Venture debt can be an attractive financing option for startups looking to raise capital without giving up equity. However, understanding how interest rates are calculated can be a bit of a mystery. In this article, we will break down the factors that determine venture debt interest rates and provide insights into how startups can secure the best rates for their business.

How Are Venture Debt Interest Rates Calculated?

Venture debt is a type of financing that is available to startups and early-stage companies. It is a form of debt financing that is typically used to help businesses grow and expand. One of the most important factors to consider when taking out venture debt is the interest rate. In this article, we will explore how venture debt interest rates are calculated.

Factors That Affect Venture Debt Interest Rates

There are several factors that can affect the interest rate on venture debt. These include:

1. Creditworthiness

The creditworthiness of the borrower is one of the most important factors that lenders consider when determining the interest rate on venture debt. If the borrower has a strong credit history and a good track record of repaying debt, they are more likely to receive a lower interest rate.

2. Collateral

Another factor that can affect the interest rate on venture debt is the presence of collateral. If the borrower has assets that can be used as collateral, the lender may be more willing to offer a lower interest rate.

3. Industry

The industry in which the borrower operates can also impact the interest rate on venture debt. If the industry is highly competitive or has a high risk of failure, lenders may charge a higher interest rate to compensate for the increased risk.

4. Loan Amount

The amount of the loan can also affect the interest rate on venture debt. Larger loans may have a lower interest rate, while smaller loans may have a higher interest rate.

Calculating Venture Debt Interest Rates

The interest rate on venture debt is typically calculated using a combination of factors, including the borrower’s creditworthiness, the amount of collateral, and the perceived risk of the loan. Lenders may also consider market conditions and the overall health of the economy when determining the interest rate.

One common method for calculating venture debt interest rates is to use a base rate, such as the prime rate or LIBOR, and add a spread to account for the risk of the loan. The spread may be based on factors such as the borrower’s creditworthiness, the amount of collateral, and the industry in which the borrower operates.

Benefits of Venture Debt Financing

Venture debt financing can offer several benefits to startups and early-stage companies. These include:

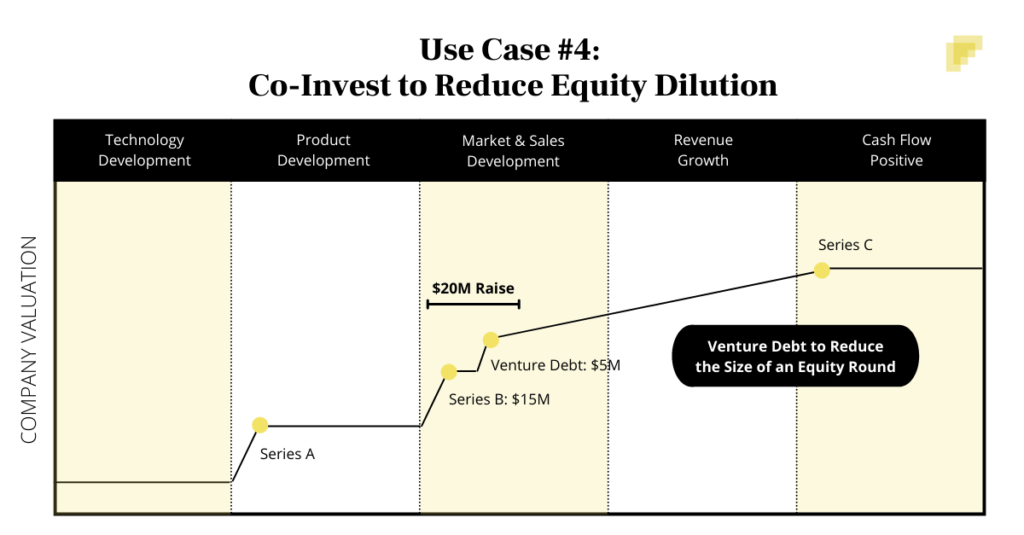

1. Lower Dilution

Unlike equity financing, which involves selling a portion of the company to investors, venture debt financing does not require the company to give up ownership. This means that founders can maintain more control over their business and avoid diluting their equity.

2. Cash Flow Management

Venture debt financing can also help companies manage their cash flow. Since the interest payments on venture debt are typically lower than the dividends or returns required by equity investors, companies can conserve cash and use it to fund growth initiatives.

3. Faster Funding

Venture debt financing can also be faster and easier to obtain than traditional bank loans or equity financing. Since venture debt lenders are typically focused on startups and early-stage companies, they may be more willing to take on risk and provide funding more quickly.

Venture Debt vs. Equity Financing

While venture debt financing can offer several benefits, it is important to consider the differences between venture debt and equity financing. Some key differences include:

1. Ownership

As mentioned earlier, venture debt financing does not require the company to give up ownership. Equity financing, on the other hand, involves selling a portion of the company to investors.

2. Risk

Venture debt financing is typically less risky than equity financing since the lender does not have an ownership stake in the company. However, the borrower is still responsible for repaying the debt, which can create financial stress if the company is not able to generate enough cash flow.

3. Returns

Equity financing can offer higher returns to investors since they have an ownership stake in the company. Venture debt financing, on the other hand, offers a fixed return in the form of interest payments.

In conclusion, venture debt interest rates are calculated based on several factors, including the borrower’s creditworthiness, collateral, industry, and loan amount. Calculating venture debt interest rates typically involves using a base rate and adding a spread to account for risk. Venture debt financing can offer several benefits to startups and early-stage companies, including lower dilution, cash flow management, and faster funding. However, it is important to consider the differences between venture debt and equity financing when deciding which option is best for your business.

Frequently Asked Questions

Here are some common questions regarding venture debt interest rates:

What is venture debt?

Venture debt is a type of debt financing that is typically provided to early-stage companies that have already raised equity financing from venture capital firms. This type of financing is often used to bridge the gap between equity rounds and help companies fund their growth without diluting their ownership.

Venture debt is typically structured as a loan with a fixed interest rate and a maturity date, but may also include warrants or other equity-like features.

What factors affect venture debt interest rates?

The interest rate on a venture debt loan is typically based on a variety of factors, including the borrower’s creditworthiness, the amount of money being borrowed, the term of the loan, and prevailing market conditions.

In addition, lenders may also consider factors such as the borrower’s industry, business model, and growth prospects when setting interest rates for venture debt financing.

How are venture debt interest rates calculated?

Venture debt interest rates are typically calculated using a base rate, such as the London Interbank Offered Rate (LIBOR), plus a spread. The spread is the lender’s profit margin and is typically based on the borrower’s creditworthiness and other risk factors.

The total interest rate on a venture debt loan may also include other fees, such as origination fees, commitment fees, or prepayment penalties, which can impact the overall cost of borrowing.

What are the advantages of venture debt?

One of the main advantages of venture debt is that it allows companies to finance their growth without diluting their ownership or giving up control to equity investors. This can be particularly useful for companies that are still in the early stages of development and may not be ready to raise additional equity financing.

Venture debt can also be a cost-effective form of financing, as interest rates are typically lower than those associated with equity financing, and lenders may not require the same level of due diligence or control as equity investors.

What are the risks of venture debt?

Like any form of debt financing, venture debt carries a certain level of risk. If a company is unable to repay its loan, it may be forced to default, which can damage the borrower’s creditworthiness and make it more difficult to obtain financing in the future.

In addition, some lenders may include covenants or other restrictions in their venture debt agreements, which can limit a borrower’s flexibility and make it more difficult to operate their business.

Average Venture Debt Interest Rates

In conclusion, venture debt interest rates are calculated using various factors. The lender considers the creditworthiness of the borrower, the risk associated with the investment, the length of the loan, and the current market rates. The interest rate is usually higher than traditional bank loans to compensate for the higher risk involved.

It is important to note that venture debt can be a valuable source of financing for startups and small businesses. It provides access to capital without diluting equity and allows companies to fund growth initiatives. However, the interest rates can be quite high, so it’s essential to carefully consider the terms before accepting any venture debt offers.

Overall, understanding how venture debt interest rates are calculated is crucial for entrepreneurs seeking funding for their business. By knowing the factors that influence interest rates, borrowers can negotiate better terms and make informed decisions about their financing options.