Venture debt funds have become an increasingly popular option for startups seeking funding. But how are these funds structured, and what makes them different from other forms of financing? In this article, we’ll take a deep dive into the world of venture debt and explore its unique characteristics, including its structure, terms, and benefits. Whether you’re an entrepreneur looking to secure funding or an investor interested in the mechanics of venture debt, this article is for you. So let’s get started and demystify the world of venture debt funds!

How are Venture Debt Funds Structured?

Venture debt funds are a type of financing used by startups and early-stage companies to raise capital. Unlike traditional equity financing, venture debt funds provide debt financing with flexible repayment terms and lower interest rates. This article will explore the structure of venture debt funds and how they differ from traditional venture capital funds.

Overview of Venture Debt Funds

Venture debt funds are typically structured as limited partnerships, with limited partners providing the majority of the capital and the general partner managing the fund. The general partner is responsible for sourcing investment opportunities, managing the portfolio, and making investment decisions. In exchange for their services, the general partner receives a management fee and a share of the profits.

Venture debt funds invest in a variety of companies, including early-stage startups, growth-stage companies, and established companies with a proven track record. The investments are typically structured as debt instruments, such as loans or convertible notes, with the option to convert to equity at a later date.

Investment Criteria and Due Diligence

Before investing in a company, venture debt funds conduct a rigorous due diligence process to assess the company’s financial health, market potential, and management team. They typically look for companies with a strong financial profile, a clear path to profitability, and a competitive advantage in their market.

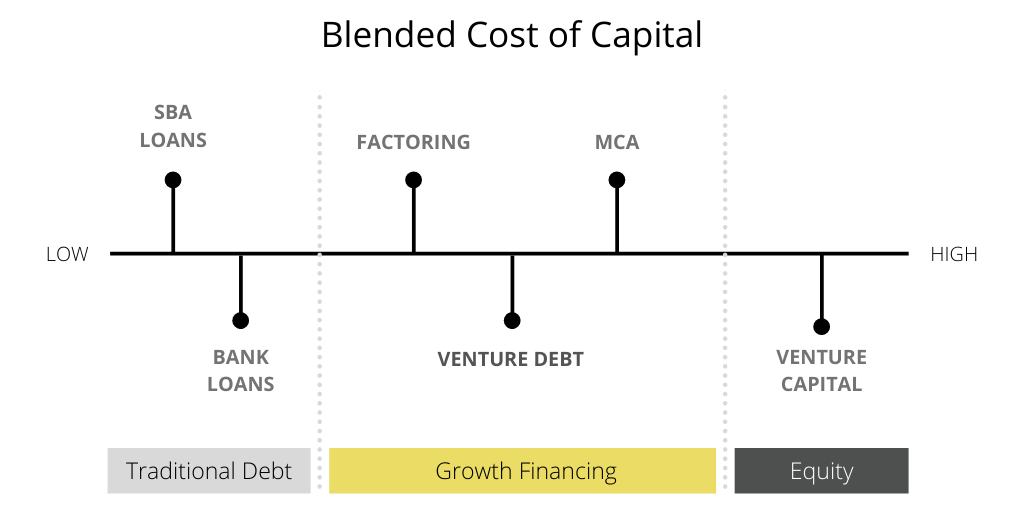

Unlike traditional venture capital funds, venture debt funds focus on companies with a lower risk profile and a more predictable revenue stream. This allows them to offer debt financing at a lower cost of capital than traditional lenders, while still providing the potential for equity-like returns.

Terms and Conditions of Venture Debt Financing

The terms and conditions of venture debt financing vary depending on the specific fund and the company’s needs. However, there are several common features that are typical of most venture debt agreements.

First, venture debt financing typically includes a fixed interest rate and a repayment schedule that is tailored to the company’s cash flow needs. This allows companies to manage their debt obligations while still investing in growth opportunities.

Second, venture debt financing often includes warrants or options that give the lender the right to purchase equity in the company at a later date. This allows the lender to participate in the company’s upside potential while still providing debt financing.

Benefits of Venture Debt Financing

Venture debt financing offers several benefits to startups and early-stage companies. First, it provides access to capital at a lower cost of capital than traditional lenders, which can help companies conserve equity and maintain control of their business. Second, it allows companies to manage their debt obligations while still investing in growth opportunities. Finally, it provides the potential for equity-like returns without diluting existing shareholders.

Venture Debt vs. Traditional Venture Capital

Venture debt and traditional venture capital are both forms of financing used by startups and early-stage companies. However, there are several key differences between the two.

First, venture debt provides debt financing with flexible repayment terms and lower interest rates, while traditional venture capital provides equity financing in exchange for a share of ownership in the company.

Second, venture debt is typically offered to companies with a lower risk profile and a more predictable revenue stream, while traditional venture capital is focused on high-growth companies with the potential for significant returns.

Finally, venture debt allows companies to maintain control of their business and conserve equity, while traditional venture capital often requires significant dilution of existing shareholders.

Conclusion

Venture debt funds are a valuable source of financing for startups and early-stage companies. They provide debt financing with flexible repayment terms and lower interest rates, allowing companies to manage their debt obligations while still investing in growth opportunities. While venture debt and traditional venture capital are both forms of financing used by startups, they differ in their structure, investment criteria, and terms and conditions. By understanding the structure of venture debt funds, companies can make informed decisions about their financing options.

Frequently Asked Questions

Here are some common questions and answers about how venture debt funds are structured.

What is a venture debt fund?

A venture debt fund is a type of investment fund that provides financing to startups and early-stage companies. Unlike traditional venture capital funds, which primarily invest in equity, venture debt funds provide debt financing in the form of loans or other debt instruments.

These funds typically target companies that have already raised equity financing and are seeking additional capital to support their growth. Venture debt funds may also offer other services to their portfolio companies, such as introductions to potential investors or strategic partners.

How are venture debt funds structured?

Venture debt funds are typically structured as limited partnerships, with the fund manager serving as the general partner and investors serving as limited partners. The fund manager is responsible for making investment decisions and managing the portfolio of investments, while the limited partners provide the capital for the fund.

Investors in a venture debt fund typically receive a fixed rate of interest on their investment, as well as a share of any profits generated by the fund. The fund manager may also charge a management fee, which is typically a percentage of the total assets under management.

What types of companies are targeted by venture debt funds?

Venture debt funds typically target high-growth startups and early-stage companies that have already raised equity financing. These companies may be in a variety of industries, but are typically focused on technology or other emerging sectors.

Companies that are a good fit for venture debt financing are often those that have strong revenue growth potential but may not yet be profitable. They may also have a need for additional capital to support their growth, but do not want to dilute their equity by raising additional rounds of financing.

What are the advantages of venture debt financing?

One of the main advantages of venture debt financing is that it allows companies to raise additional capital without diluting their equity. This can be particularly important for companies that have already raised several rounds of equity financing and may not want to give up additional ownership.

Venture debt financing can also be less expensive than equity financing, since the interest rates on debt are typically lower than the cost of equity. Additionally, venture debt funds may provide other benefits to their portfolio companies, such as introductions to potential investors or strategic partners.

What are the risks of investing in a venture debt fund?

Like any investment, investing in a venture debt fund carries some risks. One potential risk is that the companies in the fund’s portfolio may not perform as well as expected, which could lead to lower returns for investors.

Additionally, venture debt funds may be more susceptible to economic downturns or other market conditions that could impact the performance of their portfolio companies. Finally, there is always the risk that the fund manager may make poor investment decisions or mismanage the fund, which could also impact returns for investors.

In conclusion, venture debt funds are structured to provide a unique financing solution for startups and early-stage companies. The funds typically offer a lower cost of capital than equity financing, while also providing a flexible repayment schedule that aligns with the company’s growth and revenue trajectory. Additionally, venture debt funds often provide value-added services such as introductions to potential investors and strategic partners, which can help startups accelerate their growth and achieve success.

One key feature of venture debt funds is their use of warrants, which provide the lender with the option to purchase equity in the company at a predetermined price. This allows the lender to participate in the upside potential of the company while also mitigating their downside risk. The use of warrants can also be a valuable tool for startups, as it allows them to raise capital without diluting existing shareholders.

Another important consideration when evaluating venture debt funds is their underwriting criteria. Most funds will focus on companies with a proven business model, a clear path to profitability, and a strong management team. This means that companies that are pre-revenue or have unproven business models may struggle to secure venture debt financing. However, for companies that meet the underwriting criteria, venture debt can be an attractive financing option that allows them to fund their growth and achieve their goals.