Venture debt has become an increasingly popular financing option for startups looking to scale their business. While it may seem like a simple loan, venture debt can have a significant impact on a company’s valuation. In this article, we’ll explore how venture debt works and how it can affect a company’s valuation, as well as the pros and cons to consider before taking on this type of financing. So, let’s dive in and discover the intricate relationship between venture debt and company valuation.

How Does Venture Debt Affect Company Valuation?

When a company is looking to raise capital, they have a few options to consider. One of these options is venture debt. Venture debt is a type of debt financing that is typically provided by banks or other financial institutions to startup companies that have already raised equity financing. The purpose of venture debt is to help these companies extend their runway by providing additional capital that can be used to fund growth. But how does venture debt affect company valuation? Let’s take a closer look.

What is Venture Debt?

Venture debt is a type of debt financing that is specifically designed for early-stage companies that have already raised equity financing. Unlike traditional debt financing, venture debt typically does not require collateral. Instead, it is based on the company’s ability to generate cash flow and its potential for future growth. Venture debt is typically used to fund growth initiatives like hiring new employees, expanding into new markets, or developing new products.

One of the key benefits of venture debt is that it allows companies to extend their runway without diluting existing shareholders. This means that the company can continue to grow and develop without giving up additional equity.

How Does Venture Debt Affect Company Valuation?

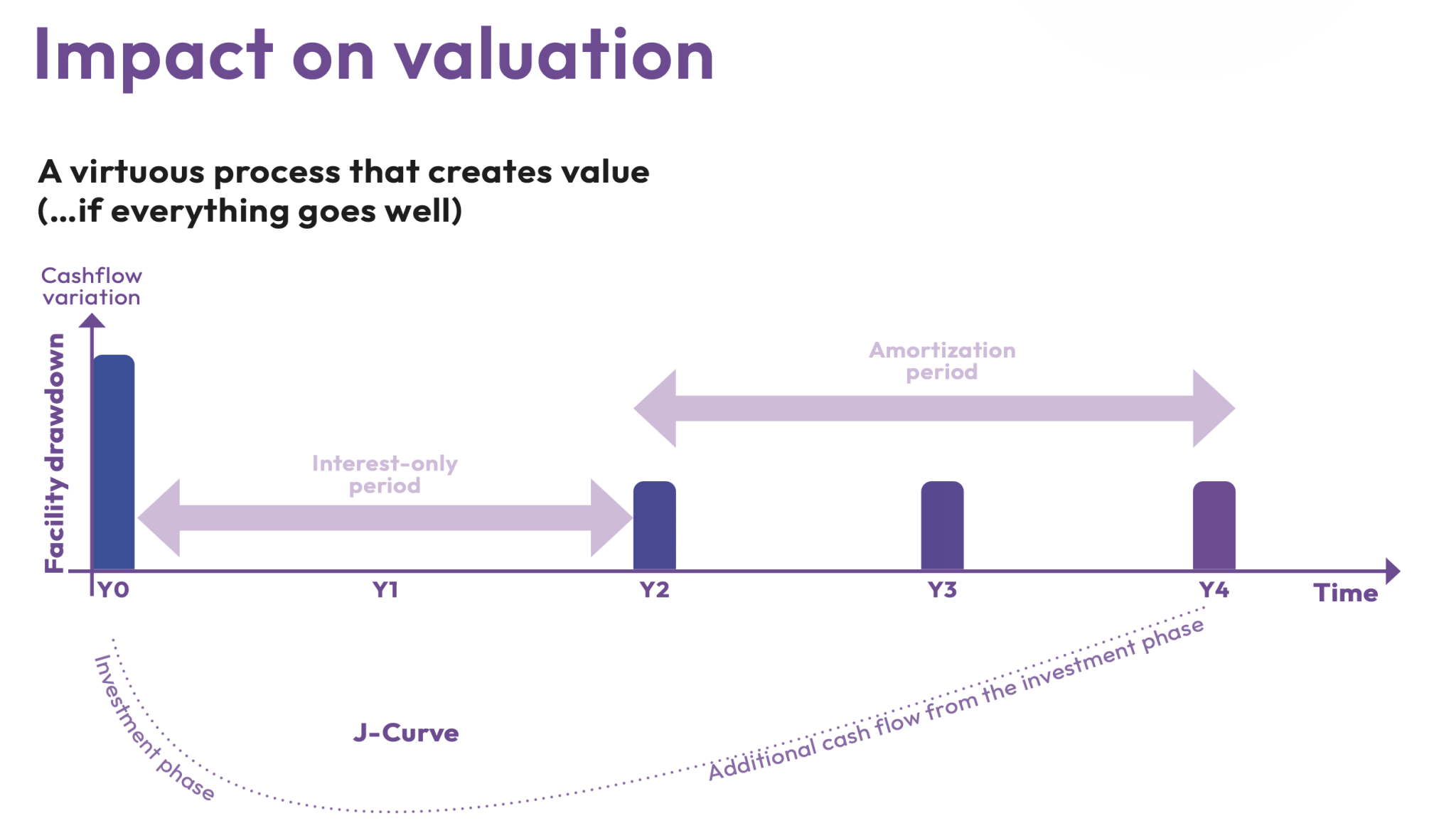

Venture debt can have both positive and negative effects on company valuation. On the positive side, venture debt can help increase a company’s valuation by providing additional capital that can be used to fund growth initiatives. This additional capital can help the company achieve key milestones and increase its overall value.

On the negative side, venture debt can also have a dilutive effect on company valuation. This is because venture debt typically comes with warrants or options that give the lender the right to purchase equity in the company at a future date. This can result in additional dilution for existing shareholders.

Benefits of Venture Debt

There are several benefits of venture debt for early-stage companies. First, it allows companies to extend their runway without diluting existing shareholders. This means that the company can continue to grow and develop without giving up additional equity.

Second, venture debt is typically less expensive than equity financing. This is because the lender is taking on less risk than an equity investor. As a result, the interest rates and fees associated with venture debt are typically lower than equity financing.

Finally, venture debt can help companies achieve key milestones and increase their overall value. This is because the additional capital provided by venture debt can be used to fund growth initiatives like hiring new employees, expanding into new markets, or developing new products.

VC vs. Venture Debt

Venture debt is often compared to traditional venture capital financing. While both options provide early-stage companies with capital, there are some key differences to consider.

First, venture debt is typically less expensive than venture capital financing. This is because venture debt comes with less risk for the lender than equity financing. As a result, the interest rates and fees associated with venture debt are typically lower than those associated with venture capital financing.

Second, venture debt does not dilute existing shareholders. This means that the company can continue to grow and develop without giving up additional equity. Venture capital financing, on the other hand, typically requires companies to give up a significant portion of their equity in exchange for capital.

Finally, venture debt is typically easier to obtain than venture capital financing. This is because venture debt is based on the company’s ability to generate cash flow and its potential for future growth. Venture capital financing, on the other hand, is typically based on the company’s potential for explosive growth.

Conclusion

In conclusion, venture debt can have both positive and negative effects on company valuation. While it can help increase a company’s valuation by providing additional capital, it can also have a dilutive effect on existing shareholders. However, the benefits of venture debt, including the ability to extend a company’s runway without diluting existing shareholders, make it an attractive option for many early-stage companies. By understanding the benefits and drawbacks of venture debt, companies can make informed decisions about their financing options and chart a course for sustainable growth.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing that provides companies with access to capital without diluting ownership. Typically, venture debt lenders provide funds to startups and other high-growth companies that have already raised equity financing. The debt is often secured by the company’s assets and/or a personal guarantee from the company’s founders.

How does venture debt work?

Venture debt works by providing companies with additional capital to support growth without diluting equity. Typically, venture debt lenders provide funds based on the company’s creditworthiness and growth prospects. The loan is often structured as a term loan or a line of credit, and interest rates are typically higher than traditional bank loans. The loan is repaid over a set period of time, usually with a balloon payment due at the end of the term.

How does venture debt affect a company’s balance sheet?

Venture debt can affect a company’s balance sheet in several ways. First, it increases the company’s liabilities, which can impact its debt-to-equity ratio and other financial metrics. Second, it can improve the company’s liquidity, providing additional cash to support growth initiatives. Finally, the interest payments associated with venture debt can impact the company’s net income and cash flow.

What are the benefits of venture debt?

Venture debt can provide several benefits to companies, including access to additional capital without diluting equity, improved liquidity, and the ability to fund growth initiatives. Additionally, venture debt lenders often have experience working with high-growth startups and can provide valuable advice and connections to other investors and industry experts.

What are the risks of venture debt?

Venture debt comes with several risks, including higher interest rates than traditional bank loans, potential personal guarantees required from the company’s founders, and the risk of default if the company is unable to make payments. Additionally, venture debt lenders may have strict covenants and reporting requirements that can impact the company’s flexibility and growth potential. It is important for companies to carefully consider the risks and benefits of venture debt before pursuing this type of financing.

In conclusion, venture debt can have a significant impact on the valuation of a company. By providing additional capital at a lower cost than equity financing, venture debt can help a company achieve its growth objectives while minimizing dilution for existing shareholders.

However, it’s important for companies to carefully consider their debt levels and repayment obligations, as excessive debt can ultimately lead to financial distress and a lower valuation. Furthermore, companies should work closely with their lenders to negotiate favorable terms and ensure they are able to meet their repayment obligations without sacrificing their long-term growth prospects.

Overall, venture debt can be a valuable tool for companies looking to finance their growth, but it’s important to approach it with caution and carefully weigh the potential benefits and risks. With the right strategy in place, venture debt can help companies achieve their goals and ultimately increase their valuation in the long run.