As a business owner, raising capital is essential for growth, and one option you may consider is venture debt. However, some entrepreneurs worry that taking on debt will dilute their ownership.

While it’s understandable to have concerns, venture debt can actually be a valuable tool for scaling your business without sacrificing equity. In this article, we’ll explore how venture debt works, the benefits it offers, and whether or not it will dilute your ownership. So, let’s dive in!

Understanding Venture Debt and its Impact on Ownership

Venturing into a new business requires a considerable amount of capital, and often entrepreneurs seek financial assistance from investors to fund their operations. One option for acquiring capital is through venture debt, which can be a viable alternative to equity financing. However, many entrepreneurs may be hesitant to take on debt, fearing that it could dilute their ownership. In this article, we’ll take a closer look at venture debt and explore whether it can impact ownership.

What is Venture Debt?

Venture debt is a form of financing that provides businesses with debt capital to support their growth. Unlike traditional bank loans, venture debt is specifically designed for startups and emerging companies. Venture debt is typically provided by specialized lenders who understand the needs of these companies. This type of financing can be an attractive alternative to equity financing because it allows entrepreneurs to retain ownership and control of their businesses.

Benefits of Venture Debt

There are several benefits to using venture debt financing. Here are some of the most significant:

- Retain ownership: With venture debt, entrepreneurs can retain ownership and control of their businesses.

- No dilution: Unlike equity financing, venture debt does not result in dilution of ownership.

- Faster funding: Venture debt can often be obtained more quickly than equity financing, allowing businesses to fund their operations more efficiently.

- Flexible terms: Venture debt lenders offer flexible terms, which can be tailored to the needs of the borrower.

Venture Debt vs. Equity Financing

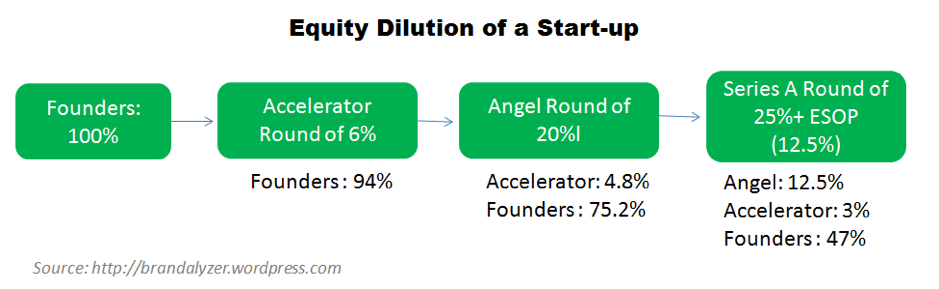

While venture debt has several benefits, it is essential to understand how it differs from equity financing. Equity financing involves selling ownership in a company to raise capital. In contrast, venture debt involves borrowing money that needs to be repaid with interest.

Here are some of the key differences between venture debt and equity financing:

| Venture Debt | Equity Financing |

|---|---|

| Borrowing money | Selling ownership in a company |

| Interest payments | No interest payments |

| No dilution of ownership | Dilution of ownership |

| Flexible terms | Less flexible terms |

How Venture Debt Can Impact Ownership

Many entrepreneurs are hesitant to take on debt because they fear it will impact their ownership. However, venture debt does not result in dilution of ownership. In fact, it can help entrepreneurs retain control of their businesses.

When a company takes on venture debt, it is essentially borrowing money that needs to be repaid with interest. The lender does not receive any ownership in the company. As a result, the entrepreneur retains full ownership and control of the business.

However, it is essential to understand that venture debt does come with some risks. If the company is unable to repay the debt, it can impact the business’s financial standing and potentially lead to bankruptcy. Therefore, it is crucial to carefully consider the terms of any venture debt agreement and ensure that the company can meet its obligations.

Pros and Cons of Venture Debt

Venture debt has several advantages, but it also comes with some risks. Here are some of the pros and cons of using venture debt financing:

Pros of Venture Debt

- Retain ownership: Venture debt allows entrepreneurs to retain ownership and control of their businesses.

- No dilution: Venture debt does not result in dilution of ownership.

- Faster funding: Venture debt can be obtained more quickly than equity financing, allowing businesses to fund their operations more efficiently.

Cons of Venture Debt

- Higher interest rates: Venture debt typically comes with higher interest rates than traditional bank loans.

- Risk of default: If the company is unable to repay the debt, it can impact the business’s financial standing and potentially lead to bankruptcy.

- Covenants: Venture debt lenders often require covenants, which can restrict the company’s ability to operate or make financial decisions.

Conclusion

Venture debt can be an attractive alternative to equity financing for entrepreneurs looking to fund their businesses. It allows entrepreneurs to retain ownership and control of their businesses while providing them with the capital they need to grow. However, it is essential to carefully consider the terms of any venture debt agreement and ensure that the company can meet its obligations. With the right approach, venture debt can be an effective tool for supporting business growth without diluting ownership.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing offered to startups and other high-growth companies that don’t have the credit history or assets to qualify for traditional bank loans. It typically comes from specialized lenders who are familiar with the unique needs and risks of early-stage companies.

How does venture debt work?

Venture debt works by providing a company with a loan that is secured by its assets, such as accounts receivable or inventory. Unlike equity financing, which involves selling ownership in the company, venture debt does not dilute the ownership of existing shareholders. Instead, it provides the company with additional capital to fuel growth and operations.

What are the benefits of venture debt?

Venture debt can offer several benefits to startups and other high-growth companies. For one, it can provide additional funding without diluting ownership or control. Additionally, venture debt lenders may be more flexible than traditional banks, offering more favorable terms and structures to better suit the needs of early-stage companies.

What are the risks of venture debt?

Like any form of debt financing, venture debt carries risks. If the company is unable to meet its debt obligations, it can result in default and potentially bankruptcy. Additionally, venture debt lenders may require more frequent reporting and monitoring, which can be time-consuming and costly for the company.

How do I know if venture debt is right for my company?

Deciding whether or not to pursue venture debt financing depends on a variety of factors, including the stage of your company, its growth prospects, and its ability to generate cash flow. It’s important to weigh the benefits and risks of venture debt against other financing options, such as equity financing or traditional bank loans, to determine which is the best fit for your company’s needs.

The Value of Venture Debt Explained – Trinity Capital Inc.

In conclusion, venture debt is a viable option for startups looking to raise capital without diluting their ownership. While there is some level of dilution involved, it is often minimal compared to traditional equity financing. Additionally, venture debt can provide startups with the necessary funds to grow and scale their businesses without giving up too much control.

It is important to carefully consider all options and consult with experienced professionals before deciding on a financing strategy. With the right approach, venture debt can be a valuable tool for startups looking to achieve their growth and expansion goals while maintaining ownership and control of their business.

Ultimately, the decision to pursue venture debt or any other financing option should be based on the unique needs and goals of each individual startup. By weighing the pros and cons and seeking expert guidance, startups can make informed decisions that set them up for success in the long run.