Venture debt can be a valuable tool in financing your startup’s growth. However, negotiating a venture debt deal can be a daunting task. With the right approach and preparation, you can secure favorable terms and set your business up for success.

In this guide, we’ll walk you through the key steps to negotiating a venture debt deal. From understanding the different types of venture debt to knowing what terms to negotiate, we’ll equip you with the knowledge and strategies you need to navigate the process with confidence. So let’s dive in and learn how to secure the funding your startup needs to thrive!

How to Negotiate a Venture Debt Deal?

Venture debt can be a great way to raise capital for your startup without diluting your equity. However, negotiating a venture debt deal can be challenging, especially if you are not familiar with the process. In this article, we will discuss the key steps involved in negotiating a venture debt deal.

1. Understand the different types of venture debt

There are several types of venture debt, including term loans, lines of credit, and convertible debt. Each type has its own pros and cons, and it’s essential to understand them before negotiating a deal. For example, term loans may have a fixed interest rate, while lines of credit may have a variable interest rate. Convertible debt may allow you to convert the debt into equity down the line.

Benefits of term loans:

- Fixed interest rate

- Predictable payments

- No dilution of equity

Benefits of lines of credit:

- Flexible borrowing

- Variable interest rate

- No dilution of equity

Benefits of convertible debt:

- Option to convert debt into equity

- Potential for higher returns

- No dilution of equity upfront

2. Determine your borrowing needs

Before negotiating a venture debt deal, you need to determine how much capital you need and what you will use it for. This will help you decide which type of debt is best for your needs. You should also consider your ability to repay the debt and any collateral you can offer to secure the loan.

Benefits of determining your borrowing needs:

- Helps you choose the right type of debt

- Ensures you have the capital you need

- Helps you plan for repayment

3. Research potential lenders

Once you know what type of debt you need, you should research potential lenders. Look for lenders who have experience working with startups in your industry and who offer competitive interest rates and terms. You should also check their reputation and read reviews from other borrowers.

Benefits of researching potential lenders:

- Helps you find the right lender for your needs

- Ensures you get competitive rates and terms

- Reduces the risk of working with a bad lender

4. Prepare your pitch

Before approaching potential lenders, you should prepare a pitch that highlights your company’s strengths and why you need the capital. Your pitch should also include financial projections and a plan for repaying the debt. Be prepared to answer any questions the lender may have and provide any additional information they request.

Benefits of preparing your pitch:

- Makes a good impression on potential lenders

- Helps you explain why you need the capital

- Shows that you have a plan for repayment

5. Negotiate the terms

Once you have found a lender that you want to work with, you need to negotiate the terms of the debt. This includes the interest rate, repayment period, and any fees or penalties. You should also negotiate any collateral requirements and any covenants or restrictions on your business.

Benefits of negotiating the terms:

- Ensures you get the best terms for your needs

- Reduces the risk of default

- Helps you avoid unnecessary fees and penalties

6. Review the agreement

Before signing the agreement, you should review it carefully to make sure you understand all the terms and conditions. You should also have a lawyer review the agreement to ensure that it’s fair and reasonable.

Benefits of reviewing the agreement:

- Ensures you understand all the terms and conditions

- Reduces the risk of misunderstandings or disputes

- Ensures that the agreement is fair and reasonable

7. Close the deal

Once you are satisfied with the terms of the agreement, you can sign it and close the deal. You should also make sure that you have all the necessary documentation and that the funds are transferred to your account.

Benefits of closing the deal:

- Provides you with the capital you need

- Helps you achieve your business goals

- Strengthens your relationship with the lender

8. Monitor your debt

After closing the deal, it’s important to monitor your debt and make sure you are making payments on time. You should also keep track of any covenants or restrictions on your business and make sure you are complying with them.

Benefits of monitoring your debt:

- Reduces the risk of default

- Helps you avoid unnecessary fees and penalties

- Ensures that you are complying with the agreement

9. Consider refinancing or restructuring

If you are struggling to make payments or if your business has changed significantly, you may need to consider refinancing or restructuring your debt. This may involve negotiating new terms with your current lender or finding a new lender who can offer better terms.

Benefits of refinancing or restructuring:

- Reduces the risk of default

- Helps you avoid unnecessary fees and penalties

- Allows you to adjust to changing business conditions

10. Evaluate the benefits and drawbacks

Finally, it’s important to evaluate the benefits and drawbacks of venture debt and whether it’s the right financing option for your business. Venture debt can provide you with the capital you need without diluting your equity, but it also comes with risks and costs.

Benefits of evaluating the benefits and drawbacks:

- Helps you make an informed decision about venture debt

- Ensures that you understand the risks and costs involved

- Helps you plan for the future

In conclusion, negotiating a venture debt deal can be a complex process, but by following these steps and working with the right lender, you can raise the capital you need to grow your business. Just remember to do your research, prepare your pitch, negotiate the terms, and monitor your debt to ensure that you are successful.

Frequently Asked Questions

What is venture debt?

Venture debt is a form of debt financing that is provided to startups and other early-stage companies that have not yet reached profitability. Unlike traditional bank loans, venture debt is typically structured as a loan with warrants or options to purchase equity in the company.

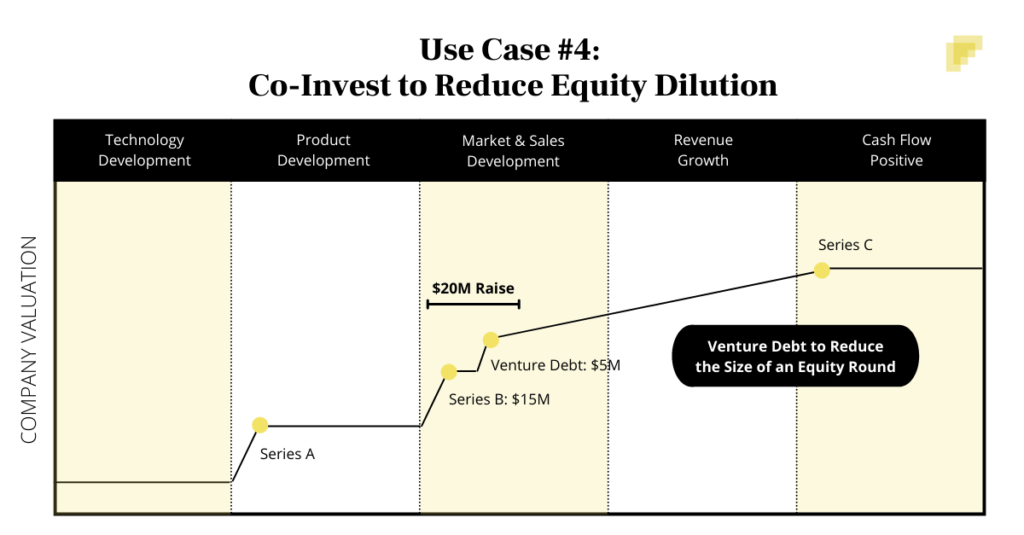

Venture debt can be a useful financing option for companies that need to raise capital but do not want to dilute their ownership stake in the company. It can also be a good option for companies that have a proven business model and are looking to scale up their operations.

What are the terms of a typical venture debt deal?

The terms of a venture debt deal can vary widely depending on the stage of the company and the lender involved. However, some common terms include an interest rate of 8-12%, a term of 2-4 years, and warrants or options to purchase equity in the company at a set price.

Other terms may include covenants that require the company to maintain certain financial ratios or achieve certain milestones, as well as fees for things like early repayment or late payments. It is important to carefully review and negotiate the terms of any venture debt deal before signing on.

What are some tips for negotiating a venture debt deal?

One key tip for negotiating a venture debt deal is to shop around and compare offers from multiple lenders. This can help you get a better sense of what terms are reasonable and ensure that you are getting the best deal possible.

It is also important to carefully review and negotiate the terms of the deal. This may include negotiating the interest rate, term, and any covenants or fees. Finally, it is important to have a solid understanding of the company’s financials and growth projections, as this can help you negotiate better terms.

What are some common mistakes to avoid when negotiating a venture debt deal?

One common mistake to avoid when negotiating a venture debt deal is to focus too much on the interest rate and not enough on the other terms of the deal. It is important to carefully review and negotiate all aspects of the deal, including any covenants, fees, and equity options.

Another mistake to avoid is signing on to a deal without fully understanding the company’s financials and growth projections. It is important to have a clear picture of the company’s current financial situation and future prospects before signing on to a debt financing deal.

What are the benefits of venture debt financing?

Venture debt financing can offer several benefits for startups and early-stage companies. For one, it can be a way to raise capital without diluting ownership or giving up control of the company.

Additionally, venture debt financing can be a useful way to bridge the gap between equity rounds, provide working capital for growth, and help companies achieve their business goals. Finally, venture debt financing can be a way to build relationships with lenders and establish a credit history for the company.

In conclusion, negotiating a venture debt deal can be a complex and intimidating process, but with the right preparation and approach, it can also be a highly rewarding one. By taking the time to understand the lender’s needs and concerns, and by presenting a compelling business case, entrepreneurs can secure the funding they need to take their venture to the next level.

One key aspect of successful negotiation is communication. Entrepreneurs should be clear and honest about their needs, and should be prepared to listen to and address the lender’s concerns. By establishing a good working relationship with the lender, entrepreneurs can build trust and increase their chances of securing favorable terms.

Finally, it’s important for entrepreneurs to be patient and persistent. Negotiations can take time, and it’s not uncommon for lenders to push back on certain terms or ask for additional information. By staying focused on their goals and maintaining a positive attitude, entrepreneurs can navigate these challenges and ultimately secure the financing they need to grow and thrive.