Venture debt has become an increasingly popular financing option for startups and emerging companies looking to fund their growth and expansion. However, many entrepreneurs and business owners are still uncertain about the collateral requirements for this type of financing.

Unlike traditional bank loans, venture debt typically does not require collateral in the form of physical assets. Instead, lenders typically rely on the future cash flows and potential of the business as collateral, making it a more flexible and accessible option for many companies. In this article, we will explore the nuances of venture debt collateral requirements and help you determine whether it is the right financing option for your business.

Does Venture Debt Require Collateral?

Venture debt is a form of financing that has become increasingly popular in recent years. It is a type of debt that is offered to startups and other high-growth companies that may not yet be profitable, but have the potential for significant growth in the future. One of the questions that often comes up with venture debt is whether or not collateral is required. In this article, we will explore this question in detail.

What is Venture Debt?

Venture debt is a type of financing that is typically offered to high-growth companies that have already raised money from venture capital firms. It is often used as a way to bridge the gap between equity rounds, or to provide additional working capital to help a company grow.

Venture debt is different from traditional bank loans in several ways. First, it is typically offered by specialty lenders who understand the unique needs of startups and high-growth companies. Second, it is often structured as a hybrid of debt and equity, which means that lenders may receive both interest payments and equity stakes in the company. Finally, venture debt is often more flexible than traditional bank loans, with fewer covenants and more relaxed collateral requirements.

Does Venture Debt Require Collateral?

The short answer is that it depends on the lender. Some venture debt lenders require collateral, while others do not. In general, collateral is less of a requirement for venture debt than it is for traditional bank loans, but it may still be required in some cases.

When collateral is required, it can take many forms. Some lenders may require a personal guarantee from the founders or other key executives. Others may require a lien on the company’s assets, such as intellectual property or equipment. Still, others may require a pledge of the company’s equity as collateral.

The specific collateral requirements will vary from lender to lender, and may also depend on the size and stage of the company. Early-stage startups may have fewer assets to pledge as collateral, while more established companies may have a broader range of assets available.

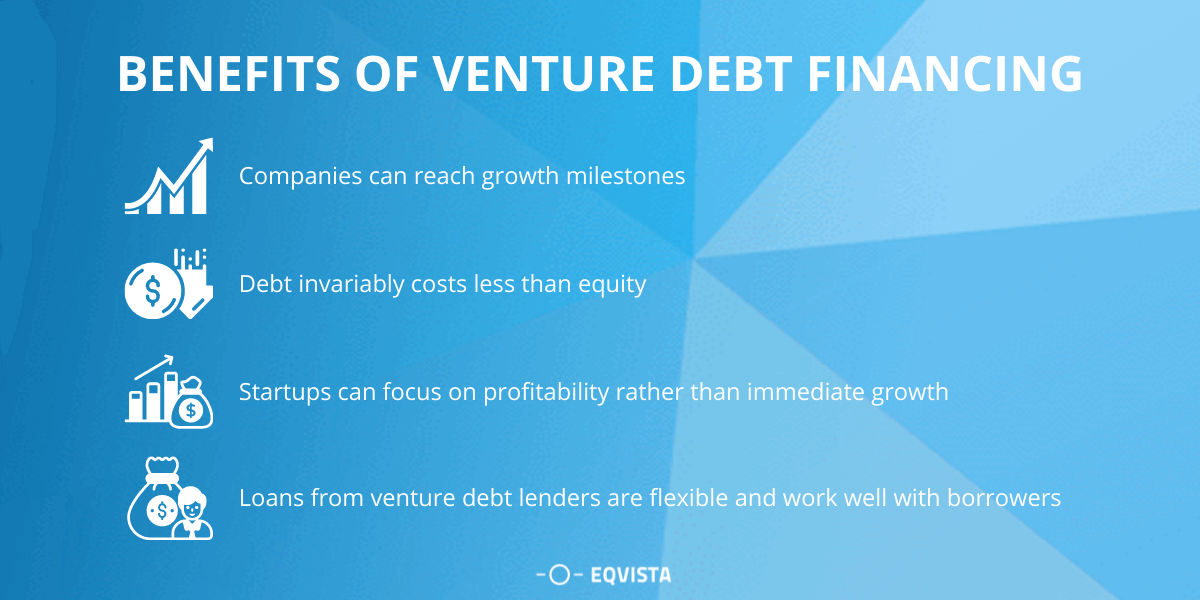

The Benefits of Venture Debt

There are several benefits to using venture debt as a form of financing. First, it can be an excellent way to extend a company’s runway and provide additional working capital without diluting the equity of existing shareholders. This can be particularly important for startups that are not yet profitable, but have the potential for significant growth in the future.

Venture debt can also be more flexible than traditional bank loans, with fewer covenants and more relaxed collateral requirements. This can make it easier for high-growth companies to access the capital they need to grow and succeed.

Finally, venture debt lenders often have a deep understanding of the needs of startups and high-growth companies. This means that they can provide more than just capital – they can also provide valuable advice, connections, and other resources that can help a company succeed.

Venture Debt vs. Equity Financing

One of the key decisions that startups and high-growth companies need to make is whether to raise capital through equity financing or venture debt. There are pros and cons to both approaches.

Equity financing involves selling shares of the company to investors. This can be an excellent way to raise significant capital, but it also dilutes the ownership stake of existing shareholders. In addition, equity investors may have significant control over the company’s decisions and operations.

Venture debt, on the other hand, does not dilute existing shareholders and can be more flexible than equity financing. However, it also typically involves higher interest rates and other fees than traditional bank loans.

Ultimately, the decision of whether to use venture debt or equity financing will depend on the specific needs and goals of the company. It is important to carefully consider the pros and cons of each approach before making a decision.

The Bottom Line

Venture debt can be an excellent way for startups and high-growth companies to access the capital they need to grow and succeed. While collateral may be required in some cases, it is generally less of a requirement for venture debt than it is for traditional bank loans. However, it is important to carefully consider the specific collateral requirements and other terms of any venture debt agreement before signing on the dotted line. With the right financing partner and a solid growth plan, venture debt can be a valuable tool for any high-growth company.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing that provides funding to early-stage and growth-stage companies that have already raised some equity capital. The debt is typically used to finance working capital, capital expenditures, or other growth initiatives.

What are the benefits of venture debt?

Venture debt offers several benefits to startups, including lower interest rates compared to equity financing, less dilution of ownership, and the ability to extend a company’s runway without having to raise additional equity capital. Additionally, venture debt lenders can provide valuable industry experience and connections to startups.

What types of collateral are typically required for venture debt?

While venture debt lenders do require collateral to secure their loans, the types of collateral can vary depending on the lender. Common types of collateral include accounts receivable, inventory, equipment, and intellectual property. In some cases, personal guarantees from company founders may also be required.

How is the interest rate determined for venture debt?

Interest rates for venture debt are typically determined based on the company’s creditworthiness, as well as the lender’s perceived risk of the investment. In general, interest rates for venture debt tend to be higher than traditional bank loans but lower than the cost of equity financing. Lenders may also charge fees for origination, underwriting, and other services.

What are the risks associated with venture debt?

While venture debt can be a useful financing tool for startups, there are several risks associated with this type of borrowing. First and foremost, failure to repay the debt can result in the loss of collateral and damage to the company’s credit rating. Additionally, if the company’s performance does not meet expectations, it may be difficult to secure additional funding in the future. Finally, some venture debt lenders may have restrictive covenants or other terms that can limit a company’s flexibility and growth potential.

How to think about venture debt

In conclusion, venture debt is an attractive financing option for startups and growing companies. While it is true that many venture debt lenders require collateral, this is not always the case. Some lenders may be willing to provide unsecured loans, although these may come with higher interest rates and stricter repayment terms.

It is important for companies considering venture debt to carefully evaluate their options and choose a lender that fits their needs. Some lenders may be more flexible than others in terms of collateral requirements and repayment terms.

Ultimately, venture debt can be a valuable tool for companies looking to grow quickly and efficiently. By providing access to additional capital without diluting ownership or control, venture debt can help companies achieve their goals and thrive in today’s competitive business landscape.