Venture debt has become a popular financing option for startups looking to accelerate their growth. This type of financing is different from traditional equity financing, as it provides debt instead of ownership in the company. But how exactly can venture debt help startups grow faster? In this article, we will explore the benefits of venture debt and how it can help startups scale their businesses.

How Venture Debt Can Accelerate Growth

Venture debt is a type of financing that provides companies with capital to fund their growth. Unlike traditional debt, venture debt is typically provided by specialized lenders that understand the unique needs of startups and high-growth companies. Venture debt can be an attractive option for companies that want to accelerate their growth without diluting their equity or raising additional capital. In this article, we will explore how venture debt can help accelerate growth for companies.

1. Provides Capital for Growth

Venture debt provides companies with additional capital to fund their growth. This capital can be used for a variety of purposes, such as expanding sales and marketing efforts, hiring additional employees, developing new products, or making strategic acquisitions. By providing additional capital, venture debt can help companies accelerate their growth and achieve their goals more quickly.

Venture debt can be particularly attractive for companies that have reached a stage where they are generating revenue but not yet profitable. These companies may not be able to raise additional equity capital without diluting their ownership or may not be able to secure traditional bank financing. Venture debt can provide these companies with the capital they need to continue growing without diluting their equity or raising additional capital.

2. Lowers Cost of Capital

Venture debt typically has a lower cost of capital than equity financing. This is because venture debt is less risky than equity financing, as the lender has a claim on the company’s assets in the event of default. Additionally, venture debt typically has a lower interest rate than traditional bank loans, as the lender is willing to take on more risk in exchange for higher returns.

By using venture debt to fund their growth, companies can lower their overall cost of capital and preserve their equity for future fundraising rounds. This can be particularly attractive for companies that are growing quickly and need to raise additional capital frequently.

3. Provides Flexibility

Venture debt can provide companies with flexibility in their financing structure. Unlike equity financing, which typically requires companies to give up a portion of their ownership in exchange for capital, venture debt does not dilute the company’s ownership. This can be particularly attractive for companies that want to maintain control over their business and strategic direction.

Additionally, venture debt typically has fewer restrictive covenants than traditional bank loans. This can provide companies with more flexibility in their operations and allow them to focus on their growth objectives.

4. Can Be Structured to Meet Specific Needs

Venture debt can be structured in a variety of ways to meet the specific needs of companies. For example, venture debt can be structured as a term loan, where the company receives a lump sum of capital upfront and repays the loan over a set period of time. Alternatively, venture debt can be structured as a line of credit, where the company has access to a revolving pool of capital that can be used as needed.

Additionally, venture debt can be structured with equity kickers, where the lender receives an equity stake in the company in addition to the loan. This can provide the lender with additional upside potential in the event that the company achieves a successful exit.

5. Can Be Used in Combination with Equity Financing

Venture debt can be used in combination with equity financing to provide companies with a more balanced capital structure. By using venture debt in combination with equity financing, companies can raise additional capital without diluting their ownership or raising additional equity capital.

This combination of financing can be particularly attractive for companies that are growing quickly and need to raise additional capital frequently. By using venture debt to supplement their equity financing, companies can maintain control over their business and strategic direction while still accessing the capital they need to fund their growth.

6. Can Provide a Bridge to the Next Funding Round

Venture debt can provide companies with a bridge to their next funding round. This can be particularly attractive for companies that are close to achieving profitability or reaching a key milestone but need additional capital to get there.

By using venture debt to bridge the gap between funding rounds, companies can continue to grow their business and achieve their goals without diluting their ownership or raising additional equity capital.

7. Can Provide a Competitive Advantage

Venture debt can provide companies with a competitive advantage by allowing them to accelerate their growth more quickly than their competitors. By using venture debt to fund their growth, companies can expand their operations, develop new products, or make strategic acquisitions faster than their competitors.

This can help companies gain market share and establish themselves as leaders in their industry. Additionally, by using venture debt to fund their growth, companies can maintain control over their business and strategic direction, which can be a competitive advantage in itself.

8. Vs Traditional Bank Loans

Venture debt differs from traditional bank loans in several ways. Unlike traditional bank loans, venture debt is typically provided by specialized lenders that understand the unique needs of startups and high-growth companies. Additionally, venture debt typically has fewer restrictive covenants than traditional bank loans, which can provide companies with more flexibility in their operations.

Venture debt also typically has a lower cost of capital than traditional bank loans, as the lender is willing to take on more risk in exchange for higher returns. Finally, venture debt does not dilute the company’s ownership, unlike traditional bank loans, which typically require the company to pledge collateral or give up a portion of their ownership in exchange for capital.

9. Benefits of Venture Debt

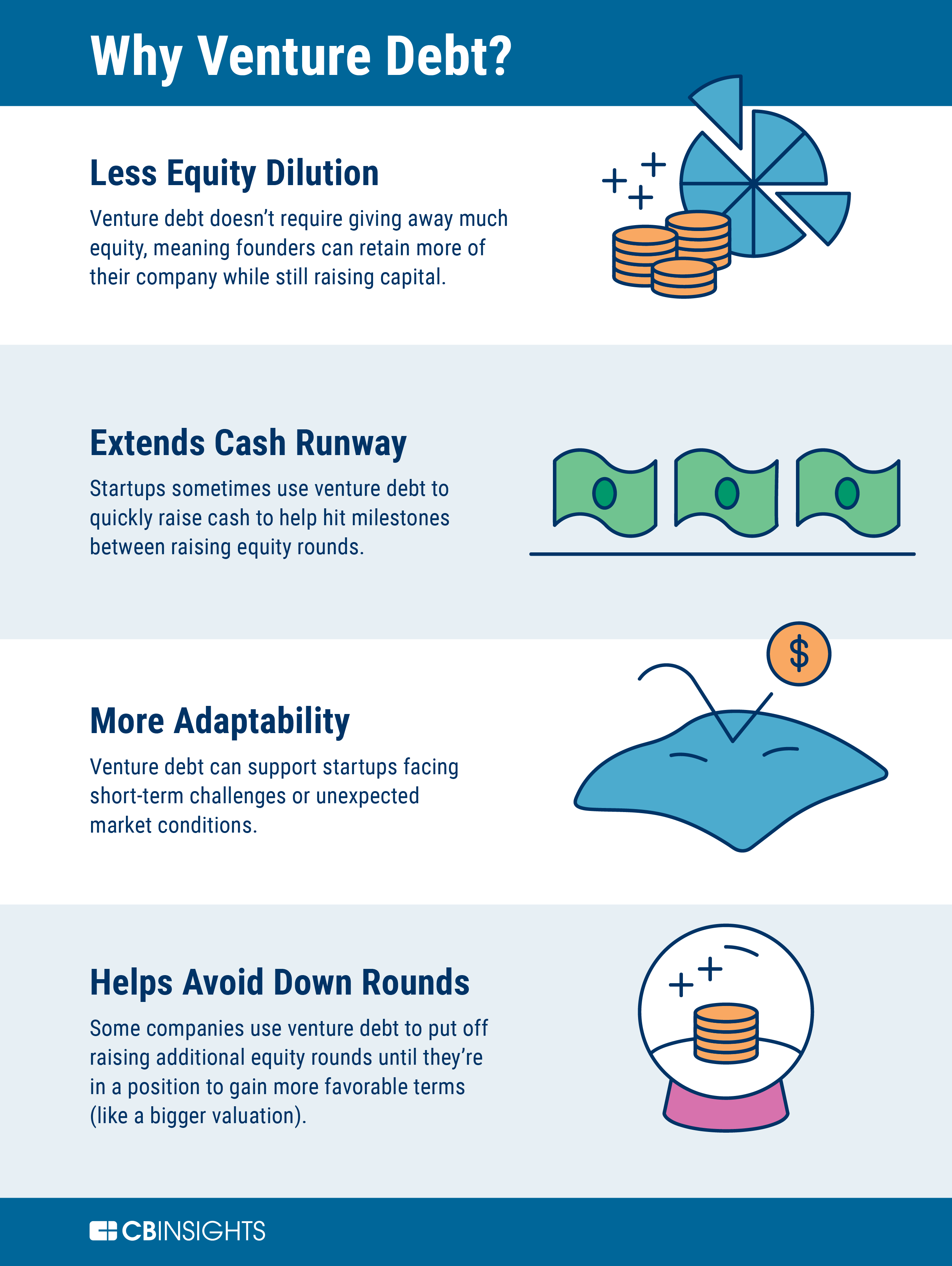

The benefits of venture debt include providing companies with additional capital to fund their growth, lowering the overall cost of capital, providing flexibility in their financing structure, and being able to be structured to meet specific needs. Additionally, venture debt can be used in combination with equity financing to provide companies with a more balanced capital structure and can provide a bridge to the next funding round.

10. Conclusion

Venture debt can be an attractive option for companies that want to accelerate their growth without diluting their equity or raising additional capital. By providing additional capital, lowering the overall cost of capital, and providing flexibility in the financing structure, venture debt can help companies achieve their growth objectives more quickly. By understanding the benefits of venture debt, companies can make informed decisions about their financing options and position themselves for long-term success.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing that is offered to startups and other high-growth companies. It is typically used to finance growth initiatives and can be a valuable tool for companies looking to accelerate their growth. Unlike traditional bank loans, venture debt is often provided by specialized lenders who have expertise in working with high-growth companies.

Venture debt is typically structured as a loan with a fixed interest rate and a term of 2-4 years. It is often used in conjunction with equity financing to provide startups with a more balanced capital structure.

How can venture debt help accelerate growth?

Venture debt can be a valuable tool for startups and other high-growth companies looking to accelerate their growth. Because venture debt is typically less dilutive than equity financing, it allows companies to raise additional capital without giving up as much ownership. This can be particularly important for companies that are not yet profitable or have limited access to equity financing.

In addition to providing additional capital, venture debt can also help companies extend their cash runway. This can be particularly important for startups that are still in the early stages of development and need additional time to reach profitability.

What are the benefits of venture debt?

One of the main benefits of venture debt is that it is typically less dilutive than equity financing. This means that companies can raise additional capital without giving up as much ownership. Venture debt can also be structured to provide more flexible repayment terms than traditional bank loans.

Another benefit of venture debt is that it can help companies extend their cash runway. This can be particularly important for startups that are not yet profitable or have limited access to equity financing. By extending their cash runway, companies can focus on growth initiatives without worrying as much about their short-term cash needs.

What are the risks of venture debt?

Like any type of debt financing, venture debt comes with certain risks. One of the main risks is that it can be more expensive than traditional bank loans. Because venture debt is typically provided by specialized lenders who work with high-growth companies, the interest rates can be higher than traditional bank loans.

Another risk of venture debt is that it can be structured with more onerous covenants than traditional bank loans. These covenants can restrict a company’s ability to take certain actions, which can be particularly challenging for startups that need flexibility to pursue growth initiatives.

When is venture debt a good option?

Venture debt can be a good option for startups and other high-growth companies that are looking to accelerate their growth. It can be particularly valuable for companies that are not yet profitable or have limited access to equity financing. Venture debt can also be a good option for companies that are looking to extend their cash runway and focus on growth initiatives without worrying as much about their short-term cash needs.

However, venture debt may not be a good option for all companies. Companies that are already profitable and have access to equity financing may not need the additional capital that venture debt provides. Additionally, companies that are not confident in their ability to meet the repayment terms may want to consider other financing options.

In conclusion, venture debt can be a powerful tool for accelerating growth for young, high-growth companies. By providing additional capital without the dilution of equity financing, venture debt can help companies reach important milestones more quickly and efficiently. Additionally, the relatively low cost of debt financing can enable companies to invest in additional growth opportunities that may have otherwise been out of reach.

However, it’s important for companies to carefully consider their financing options and ensure that venture debt makes sense for their particular situation. While the benefits of venture debt are many, the added debt burden can also be a challenge for companies that are not yet generating significant revenue or have limited cash flow.

Overall, venture debt represents a valuable financing option for young, high-growth companies looking to accelerate their growth and reach important milestones. By carefully weighing the benefits and risks of venture debt, companies can make informed decisions about their financing strategy and position themselves for long-term success.