Startups are the lifeblood of the modern economy, and venture capital is often the fuel that keeps them going. However, as competition for funding grows more intense, many startups are turning to alternative sources of capital, such as venture debt.

Venture debt is a type of financing that allows startups to borrow money from investors instead of selling equity. This can be an attractive option for startups that want to maintain control over their business while still accessing the capital they need to grow. In this article, we’ll explore whether or not startups prefer venture debt, and what factors they consider when making this decision.

Do Startups Prefer Venture Debt?

Venture debt has become a popular financing option for startups. It is a form of debt financing that is provided by specialized lenders to startups that have already raised equity capital. Venture debt is used to extend the runway of the startup and provide additional capital for growth. This article explores whether startups prefer venture debt as a financing option.

What is venture debt?

Venture debt is a form of debt financing that is provided by specialized lenders to startups. The lenders provide debt capital to startups that have already raised equity capital. Venture debt is typically structured as a loan with interest and principal payments due over a period of time. The loan is secured by the assets of the startup and is often accompanied by warrants or equity options.

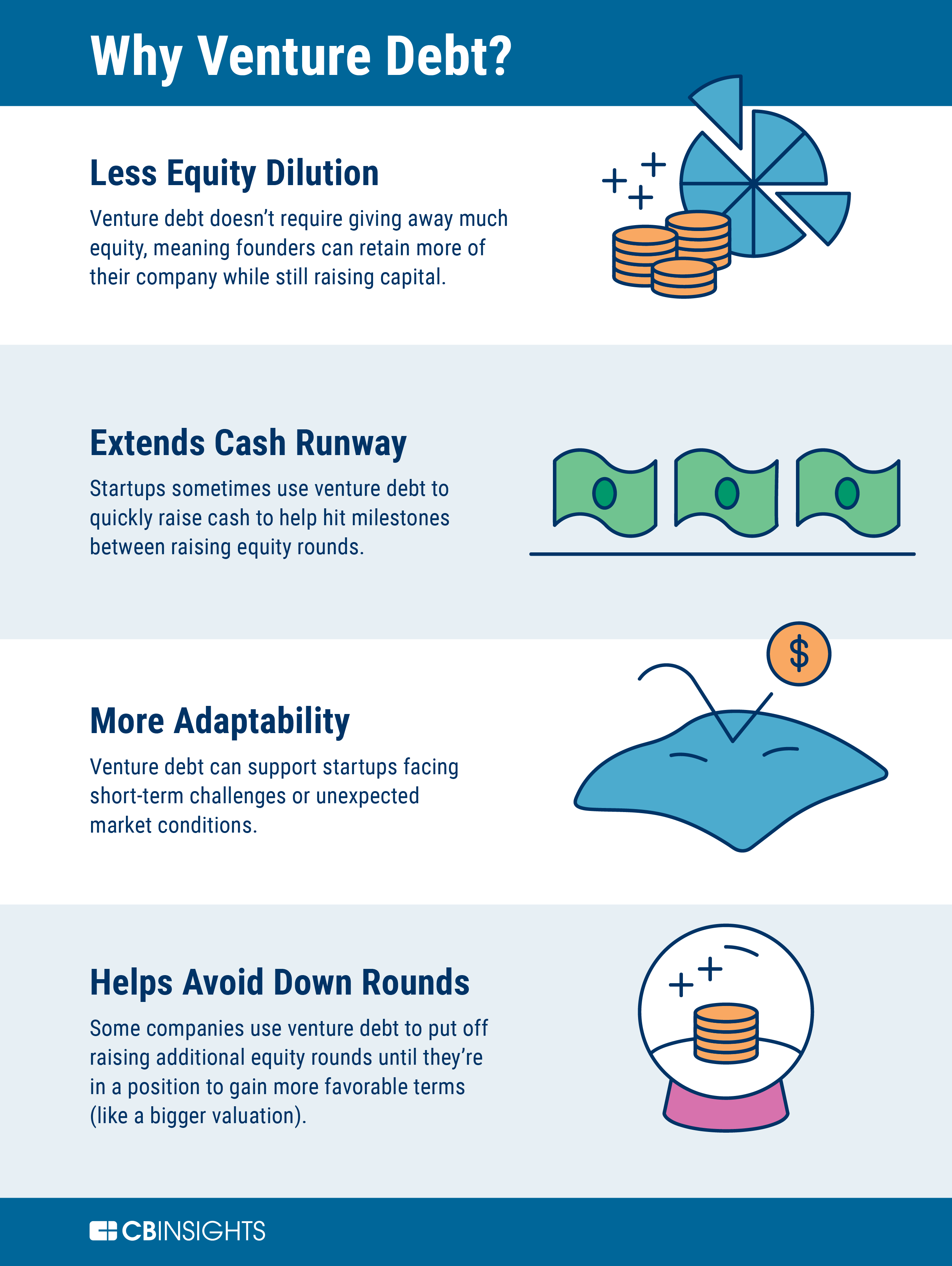

Benefits of venture debt

Venture debt has several benefits for startups. It allows startups to extend their runway and provide additional capital for growth without diluting the equity of the company. Venture debt is also less dilutive than equity financing, as the lenders are not taking ownership in the company. Additionally, venture debt can be a faster and easier financing option than equity financing, as it requires less due diligence and legal work.

Disadvantages of venture debt

Venture debt also has some disadvantages for startups. The interest rates on venture debt are typically higher than traditional bank loans, as the lenders are taking on more risk. Additionally, venture debt is typically accompanied by warrants or equity options, which can dilute the equity of the company in the future. Furthermore, venture debt can be a risky financing option if the startup does not have enough cash flow to make the required interest and principal payments.

Why do startups prefer venture debt?

Startups prefer venture debt for several reasons. First, venture debt allows startups to extend their runway and provide additional capital for growth without diluting the equity of the company. This is particularly important for startups that are not yet profitable or have a long path to profitability. Second, venture debt can be a faster and easier financing option than equity financing, as it requires less due diligence and legal work. Finally, venture debt can be a good option for startups that want to maintain control over their company and avoid taking on additional equity partners.

Venture debt vs. traditional bank loans

Venture debt is typically more expensive than traditional bank loans, as the lenders are taking on more risk. However, venture debt can be a good option for startups that do not have the credit history or collateral to qualify for traditional bank loans. Additionally, venture debt can be a faster and easier financing option than traditional bank loans.

Venture debt vs. equity financing

Venture debt is less dilutive than equity financing, as the lenders are not taking ownership in the company. Additionally, venture debt can be a good option for startups that want to maintain control over their company and avoid taking on additional equity partners. However, venture debt is typically more expensive than equity financing, as the lenders are taking on more risk. Additionally, venture debt can be a risky financing option if the startup does not have enough cash flow to make the required interest and principal payments.

Conclusion

In conclusion, venture debt has become a popular financing option for startups. It allows startups to extend their runway and provide additional capital for growth without diluting the equity of the company. Venture debt is also less dilutive than equity financing and can be a faster and easier financing option. However, venture debt is typically more expensive than traditional bank loans and can be a risky financing option if the startup does not have enough cash flow to make the required interest and principal payments.

Frequently Asked Questions

Here are some commonly asked questions about venture debt for startups:

What is venture debt?

Venture debt is a type of debt financing that is specifically designed for startups and high-growth companies. Unlike traditional bank loans, venture debt is typically provided by specialized lenders who understand the unique needs and challenges of startups. Venture debt can be a useful tool for startups that need additional capital to fuel growth, but don’t want to dilute their equity by selling more shares or taking on more investment.

However, it’s important to note that venture debt typically comes with higher interest rates and more stringent repayment terms than traditional bank loans. Startups should carefully evaluate their cash flow and growth projections before taking on venture debt to ensure that they will be able to meet their repayment obligations.

What are the advantages of venture debt for startups?

One of the main advantages of venture debt for startups is that it allows them to access additional capital without diluting their equity. This can be especially important for startups that are not yet profitable or that are still in the early stages of growth. Venture debt can also be a good option for startups that have already raised equity financing but need additional capital to fund specific projects or initiatives.

Another advantage of venture debt is that it can help startups build their credit history and establish a relationship with a lender. This can be valuable for startups that may need to access more traditional forms of debt financing in the future.

What are the disadvantages of venture debt for startups?

One of the main disadvantages of venture debt for startups is that it typically comes with higher interest rates and more stringent repayment terms than traditional bank loans. This can put additional strain on a startup’s cash flow and make it more difficult to meet other financial obligations.

Additionally, if a startup is unable to repay its venture debt, it may be forced to give up additional equity or face other consequences that could ultimately harm its long-term prospects for success.

Do all startups use venture debt?

No, not all startups use venture debt. In fact, many startups choose to rely solely on equity financing or traditional bank loans. The decision to use venture debt depends on a variety of factors, including the startup’s growth trajectory, its cash flow needs, and its overall financial strategy.

Startups should carefully evaluate all of their financing options, including venture debt, before deciding which path to pursue.

How can startups qualify for venture debt?

To qualify for venture debt, startups typically need to have a solid growth trajectory and a clear plan for how they will use the additional capital. Lenders will also typically evaluate a startup’s cash flow and financial history to ensure that it has the ability to repay the debt.

Startups that have already raised equity financing or that have a strong credit history may be more likely to qualify for venture debt. Additionally, startups that have established relationships with specialized venture debt lenders may have an easier time accessing this type of financing.

In conclusion, startups are increasingly turning to venture debt as a way to finance their growth. While equity financing has traditionally been the preferred method for startup funding, venture debt offers a number of unique benefits, including lower dilution for founders and the ability to leverage existing equity.

That being said, venture debt is not the right choice for every startup. It’s important for founders to carefully consider their funding options and choose the financing structure that best aligns with their long-term goals.

Overall, the rise of venture debt is a positive development for the startup ecosystem, providing entrepreneurs with greater flexibility and more options when it comes to raising capital. As the startup landscape continues to evolve, it will be interesting to see how venture debt fits into the broader funding landscape.