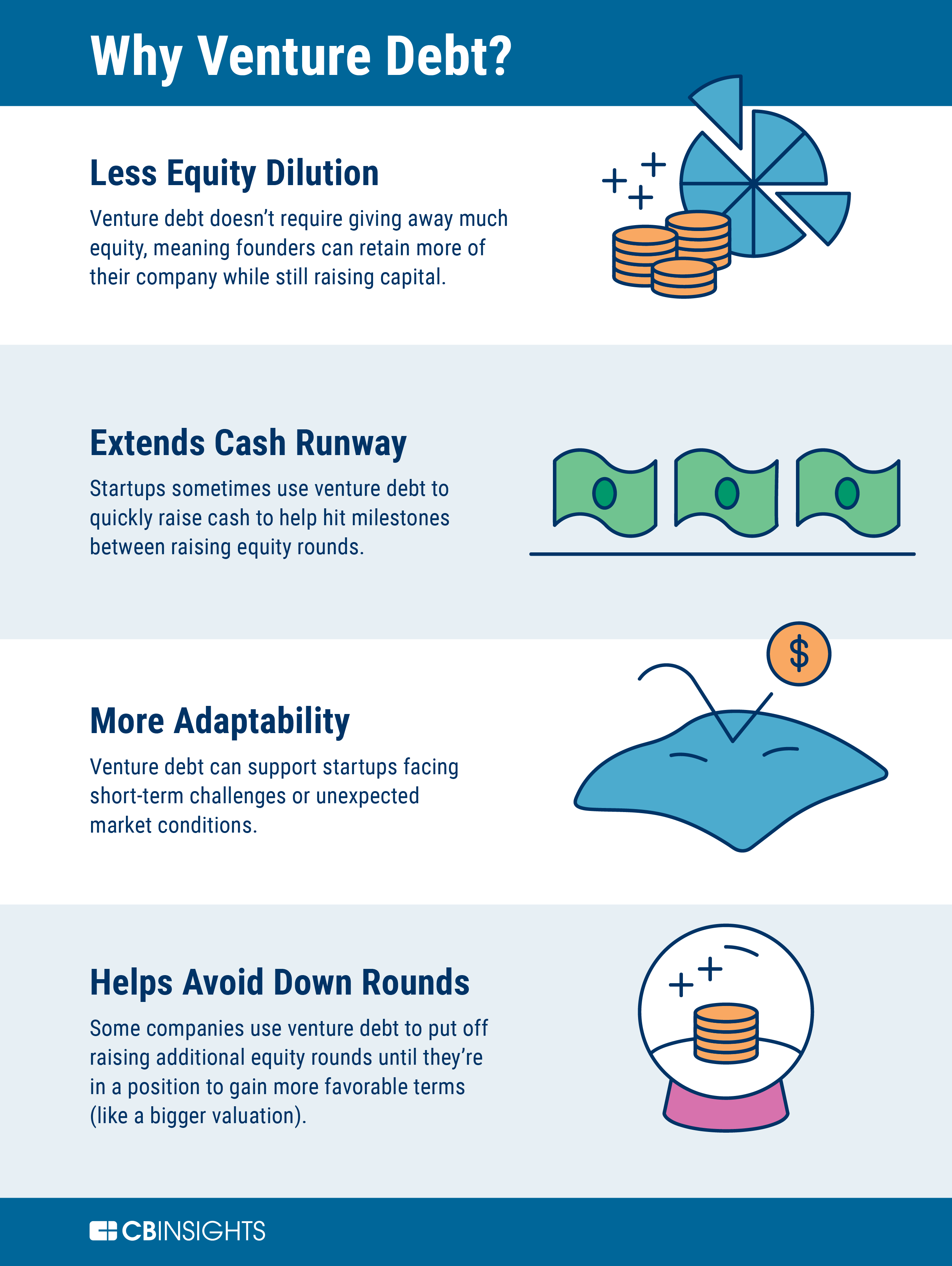

What are the benefits of venture debt?

One of the main benefits of venture debt is that it allows companies to raise capital without giving up equity. This can be particularly important for startup companies that are looking to maintain control over their business. In addition, venture debt can be a more flexible form of financing than traditional bank loans, with lenders often willing to work around the specific needs of the company.

Another benefit of venture debt is that it can help companies to build their credit rating and improve their chances of securing additional financing in the future.

What are the risks associated with venture debt?

Like any form of debt financing, venture debt carries risks. One of the main risks is that the company may not be able to repay the loan. This can result in the lender taking ownership of the company’s assets or revenue, which can be particularly damaging for startup companies.

Another risk is that the lender may require the company to meet certain performance targets or milestones. If the company fails to meet these targets, the lender may be able to take action, such as calling in the loan or requiring the company to raise additional capital.

How can companies qualify for venture debt?

To qualify for venture debt, companies typically need to have a strong track record of performance and a clear plan for how they will use the capital. Lenders will often look at a range of factors, including the company’s revenue, profitability, and growth potential.

In addition to meeting these criteria, companies may also need to provide collateral or a personal guarantee from the company’s founders. Lenders may also conduct a detailed due diligence process before providing the loan.

Where can companies learn more about venture debt?

Companies can learn more about venture debt by speaking to specialized lenders who offer this form of financing. There are also a range of resources available online, including industry publications and blogs, as well as educational resources provided by organizations such as the National Venture Capital Association and the Small Business Administration. Additionally, attending industry events and networking with other entrepreneurs can also be a valuable way to learn more about venture debt and other forms of financing.

In conclusion, venture debt is a viable financing option for startups looking to expand their business. However, it is important to educate oneself on the subject before diving in. Fortunately, there are many resources available for those who want to learn more.

One great place to start is online. There are a number of articles and blogs dedicated to discussing venture debt. These resources can provide valuable insights into the benefits and drawbacks of this type of financing, as well as tips for finding the right lender.

Another option is to attend industry conferences and events. These gatherings provide a great opportunity to network with other entrepreneurs and investors, and to learn from experts in the field. Many conferences also offer workshops and seminars specifically focused on venture debt.

Finally, entrepreneurs can also seek out advice from experienced professionals, such as attorneys, accountants, and financial advisors. These experts can provide valuable guidance on the legal and financial aspects of venture debt, and can help entrepreneurs navigate the complex landscape of startup financing.

Overall, there are many ways to learn about venture debt, and entrepreneurs should take advantage of as many resources as possible in order to make informed decisions about their financing options. With the right knowledge and support, venture debt can be an excellent tool for growing a successful business.