Venture debt can be a viable financing option for startups looking to grow without giving up equity. However, many entrepreneurs are concerned that taking on debt could lead to increased pressure on their business. This begs the question: couldn’t venture debt actually be more of a burden than a blessing in the long run?

On the one hand, venture debt can provide startups with the capital they need to accelerate growth and reach key milestones. On the other hand, it is important to carefully consider the potential consequences of taking on debt, including the added pressure to meet financial targets and the risk of default in the event of a market downturn. In this article, we will explore the potential risks and rewards of venture debt and help you determine whether it is the right financing option for your startup.

Could Venture Debt Lead to Increased Pressure on the Business?

What is Venture Debt?

Venture debt is a form of debt financing that is provided to startups and small businesses to help them grow without giving up equity in their company. Unlike traditional loans, venture debt typically has higher interest rates and shorter repayment terms, but can be a helpful tool for businesses that want to stay in control of their equity and maintain ownership of their business.

While venture debt can be a useful financing option for many businesses, it is important to understand the potential risks and downsides associated with this type of financing.

The Risks of Venture Debt

One of the biggest risks of venture debt is that it can lead to increased pressure on the business to perform. Because venture debt typically has shorter repayment terms and higher interest rates than traditional loans, businesses that take on this type of financing may need to generate significant revenue in a short amount of time in order to meet their repayment obligations.

If a business is unable to generate the necessary revenue to meet its repayment obligations, it may be forced to take on additional debt or equity financing, which can further increase the pressure on the business to perform.

The Benefits of Venture Debt

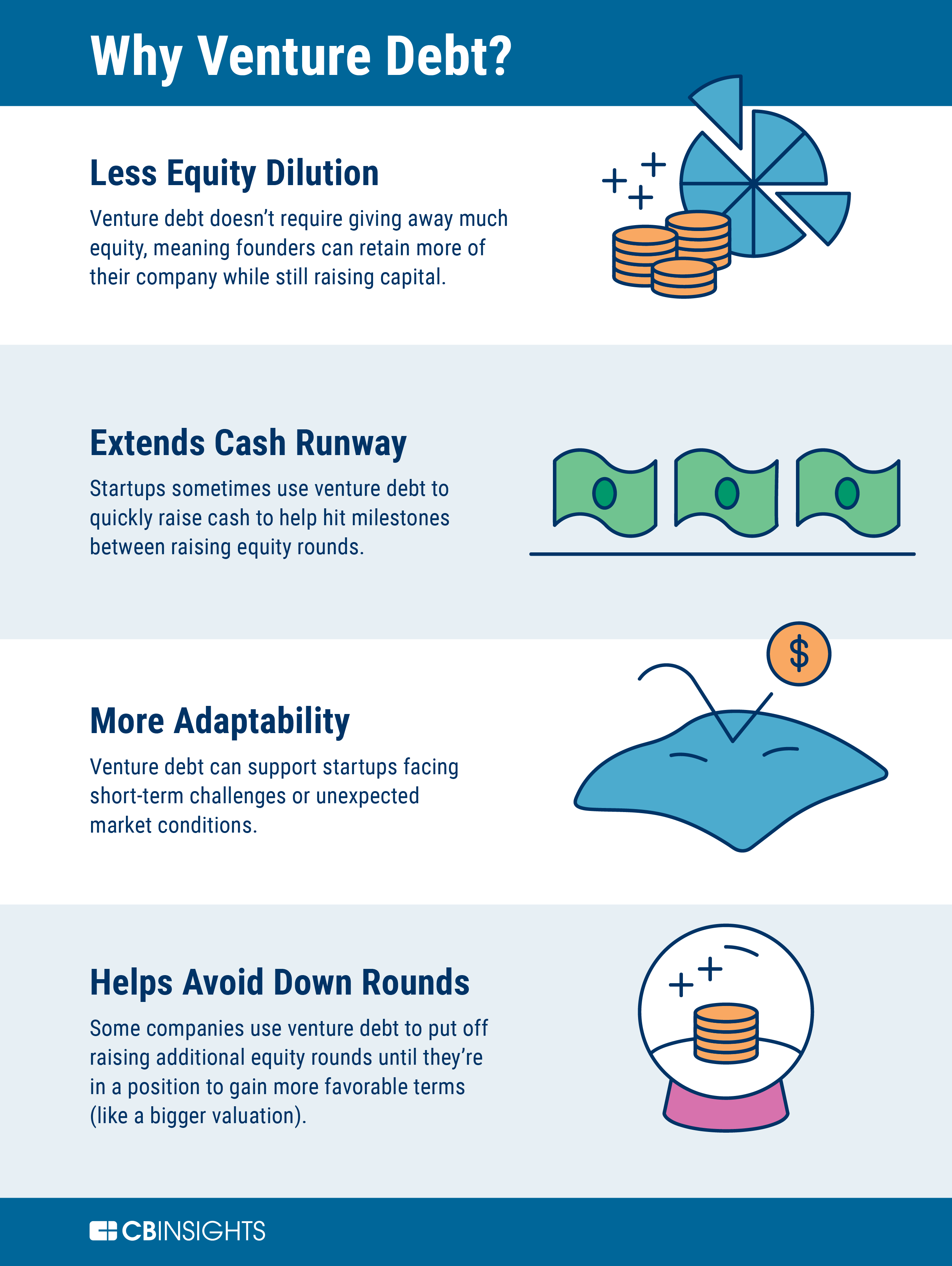

Despite the potential risks associated with venture debt, there are also a number of benefits to this type of financing. For one, venture debt can provide businesses with the capital they need to grow without giving up equity in their company.

Additionally, because venture debt typically has shorter repayment terms than traditional loans, businesses can often pay off their debt more quickly and avoid long-term debt obligations.

Venture Debt vs Equity Financing

One of the main benefits of venture debt is that it allows businesses to maintain ownership and control of their company while still accessing the capital they need to grow. Equity financing, on the other hand, requires businesses to give up a portion of their ownership in exchange for funding.

However, equity financing can also provide businesses with access to experienced investors who can provide guidance and support as the company grows.

How to Evaluate Venture Debt Financing

When considering whether or not to take on venture debt financing, it is important to carefully evaluate the terms and conditions of the financing agreement. This includes assessing the interest rates, repayment terms, and any fees associated with the financing.

Additionally, it is important to consider whether or not the business has the ability to generate the necessary revenue to meet its repayment obligations and avoid taking on additional debt or equity financing in the future.

The Bottom Line

Venture debt can be a useful financing option for businesses that want to maintain ownership and control of their company while still accessing the capital they need to grow. However, it is important to carefully evaluate the risks and benefits associated with this type of financing and to ensure that the business has the ability to meet its repayment obligations.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing that is provided to startups and early-stage companies by specialized lenders. Unlike traditional bank loans, venture debt is typically secured by the company’s assets and cash flow, rather than by collateral. Venture debt can be used to fund growth initiatives, such as expanding into new markets or developing new products, without giving up ownership or control of the business.

However, venture debt comes with higher interest rates and more stringent covenants than traditional bank loans, which means that it can lead to increased pressure on the business to perform and meet financial targets.

What are the benefits of venture debt?

Venture debt can provide startups and early-stage companies with a number of benefits, including access to capital without diluting ownership, the ability to fund growth initiatives without giving up control, and the potential to improve financial metrics and increase valuation.

Additionally, venture debt lenders often have experience working with startups and can provide valuable advice and introductions to potential investors and partners.

What are the risks of venture debt?

Venture debt comes with a number of risks, including higher interest rates and more stringent covenants than traditional bank loans. Additionally, if the company is unable to meet its financial targets, the lender may have the right to take possession of the company’s assets and liquidate them to recover the debt.

Furthermore, taking on too much debt can lead to increased pressure on the business to perform and meet financial targets, which can negatively impact the company’s culture and performance.

How can a company manage the risks of venture debt?

To manage the risks of venture debt, companies should carefully evaluate their financing options and choose a lender that is experienced in working with startups and has a track record of successful partnerships.

Additionally, companies should closely monitor their financial metrics and ensure that they have a realistic plan for meeting their financial targets. It is also important to maintain open communication with the lender and be transparent about the company’s financial performance.

What are some alternatives to venture debt?

There are a number of alternatives to venture debt, including equity financing, crowdfunding, and revenue-based financing. Equity financing involves selling ownership in the company in exchange for capital, while crowdfunding involves raising money from a large number of individuals through an online platform.

Revenue-based financing provides capital in exchange for a percentage of the company’s future revenue. Each of these financing options has its own advantages and disadvantages, and companies should carefully evaluate their options before making a decision.

What is Venture Debt and why invest in it?

In conclusion, while venture debt can provide necessary funding for growing businesses, it can also lead to increased pressure on the company. As with any form of financing, there are risks involved, and businesses need to carefully consider whether they are willing to take on additional debt and the potential consequences of doing so.

One factor to consider is the repayment terms of the venture debt, which can be more stringent than other forms of financing. This can put additional pressure on the business to meet revenue targets and maintain a healthy cash flow.

Another consideration is the potential impact on the company’s equity. Venture debt often requires a portion of the company’s equity as collateral, which can dilute the ownership stake of existing shareholders. This can further complicate the financing picture and add to the pressure on the business.

Overall, while venture debt can be a valuable tool for growing businesses, it is important to carefully weigh the potential benefits and risks before deciding whether to pursue this form of financing. By doing so, businesses can make an informed decision that supports their long-term growth and success.