Venture debt has become a popular financing option for startups and emerging companies in recent years. With the rise of venture capital and private equity investments, the demand for venture debt has also grown. But what does the future hold for this type of financing? In this article, we’ll explore the future prospects of venture debt and what it means for startups and investors alike.

What are the Future Prospects of Venture Debt?

Venture debt has become a popular funding option for high-growth startups. It is a form of debt financing that is typically used to bridge the gap between equity rounds. Venture debt has been gaining traction in recent years, with more and more startups opting for this financing option. In this article, we will explore the future prospects of venture debt and its potential benefits for startups.

1. Venture Debt is Here to Stay

Venture debt has been around for several decades, but it has gained significant popularity in recent years. The trend is expected to continue in the future as more startups opt for this financing option. Venture debt offers several benefits, which we will explore in the following sections.

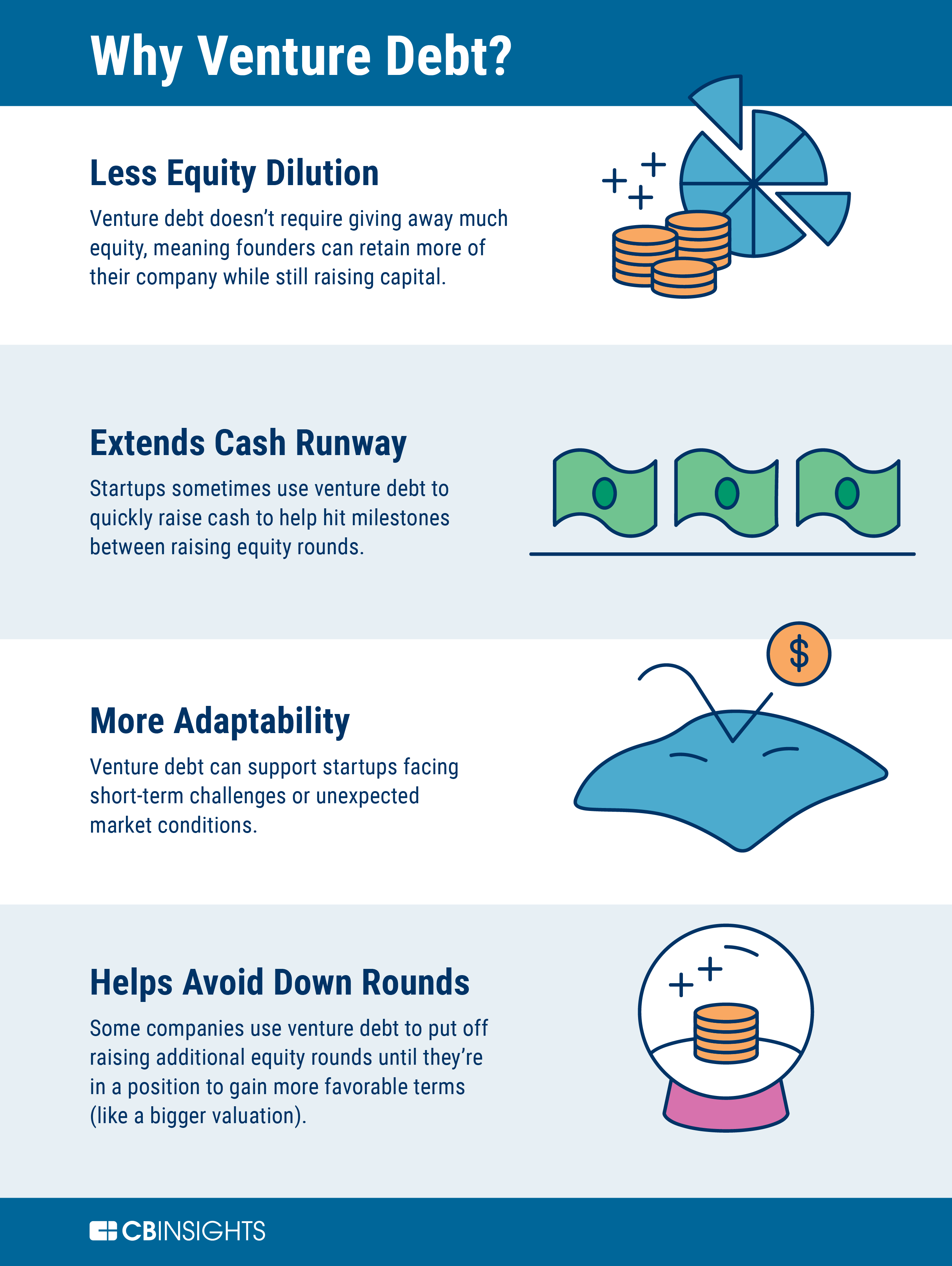

One of the primary reasons for the popularity of venture debt is that it allows startups to raise additional capital without diluting their equity. This is particularly important for startups that are in the early stages of their growth and have not yet achieved profitability.

2. Venture Debt is a Cost-Effective Financing Option

Venture debt is a cost-effective financing option compared to equity financing. Startups can raise debt at a lower cost than equity financing. Venture debt typically has a lower interest rate than other forms of debt financing, making it an attractive option for startups looking to raise capital.

Moreover, venture debt typically comes with fewer covenants and restrictions than other forms of debt financing. This means that startups can retain more control over their operations and strategic decisions.

3. Venture Debt Offers Flexibility

Venture debt offers greater flexibility than other forms of debt financing. Startups can customize the terms of the debt financing to meet their specific needs. This includes the amount of debt raised, the interest rate, and the repayment terms.

Furthermore, venture debt can be structured in a way that allows startups to defer repayment until a later date. This can be particularly beneficial for startups that are not yet generating revenue or are in the early stages of their growth.

4. Venture Debt is a Good Option for Startups with High Growth Potential

Venture debt is an excellent option for startups with high growth potential. It is particularly useful for startups that have demonstrated a clear path to profitability and are looking to scale quickly. Venture debt can provide the additional capital needed to fuel growth without diluting equity.

Moreover, venture debt can be used to extend the runway between equity rounds. This can provide startups with additional time to achieve their growth targets and improve their valuation before raising the next round of equity financing.

5. Venture Debt is a Good Option for Startups in Niche Markets

Venture debt can be a good option for startups in niche markets. These startups may not have access to traditional forms of debt financing, such as bank loans. Venture debt can provide an alternative source of financing that allows these startups to raise capital and grow their businesses.

Moreover, venture debt can be structured in a way that aligns with the specific needs of niche startups. This can include customized repayment terms, interest rates, and covenants that are tailored to the unique characteristics of the business.

6. Venture Debt is a Good Option for Startups with a Strong Management Team

Venture debt is an excellent option for startups with a strong management team. Lenders are often more willing to provide debt financing to startups that have a strong track record of success and a proven management team.

Moreover, venture debt can be structured in a way that aligns with the objectives of the management team. This can include customized repayment terms and covenants that incentivize the management team to achieve specific growth targets.

7. Venture Debt vs. Equity Financing

Venture debt is often compared to equity financing, and there are several key differences between the two. Equity financing involves selling a portion of the company to investors in exchange for capital. This dilutes the ownership of the existing shareholders.

Venture debt, on the other hand, involves borrowing money from lenders in exchange for interest payments and the repayment of the debt. This does not dilute the ownership of the existing shareholders.

Benefits of Venture Debt

- Does not dilute equity ownership

- Lower cost of capital than equity financing

- Customizable repayment terms

- Flexibility in the structure of the financing

- Can be used to extend the runway between equity rounds

Benefits of Equity Financing

- Provides more capital than debt financing

- Can provide access to strategic investors and partnerships

- Can provide expertise and guidance from experienced investors

8. Venture Debt vs. Traditional Debt Financing

Venture debt is also often compared to traditional debt financing, such as bank loans. There are several key differences between the two. Traditional debt financing typically has more covenants and restrictions than venture debt.

Moreover, traditional debt financing is often more difficult to obtain for startups that are in the early stages of their growth and have not yet achieved profitability. Venture debt can provide an alternative source of financing that is tailored to the needs of high-growth startups.

Benefits of Venture Debt

- Lower cost of capital than traditional debt financing

- Customizable repayment terms

- Flexibility in the structure of the financing

- Can provide access to additional capital without diluting equity

Benefits of Traditional Debt Financing

- Lower interest rates than venture debt

- More established financing option

- May have more favorable repayment terms and covenants

9. Venture Debt Lenders and Providers

There are several venture debt lenders and providers that specialize in providing debt financing to startups. These lenders include Silicon Valley Bank, Hercules Capital, and TriplePoint Capital.

Moreover, there are several online lenders and platforms that provide venture debt financing to startups. These include Lighter Capital, Kabbage, and Fundation.

Benefits of Venture Debt Providers

- Specialize in providing debt financing to startups

- Understand the unique needs of high-growth companies

- Can provide customized financing terms and structures

- Can provide access to additional capital without diluting equity

10. Conclusion

In conclusion, venture debt is a financing option that is here to stay. It offers several benefits to startups, including lower cost of capital, greater flexibility, and customized repayment terms.

Venture debt is an excellent option for startups with high growth potential, niche startups, and startups with a strong management team. It is also a good alternative to traditional debt financing and can be used to extend the runway between equity rounds.

There are several venture debt lenders and providers that specialize in providing debt financing to startups. These lenders can provide customized financing terms and structures that align with the specific needs of the business.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing provided to startups and growth-stage companies. It is usually provided by banks, venture capital firms, or specialty lenders. Unlike equity financing, venture debt requires companies to pay back the loan with interest.

This type of financing is often used as an alternative to equity financing to help companies extend their runway and reach key milestones without diluting the ownership of existing shareholders.

How does venture debt work?

Venture debt is typically structured as a loan with a fixed interest rate and a set repayment schedule. In addition to interest, lenders may also require warrants or equity options as part of the loan agreement, giving them the right to purchase stock in the company at a later date.

This type of financing is often used in conjunction with equity financing to provide a company with additional capital to fund growth without diluting ownership too much.

What are the benefits of venture debt?

One of the key benefits of venture debt is that it allows companies to access additional capital without diluting the ownership of existing shareholders. This can be particularly important for startups and growth-stage companies that are not yet profitable or cash flow positive.

In addition, venture debt can be less expensive than equity financing in terms of the cost of capital, especially for companies with strong revenue growth and a clear path to profitability.

What are the risks of venture debt?

One of the main risks of venture debt is that it can be more expensive than traditional bank loans due to the higher risk involved. In addition, lenders may require warrants or equity options as part of the loan agreement, which could dilute the ownership of existing shareholders if the company does not perform as expected.

Another risk is that venture debt can be more restrictive than equity financing in terms of the covenants and financial reporting requirements. This can limit the flexibility of the company to operate and make strategic decisions.

What are the future prospects of venture debt?

The future prospects of venture debt look positive, as more and more companies are turning to this type of financing to fund growth without diluting ownership too much. This trend is expected to continue as the startup ecosystem continues to mature and more institutional investors enter the market.

In addition, the rise of alternative lenders and fintech platforms is expected to make venture debt more accessible and affordable for a wider range of companies, further fueling its growth and adoption.

In conclusion, the future of venture debt seems bright. As startups continue to gain popularity and more entrepreneurs seek funding, venture debt will likely become a more common financing option. With its unique benefits, such as the ability to raise capital without diluting ownership or control, venture debt will likely remain an attractive option for many startups.

Furthermore, the rise of financial technology companies (fintech) has made it easier than ever for entrepreneurs to access venture debt. Fintech companies have streamlined the process of applying for and receiving loans, making it faster and more efficient for startups to secure funding. This trend is expected to continue, making venture debt even more accessible to startups in the future.

Overall, while there are always risks associated with any type of financing, the benefits of venture debt make it a promising option for startups looking to raise capital. As the startup ecosystem continues to grow and evolve, venture debt will likely become an increasingly important part of the funding landscape.