In the world of startups and entrepreneurship, venture debt has become an increasingly popular option for funding growth and expansion. But the question remains, does venture debt actually increase company valuation?

While some argue that venture debt can lead to dilution of equity and ultimately decrease valuation, others believe that it can actually have a positive impact on a company’s worth. In this article, we will explore the various factors that can influence a company’s valuation when utilizing venture debt, and whether or not it can truly be a valuable tool for growth.

Did Venture Debt Increase Company Valuation?

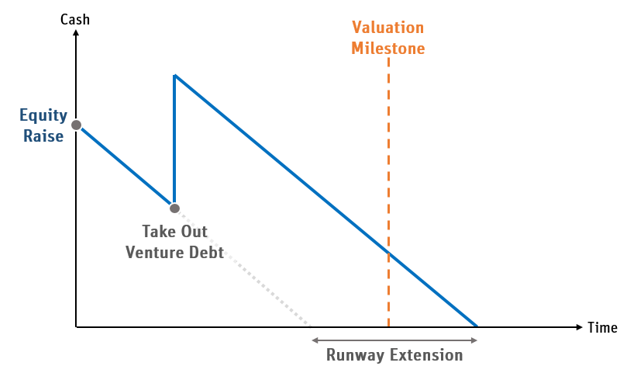

Venture debt is a type of financing that provides startups with loans rather than equity. These loans are typically secured by the company’s assets, and the interest rates are higher than traditional bank loans. The goal of venture debt is to provide startups with additional capital to fund growth without diluting the ownership of the company. In recent years, venture debt has become an increasingly popular financing option for startups. But does venture debt actually increase company valuation? Let’s explore.

What is Venture Debt?

Venture debt is a type of financing that is provided to startups. The loans are typically structured as term loans, lines of credit, or convertible debt. Venture debt is usually provided by specialized lenders that focus on working with startups. These lenders understand the unique needs and challenges of startups and are able to provide flexible financing options that traditional lenders might not offer.

Benefits of Venture Debt

Venture debt has several benefits that make it an attractive financing option for startups. These benefits include:

- Lower dilution: Unlike equity financing, venture debt does not require the startup to give up ownership in the company. This means that founders can maintain control of the company while still raising capital.

- Flexibility: Venture debt is often more flexible than traditional bank loans. Lenders are willing to work with startups to structure loans that meet their unique needs.

- Speed: Venture debt can be obtained more quickly than equity financing. This is because the due diligence process is typically less involved.

- Lower cost: While venture debt typically has higher interest rates than traditional bank loans, it is usually less expensive than equity financing.

Venture Debt vs. Equity Financing

Venture debt is often compared to equity financing, which is another popular financing option for startups. Equity financing involves selling a portion of the company to investors in exchange for capital. There are several key differences between venture debt and equity financing:

| Venture Debt | Equity Financing |

|---|---|

| Debt financing | Equity financing |

| Interest payments | No interest payments |

| No dilution of ownership | Dilution of ownership |

| Lower cost | Higher cost |

| More flexible repayment terms | Fixed repayment terms |

Does Venture Debt Increase Company Valuation?

One of the primary goals of startup financing is to increase company valuation. The question is whether venture debt can help achieve this goal. The answer is yes, but with some caveats.

How Venture Debt Can Increase Company Valuation

Venture debt can help increase company valuation in several ways:

- Growth: Venture debt can provide the additional capital needed to fund growth initiatives. This can lead to increased revenue, which can in turn increase company valuation.

- Improved financials: Venture debt can help improve a startup’s financials by providing funding for working capital, reducing the need for equity financing. This can lead to a stronger balance sheet, which can increase company valuation.

- Reduced dilution: By using venture debt instead of equity financing, founders can avoid diluting their ownership in the company. This means that they can maintain a larger percentage of the company’s value, which can increase company valuation.

The Caveats

While venture debt can help increase company valuation, there are some caveats to keep in mind:

- Interest payments: Venture debt comes with interest payments, which can eat into profits and reduce company valuation.

- Collateral: Venture debt is typically secured by the company’s assets. This means that if the company defaults on the loan, the lender can seize its assets. This can reduce company valuation.

- Risk: Like all debt financing, venture debt comes with risk. If the company is unable to make its interest payments or repay the loan, it can harm the company’s financials and reduce company valuation.

Conclusion

Venture debt can be an effective financing option for startups looking to fund growth initiatives without diluting their ownership in the company. While it can help increase company valuation, it is important to keep in mind the potential drawbacks, such as interest payments, collateral, and risk. As with any financing option, startups should carefully consider their options and weigh the benefits and drawbacks before making a decision.

Frequently Asked Questions

Here are some commonly asked questions about venture debt and its impact on company valuation:

What is venture debt?

Venture debt is a type of debt financing that is provided to startups and high-growth companies. It is typically used to help these companies finance their growth and expansion without diluting their equity. Venture debt is often provided by specialized lenders who are familiar with the unique needs of startups and are willing to take on higher levels of risk than traditional lenders.

Venture debt can take many forms, including term loans, lines of credit, and convertible notes. The terms and conditions of venture debt are often more flexible than traditional debt financing, and may include warrants or other equity kickers that can provide additional upside for the lender.

How does venture debt impact company valuation?

Venture debt can have a positive impact on company valuation in several ways. First, it can help startups and high-growth companies finance their growth and expansion without diluting their equity, which can help to maintain or increase their valuation. Second, venture debt can be used to fund specific projects or initiatives that can increase the value of the company, such as product development, marketing campaigns, or strategic acquisitions. Finally, the terms and conditions of venture debt, such as the inclusion of warrants or other equity kickers, can provide additional upside for the lender that can ultimately benefit the company.

However, it’s important to note that venture debt also comes with risks, such as higher interest rates and fees than traditional debt financing, and the potential for default or bankruptcy if the company is unable to meet its debt obligations. As with any form of financing, companies should carefully consider the costs and benefits of venture debt before deciding whether it is the right choice for their needs.

What factors determine the impact of venture debt on company valuation?

The impact of venture debt on company valuation depends on a variety of factors, including the amount and terms of the debt, the stage of the company’s growth, and the overall market conditions. In general, venture debt is most beneficial for companies that are already generating revenue and have a clear path to profitability, as this can help to mitigate the risks associated with the debt. Companies that are earlier in their growth cycle or that have more uncertain prospects may find that venture debt is not the best choice for their needs.

Other factors that can impact the impact of venture debt on company valuation include the health of the overall economy, the availability of other sources of financing, and the competitive landscape in the company’s industry. Companies should carefully consider all of these factors before deciding whether to pursue venture debt financing.

What are some examples of companies that have used venture debt to increase their valuation?

There are many examples of companies that have used venture debt to help finance their growth and increase their valuation. For example, online retailer Zulily raised $100 million in venture debt in 2013 to help fund its expansion, which helped to increase its valuation to $2.7 billion. Similarly, online education company Coursera raised $49.5 million in venture debt in 2015 to help fund its growth, which helped to increase its valuation to $800 million.

However, it’s important to note that not all companies that use venture debt see an increase in their valuation, and that there are risks associated with any form of debt financing. Companies should carefully consider their financing options and the potential risks and benefits before deciding whether to pursue venture debt.

What are some alternatives to venture debt for companies looking to increase their valuation?

There are many alternatives to venture debt for companies looking to increase their valuation, depending on their specific needs and circumstances. For example, companies may choose to pursue equity financing, such as angel or venture capital investments, which can provide access to larger amounts of capital in exchange for an ownership stake in the company. Other options include crowdfunding, grants, and traditional debt financing.

Companies should carefully consider all of their financing options and the potential risks and benefits of each before deciding which approach is best for their needs.

In conclusion, it is clear that venture debt can indeed increase company valuation. This type of financing is a great tool for startups looking to grow and scale quickly. By providing additional capital at a lower cost than equity financing, venture debt can help startups achieve their goals without giving up too much ownership of their company.

However, it is important to note that venture debt is not a one-size-fits-all solution for every startup. It may not be the right choice for companies that are not yet generating revenue or those that are not yet profitable. Additionally, it is important to carefully consider the terms of any venture debt agreement to ensure that it is a good fit for your company’s financial needs.

Overall, venture debt can be a powerful tool for startups looking to increase their valuation and achieve their growth goals. By carefully weighing the pros and cons and working with a reputable lender, startups can take advantage of this financing option to take their business to the next level.