For many companies, accessing funding through venture debt can be an attractive option. Unlike traditional debt financing, venture debt offers greater flexibility in repayment terms, lower interest rates, and the potential for higher loan amounts. However, companies must also consider the impact venture debt can have on their credit rating.

Venture debt can be beneficial for a company’s credit rating if managed correctly. By taking on debt and making timely payments, a company can establish a positive credit history, which can help improve its overall creditworthiness. But as with any type of debt, there are risks involved, and mismanaging venture debt can have a negative impact on a company’s credit rating. In this article, we’ll explore the ways in which venture debt can impact a company’s credit rating and what companies should consider when deciding whether to pursue this funding option.

Understanding the Impact of Venture Debt on a Company’s Credit Rating

When a company is seeking to raise capital, it has several options to choose from, including equity financing, debt financing, or a combination of both. One type of debt financing that has gained popularity in recent years is venture debt. While venture debt can provide a company with much-needed capital, it is important to understand how it can impact a company’s credit rating.

What is Venture Debt?

Venture debt is a type of debt financing that is typically provided to early-stage or high-growth companies that have not yet reached profitability. Unlike traditional bank loans, venture debt is often provided by specialized lenders who understand the unique needs and risks of startup companies.

Venture debt typically takes the form of a loan that is secured by the company’s assets, such as its intellectual property or accounts receivable. The terms of the loan can vary, but they often include a higher interest rate than traditional bank loans, as well as warrants or equity options that give the lender the right to purchase shares of the company at a discounted price.

The Impact of Venture Debt on Credit Ratings

While venture debt can provide a company with additional capital to fuel growth, it can also have an impact on the company’s credit rating. A credit rating is a measure of a company’s creditworthiness, and it is used by lenders to determine the risk of lending money to the company.

When a company takes on venture debt, it increases its debt-to-equity ratio, which can negatively impact its credit rating. A high debt-to-equity ratio indicates that a company has a large amount of debt relative to its equity, which can make it more difficult for the company to obtain additional financing in the future.

In addition, venture debt often includes covenants, or restrictions, on the company’s operations and financial decisions. If the company violates these covenants, it can trigger a default on the loan, which can further damage its credit rating.

The Benefits of Venture Debt

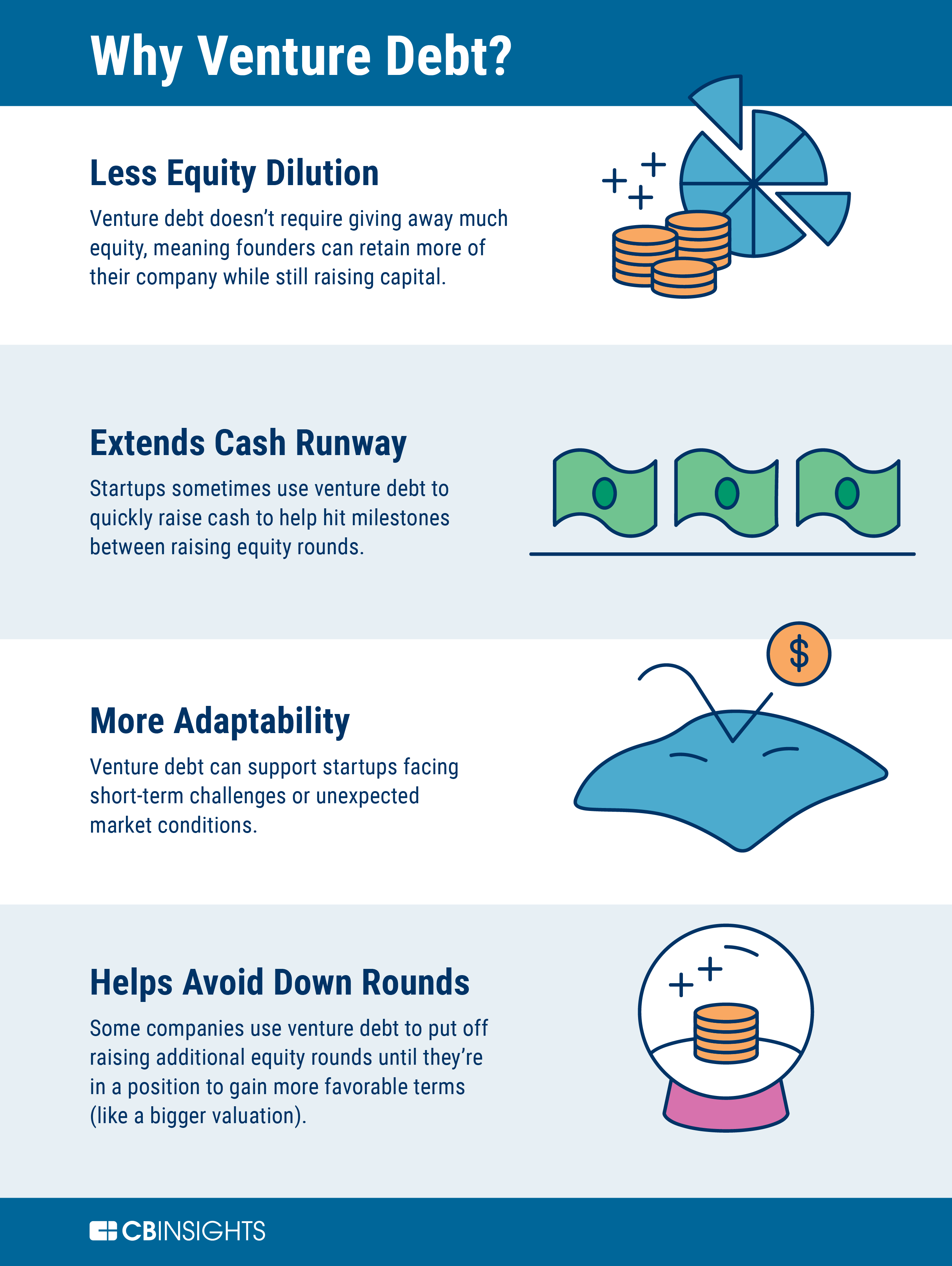

Despite the potential impact on a company’s credit rating, there are several benefits to using venture debt as a financing option. For one, venture debt can provide a company with additional capital without diluting the ownership of existing shareholders. This can be particularly attractive to founders and early investors who want to maintain control of the company.

In addition, venture debt can be a flexible financing option that allows a company to tailor the terms of the loan to its specific needs. For example, a company may be able to negotiate a longer repayment period or a lower interest rate than it would with a traditional bank loan.

Venture Debt vs. Equity Financing

When considering venture debt as a financing option, it is important to understand how it differs from equity financing. Equity financing involves selling ownership shares of the company to investors in exchange for capital. While equity financing does not impact a company’s credit rating, it does dilute the ownership of existing shareholders and can result in a loss of control for the founders.

Venture debt, on the other hand, does not dilute ownership and allows the company to maintain control. However, it does increase the company’s debt load and can impact its credit rating.

Conclusion

Venture debt can be a valuable financing option for early-stage or high-growth companies that need additional capital to fuel growth. However, it is important to understand the potential impact on a company’s credit rating and to carefully consider the terms of the loan before taking on additional debt. By weighing the benefits and drawbacks of venture debt against other financing options, companies can make an informed decision about the best way to raise capital and support their growth.

Frequently Asked Questions

What is venture debt?

Venture debt is a form of debt financing for startups and emerging companies that provides them with access to capital. Unlike traditional forms of financing, venture debt is typically used to supplement equity financing and is often provided by specialized lenders who understand the unique needs of early-stage companies.

Venture debt is generally structured as a loan with a fixed interest rate, and may also include warrants or other equity-like features that provide the lender with additional upside potential.

How does venture debt differ from traditional bank loans?

Venture debt differs from traditional bank loans in several ways. First, venture debt is typically provided by specialized lenders who focus on the needs of early-stage companies. These lenders understand the unique risks and opportunities associated with financing startups and emerging companies.

Second, venture debt is often structured with equity-like features such as warrants or options, which provide the lender with additional upside potential. This can help to offset the higher risks associated with financing early-stage companies.

Finally, venture debt is often used to supplement equity financing, rather than replace it. This means that companies can raise more capital without diluting existing shareholders.

What are the benefits of venture debt?

Venture debt can offer several benefits to companies. First, venture debt can provide access to additional capital without diluting existing shareholders. This can be especially important for startups and emerging companies that are still in the early stages of their development.

Second, venture debt can be less expensive than equity financing, as the cost of capital is typically lower for debt than for equity. This can help to preserve the company’s equity value and reduce the overall cost of capital.

Finally, venture debt can help to build a company’s credit history and improve its credit rating. This can be important for companies that may need to access additional financing in the future.

How does venture debt impact a company’s credit rating?

Venture debt can have both positive and negative impacts on a company’s credit rating. On the one hand, venture debt can help to build a company’s credit history and improve its credit rating. This is because venture debt is typically structured as a loan, which means that companies are required to make regular payments and meet certain financial covenants.

On the other hand, venture debt can also increase a company’s debt-to-equity ratio, which can negatively impact its credit rating. This is because lenders and credit rating agencies may view high levels of debt as a sign of financial risk.

What are the risks of venture debt?

Venture debt can be a useful form of financing, but it also comes with certain risks. One of the main risks is the potential for default. If a company is unable to meet its debt obligations, it may be forced to declare bankruptcy or go out of business.

Another risk of venture debt is the potential for dilution. If a company is unable to repay its debt, it may be forced to issue new equity or warrants to its lenders, which can dilute the ownership of existing shareholders.

Finally, venture debt can be more expensive than traditional bank loans, as lenders may charge higher interest rates to compensate for the higher risks associated with financing early-stage companies.

The Value of Venture Debt Explained – Trinity Capital Inc.

In conclusion, venture debt can have both positive and negative impacts on a company’s credit rating. On the one hand, taking on venture debt can demonstrate a company’s ability to secure additional funding and manage its finances effectively. This can lead to an improved credit rating, as lenders view the company as a lower risk borrower.

However, venture debt can also increase a company’s overall debt burden, which can negatively impact its credit rating. Additionally, if the company is unable to make payments on its venture debt, this can further damage its credit rating and make it more difficult to secure financing in the future.

Overall, the impact of venture debt on a company’s credit rating will depend on a variety of factors, including the amount of debt taken on, the company’s ability to manage its finances, and its overall financial health. As with any financial decision, it is important for companies to carefully consider the potential risks and benefits of taking on venture debt before making a decision.