Are you a startup owner looking for additional funding to scale your business? If so, you’ve probably heard of venture debt. But when is the right time to consider this type of financing?

Venture debt can be a useful tool for startups that have already raised equity funding and are looking to accelerate growth without further diluting ownership. However, it’s important to carefully assess your company’s financial position and growth potential before taking on debt. In this article, we’ll explore the factors to consider when deciding if venture debt is right for your startup.

When is the right time for venture debt?

Venture debt is a type of financing that allows startups to borrow money without giving up equity. While it can be a useful tool for companies looking to scale quickly, it’s important to know when the right time is to take on this type of debt. In this article, we’ll explore the different scenarios where venture debt makes sense and when it may not be the best option.

1. When You Need to Scale Quickly

If your startup is experiencing rapid growth and needs to finance its expansion, venture debt can be a good option. Unlike equity financing, venture debt doesn’t dilute the ownership stake of the existing shareholders. This means that your current investors won’t lose their stake in the company and your ownership won’t be diluted.

In addition, venture debt can be obtained quickly and with less due diligence than equity financing, which can be important if you need to move fast to take advantage of a market opportunity. However, it’s important to remember that venture debt does come with interest payments, so you’ll need to make sure that your cash flow can support the additional debt service.

2. When You Have a Clear Path to Profitability

Venture debt can also be a good option for startups that have a clear path to profitability. If you know that your business model is sound and that you’re on track to start generating revenue, venture debt can help you bridge the gap until you become cash flow positive.

In addition, venture debt can be less expensive than equity financing over the long term. While you’ll still need to make interest payments, the cost of that debt can be lower than the cost of giving up equity. This can be particularly true if you’re able to negotiate favorable terms with your lender.

3. When You Want to Preserve Your Equity

Another advantage of venture debt is that it allows you to preserve your equity. If you’re not ready to give up a portion of your company to investors, venture debt can be a good alternative.

In addition, venture debt can be a good option if you’re not yet ready for equity financing. If you’re still in the early stages of your startup and haven’t yet proven your business model, venture debt can be a good way to finance your growth without giving up equity.

4. When You Need to Finance Capital Expenditures

Venture debt can also be used to finance capital expenditures, such as the purchase of equipment or the expansion of a facility. This can be particularly useful for companies that need to purchase expensive equipment to support their growth.

In addition, venture debt can be less restrictive than other forms of debt. For example, some venture debt lenders may be willing to lend money to startups that don’t have a long credit history or haven’t yet established a track record of profitability.

5. When You Need to Bridge a Funding Gap

Venture debt can also be used to bridge a funding gap between equity financing rounds. If you’re in the process of raising a new round of equity financing but need additional funds in the meantime, venture debt can help you bridge that gap.

In addition, venture debt can be more flexible than equity financing. You may be able to negotiate more favorable terms with your lender, such as a longer term or a lower interest rate.

6. Benefits of Venture Debt

One of the main benefits of venture debt is that it allows you to finance your growth without giving up equity. This can be particularly important if you’re not yet ready for equity financing or if you want to preserve your ownership stake in the company.

In addition, venture debt can be obtained quickly and with less due diligence than equity financing. This can be important if you need to move fast to take advantage of a market opportunity.

7. Vs Equity Financing

While venture debt has its advantages, it’s important to remember that it’s not the same as equity financing. Equity financing allows you to raise capital without taking on debt. In exchange for that capital, you give up a portion of your ownership stake in the company.

In addition, equity financing can be more expensive than venture debt over the long term. While you won’t have to make interest payments, the cost of giving up equity can be higher than the cost of taking on debt.

8. How to Evaluate Venture Debt

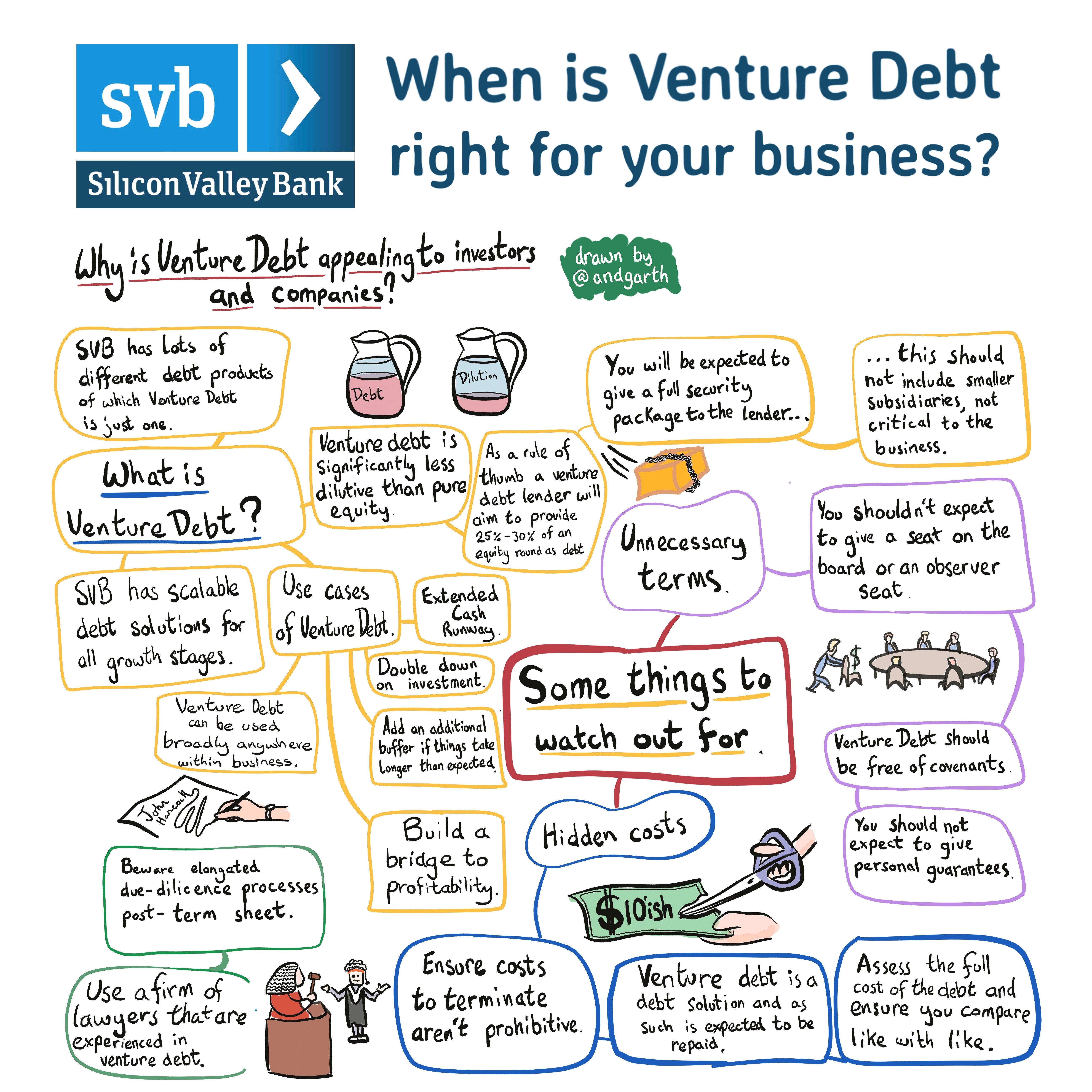

If you’re considering venture debt, it’s important to evaluate the terms of the loan carefully. Some of the factors you should consider include the interest rate, the term of the loan, and any covenants or restrictions that may be included in the loan agreement.

In addition, you should evaluate the financial health of the lender. You want to make sure that the lender has the financial resources to support your loan and that they have a track record of successful lending.

9. How to Find a Venture Debt Lender

There are a number of venture debt lenders in the market today. Some of the most well-known lenders include Silicon Valley Bank, Hercules Capital, and TriplePoint Venture Growth. In addition, there are a number of smaller lenders that specialize in venture debt financing.

To find a venture debt lender, you can start by asking your existing investors for recommendations. You can also search online for venture debt lenders or work with a broker who specializes in venture debt financing.

10. Conclusion

Venture debt can be a useful tool for startups that need to finance their growth quickly and without giving up equity. However, it’s important to evaluate the terms of the loan carefully and to make sure that your cash flow can support the additional debt service. If you’re considering venture debt, be sure to work with a lender who has experience in venture debt financing and who can provide you with the resources you need to succeed.

Frequently Asked Questions

Here are some common questions related to the right time for venture debt.

What is venture debt?

Venture debt is a type of debt financing that provides growth-stage companies with capital to fund their operations. It typically comes in the form of a loan or line of credit and is used to finance working capital, capital expenditures, and other growth-related expenses.

Unlike traditional bank loans, venture debt is often provided by specialized lenders who understand the unique needs of startups and growth-stage companies. It can be an attractive option for companies that are not yet profitable or have limited assets to use as collateral.

What are the advantages of venture debt?

Venture debt can provide several advantages for growth-stage companies. First, it can provide access to capital without diluting ownership or control. This can be especially important for companies that are not yet ready for equity financing or are not able to secure it.

Second, venture debt can be a flexible form of financing. Unlike equity financing, which requires companies to give up ownership in exchange for funding, venture debt can be structured in a way that allows companies to retain control and ownership while still accessing capital.

When should a company consider venture debt?

A company should consider venture debt when it has a clear growth strategy and needs capital to execute that strategy. Venture debt can be a good option for companies that are not yet profitable but are on a path to profitability. It can also be a good option for companies that are not able to secure equity financing or do not want to dilute ownership or control.

However, venture debt is not a good option for all companies. It can be more expensive than traditional bank loans, and companies that are not able to generate enough cash flow to service the debt may find themselves in financial trouble.

What are the risks of venture debt?

Like any form of debt financing, venture debt comes with risks. One of the biggest risks is the potential for default if the company is not able to generate enough cash flow to service the debt. This can lead to financial distress and potentially even bankruptcy.

Additionally, venture debt can be more expensive than traditional bank loans and can come with restrictive covenants that limit a company’s flexibility. Companies should carefully consider the terms of any venture debt agreement and make sure they understand the potential risks and rewards.

How can a company find the right venture debt lender?

Finding the right venture debt lender can be a challenge, but there are several steps a company can take to increase its chances of success. First, the company should identify lenders who specialize in venture debt and have experience working with startups and growth-stage companies.

Second, the company should carefully review the terms of any potential venture debt agreement and make sure it aligns with its growth strategy and financial goals. Finally, the company should seek out references and speak with other companies that have worked with the lender to get a sense of their experience and reputation.

How to think about venture debt

In conclusion, determining the right time for venture debt is crucial for any growing business. It can provide the necessary funds to take your company to the next level, but it’s important to carefully consider your financial situation and future business plans before taking on debt.

One key consideration is your revenue growth and profitability. Ideally, you should have a solid revenue stream and be on track to achieve profitability within a reasonable timeframe before taking on venture debt. This will ensure that you can comfortably make repayments and avoid getting trapped in a cycle of debt.

Another important factor is your business plans for the future. If you’re planning to expand rapidly or invest in new products or services, venture debt can be a good option to fuel your growth. However, if your plans are more modest or you’re not confident in your ability to repay the debt, it may be better to explore other funding options.

Ultimately, the decision to take on venture debt should be carefully considered and based on a thorough analysis of your financial situation and business plans. With the right approach, venture debt can be a valuable tool for any growing business looking to take the next step in its growth journey.