Venture debt is a popular funding option for startups looking to raise capital without giving up equity. While traditional debt financing can be challenging to secure for early-stage companies, venture debt offers a more flexible and less dilutive alternative. However, some entrepreneurs wonder if venture debt can be structured even more flexibly to better suit their needs.

The short answer? Yes, it can. In this article, we’ll explore the world of flexible venture debt and discuss how startups can work with lenders to create customized financing solutions that meet their unique requirements. Whether you’re looking to extend your runway, fund growth initiatives, or make strategic acquisitions, flexible venture debt may be just what your company needs to take the next step forward.

Can Venture Debt be Structured Flexibly?

Venture debt has always been a popular financing option for startups and small businesses. It is a form of debt financing that provides capital to companies that have already raised equity funding. Venture debt is often used to finance growth, acquisitions, working capital, and other operational expenses. However, the question that arises is whether venture debt can be structured flexibly or not. In this article, we will explore this topic in detail.

What is Venture Debt?

Venture debt is a type of debt financing that is provided to startups and small businesses that have already raised equity funding. It is generally provided by specialized lenders who understand the unique needs of startups and their capital requirements. Venture debt is usually structured as a term loan or a revolving line of credit, and the interest rates are higher than traditional bank loans. Venture debt is often used to finance growth, acquisitions, working capital, and other operational expenses.

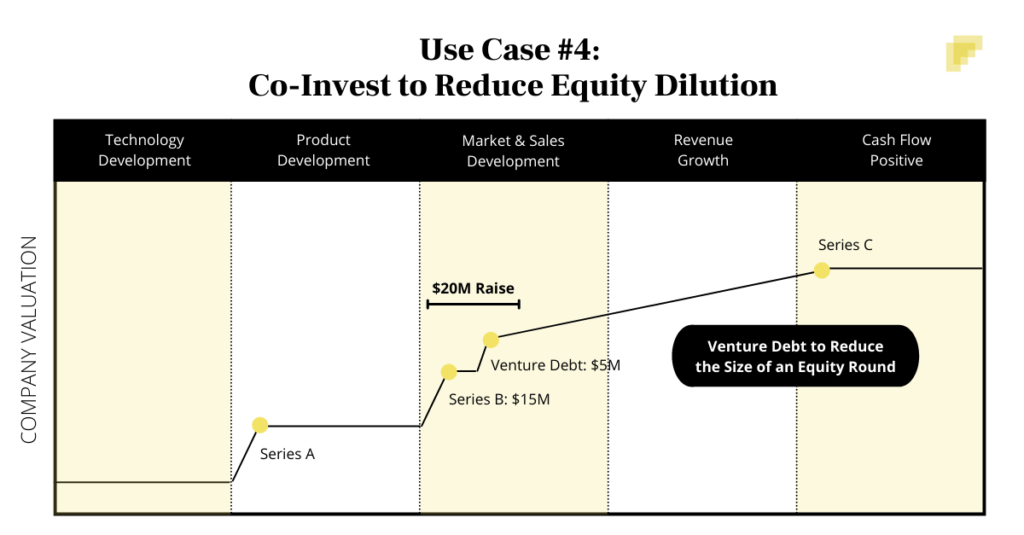

The benefits of venture debt are that it allows startups to retain equity ownership and control, as it is a debt financing option. It also provides additional liquidity to the company, allowing it to pursue growth opportunities without diluting the existing shareholders. Venture debt is also a good option for startups that are not yet profitable or generating positive cash flows.

Can Venture Debt be Structured Flexibly?

The answer to this question is yes. Venture debt can be structured flexibly to meet the unique needs of startups and small businesses. The terms of the venture debt can be customized to align with the company’s growth plans and cash flow requirements. Some of the flexible structures that are available with venture debt include:

- Flexible repayment schedules

- Flexible interest payments

- Flexible covenants

- Flexible loan-to-value ratios

- Flexible collateral requirements

Flexible repayment schedules allow startups to align their debt payments with their cash flows. This can be especially helpful for companies that are not yet generating positive cash flows. Flexible interest payments allow startups to pay lower interest rates in the early stages of the loan and higher rates as they grow. Flexible covenants allow startups to avoid strict financial covenants that could restrict their growth. Flexible loan-to-value ratios allow startups to borrow more money against their assets and collateral. Flexible collateral requirements allow startups to pledge a wider range of collateral to secure the loan.

Benefits of Structuring Venture Debt Flexibly

There are several benefits to structuring venture debt flexibly. Some of these benefits include:

- Increased flexibility to meet the unique needs of the company

- Lower costs of capital compared to equity financing

- Retain ownership and control over the company

- Additional liquidity to pursue growth opportunities

- Ability to leverage assets and collateral to secure the loan

By structuring venture debt flexibly, startups can optimize their capital structure and align it with their growth plans. This can help them avoid dilution and retain ownership and control over the company. It can also provide additional liquidity to pursue growth opportunities without taking on additional equity financing.

Venture Debt vs. Equity Financing

Venture debt is often compared to equity financing as they both provide capital to startups and small businesses. However, there are some key differences between the two. Equity financing involves selling ownership in the company in exchange for capital. This means that investors become shareholders and have a say in the company’s direction. On the other hand, venture debt is a debt financing option where the lenders are not equity holders and do not have a say in the company’s direction.

Venture debt is often considered a complement to equity financing as it allows startups to retain ownership and control over the company while providing additional liquidity to pursue growth opportunities. However, it is important to note that venture debt is a debt financing option and comes with interest payments and other covenants that need to be met.

Conclusion

Venture debt can be structured flexibly to meet the unique needs of startups and small businesses. It is a good option for companies that have already raised equity funding and need additional liquidity to pursue growth opportunities. By structuring venture debt flexibly, startups can optimize their capital structure and align it with their growth plans. However, it is important to note that venture debt is a debt financing option and comes with interest payments and other covenants that need to be met. It is important to weigh the pros and cons of venture debt and equity financing before making a decision.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing that is typically used by startups and emerging growth companies to supplement equity financing. Unlike traditional bank loans, venture debt is often structured as a form of convertible debt, meaning that it can be converted into equity in the company at a later date.

Venture debt is often used to provide companies with the capital they need to accelerate their growth without diluting the ownership stake of existing investors or founders.

How is venture debt typically structured?

Venture debt is typically structured as a loan that is secured by the assets of the company. The interest rate on the loan is usually higher than traditional bank loans to compensate for the higher risk involved in lending to startups and emerging growth companies.

In addition to the interest rate, venture debt lenders may also receive equity warrants as part of the loan agreement. These warrants give the lender the right to purchase a certain number of shares of the company’s stock at a predetermined price at a later date.

What are the benefits of flexible venture debt structures?

Flexible venture debt structures can provide companies with greater flexibility in managing their debt obligations. For example, some venture debt lenders may offer flexible repayment terms that allow companies to defer payments or make interest-only payments for a period of time.

Flexible debt structures can also provide companies with greater flexibility in managing their equity financing. For example, some lenders may offer convertible debt structures that allow companies to convert their debt into equity at a later date, which can be beneficial for companies that are looking to raise additional equity financing in the future.

Can venture debt be structured flexibly?

Yes, venture debt can be structured flexibly. Many venture debt lenders offer flexible repayment terms and convertible debt structures that allow companies to manage their debt and equity financing more effectively.

However, it is important to note that flexible venture debt structures may come with higher interest rates or other fees, so companies should carefully evaluate the costs and benefits of different structures before making a decision.

What should companies consider when evaluating venture debt structures?

When evaluating venture debt structures, companies should consider a number of factors, including the interest rate, repayment terms, equity warrants, and any other fees or charges associated with the loan.

Companies should also consider the reputation and track record of the venture debt lender, as well as their experience working with startups and emerging growth companies. It is important to work with a lender who understands the unique needs and challenges of startup financing.

What to do if you can’t raise Venture Debt?

In conclusion, venture debt can be structured flexibly, but it requires careful consideration of the terms and conditions. It is important to work with experienced lenders who understand the needs of startups and are willing to tailor their offerings to meet those needs.

Flexibility in venture debt can take many forms, such as adjustable interest rates, customizable repayment schedules, and the ability to convert debt into equity. These features can be particularly appealing to startups that are looking for financing that can grow with their business.

Overall, venture debt can be a valuable tool for startups that are looking to raise capital without diluting their ownership or giving up control. By working with the right lender and structuring the debt in a flexible way, startups can access the capital they need to fuel growth and achieve their long-term goals.