As an entrepreneur, you might be wondering why some companies choose venture debt over traditional loans. After all, both options provide access to capital, so what’s the difference? The answer lies in the unique advantages that venture debt offers, which can be especially beneficial for startups and high-growth companies.

While traditional loans may require collateral or a personal guarantee, venture debt allows companies to borrow money based on their potential for growth and future cash flows. This means that startups and high-growth companies that may not have the assets to secure a traditional loan can still access the capital they need to fuel their growth. In this article, we’ll explore the reasons why companies choose venture debt and how it can help them achieve their business goals.

Why Venture Debt is a Better Choice for Companies than Traditional Loans

When it comes to financing a business, there are several options available. The most common ones are equity financing, debt financing, and venture debt. Venture debt has become more popular with companies over the years, and this is because it offers several advantages over traditional loans. In this article, we will explain why companies choose venture debt over traditional loans.

Lower Cost of Capital

One of the main reasons why companies choose venture debt over traditional loans is the lower cost of capital. Venture debt typically has a lower interest rate compared to traditional loans, which means that companies can borrow money at a lower cost. This is because venture debt providers are willing to take on more risk than traditional lenders. Also, venture debt providers are more interested in the potential upside of the investment rather than the downside risk.

In addition to the lower interest rate, venture debt also has lower fees compared to traditional loans. Traditional loans often come with origination fees, application fees, and prepayment penalties, which can add up quickly. Venture debt providers typically charge lower fees, which means that companies can save money on the cost of borrowing.

Non-Dilutive Financing

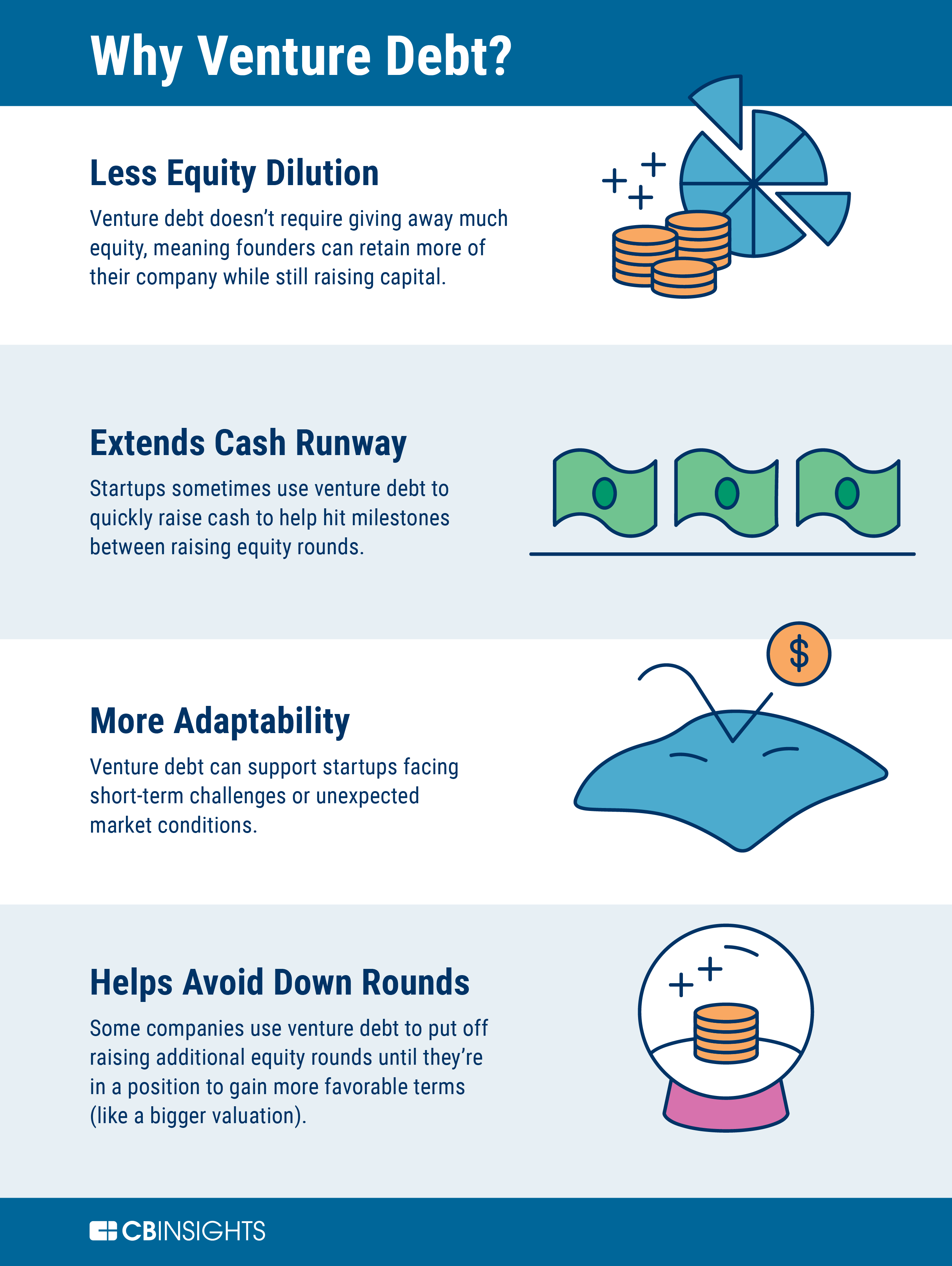

Another advantage of venture debt is that it is non-dilutive financing. This means that companies can raise money without giving up equity in their business. Equity financing requires companies to give up ownership in their business in exchange for capital. With venture debt, companies can keep their ownership intact while still raising the capital they need to grow their business.

Flexible Repayment Terms

Venture debt also offers more flexible repayment terms compared to traditional loans. Traditional loans often have fixed repayment schedules, which can be difficult for companies to manage if their cash flow is inconsistent. Venture debt providers offer more flexible repayment terms, which means that companies can adjust their payments based on their cash flow.

Quick Funding

Venture debt providers can also provide quick funding to companies. Traditional loans often take weeks or even months to fund, which can be a problem for companies that need money quickly. Venture debt providers can provide funding within a few weeks, which means that companies can get the capital they need to grow their business without waiting for weeks or months.

No Personal Guarantees

Another advantage of venture debt is that it does not require personal guarantees. Traditional loans often require business owners to provide personal guarantees, which means that they are personally liable for the debt if the business is unable to repay it. Venture debt providers do not require personal guarantees, which means that business owners can protect their personal assets.

Less Diligence

Venture debt providers also require less diligence compared to traditional lenders. Traditional lenders often require extensive due diligence, which can be time-consuming and expensive for companies. Venture debt providers are more interested in the potential upside of the investment, which means that they require less diligence.

Higher Loan Amounts

Venture debt providers can also provide higher loan amounts compared to traditional lenders. This is because venture debt providers are willing to take on more risk than traditional lenders. Higher loan amounts mean that companies can raise more capital to grow their business.

More Control

Another advantage of venture debt is that it gives companies more control over their business. Equity financing requires companies to give up control of their business in exchange for capital. With venture debt, companies can keep their control intact while still raising the capital they need to grow their business.

Disadvantages of Venture Debt

While venture debt has several advantages over traditional loans, it also has some disadvantages. One of the main disadvantages is that it can be more expensive than traditional loans in the long run. This is because venture debt typically has a shorter repayment period compared to traditional loans. Also, if a company is unable to repay the debt, it could lead to a default, which could hurt the company’s credit score.

Venture Debt vs. Traditional Loans

When comparing venture debt to traditional loans, it is clear that venture debt offers several advantages over traditional loans. Venture debt is less expensive, non-dilutive, and provides more flexible repayment terms. It also offers quick funding, no personal guarantees, and requires less diligence. While it does have some disadvantages, the benefits of venture debt make it a better choice for companies that want to raise capital without giving up equity in their business.

Frequently Asked Questions

Here are some common questions about venture debt and traditional loans:

What is venture debt and traditional loans?

Venture debt is a type of debt financing offered to startups and high-growth companies by specialized lenders. Traditional loans, on the other hand, are typically provided by banks and other financial institutions. These loans come with fixed interest rates and repayment schedules, and are secured by collateral.

While venture debt may have higher interest rates than traditional loans, it can be a useful option for companies that need additional capital to fund growth initiatives, without diluting equity or giving up control.

What are the advantages of venture debt over traditional loans?

One advantage of venture debt is that it can provide companies with additional capital without requiring them to give up equity or control. This can be particularly helpful for startups that are looking to preserve their ownership stakes. Venture debt can also be a faster and more streamlined process than traditional loans, since specialized lenders are often more familiar with the needs of high-growth companies.

Another advantage of venture debt is that it can be structured to align with a company’s growth trajectory. For example, lenders may offer flexible repayment terms that are tied to revenue or other performance metrics, which can help companies manage their cash flow more effectively.

What are the risks of venture debt compared to traditional loans?

One risk of venture debt is that it typically comes with higher interest rates than traditional loans, which can make it more expensive for companies to borrow. Additionally, venture debt may be unsecured, meaning that lenders do not have collateral to fall back on in the event of default.

Another risk of venture debt is that it may be more difficult to obtain than traditional loans, especially for companies that are not yet generating significant revenue. Lenders may also require more documentation and due diligence, which can be time-consuming and expensive for startups.

When is venture debt a good option for companies?

Venture debt can be a good option for companies that are looking to raise additional capital without diluting equity or giving up control. It can also be a good option for companies that have a clear path to revenue growth and profitability, but need additional capital to fund their growth initiatives.

Additionally, venture debt can be a good option for companies that are in industries with long sales cycles or that require significant upfront investment, since it can help them bridge the gap between funding rounds.

How can companies determine whether venture debt or traditional loans are the right option?

Companies should carefully evaluate their financing needs and growth trajectory before deciding whether venture debt or traditional loans are the right option. They should consider factors such as their current cash flow, revenue projections, and long-term growth plans, as well as the costs and risks associated with each type of financing.

It may also be helpful for companies to work with a financial advisor or specialized lender who can help them determine the best financing options for their specific needs and circumstances.

The Value of Venture Debt Explained – Trinity Capital Inc.

In conclusion, there are several reasons why a company may choose venture debt over traditional loans. Firstly, venture debt allows companies to raise capital without diluting their equity, making it an attractive option for startups and early-stage companies. Secondly, venture debt often comes with more flexible repayment terms, which can be beneficial for companies with fluctuating cash flows. Finally, venture debt lenders typically have a deep understanding of the startup ecosystem, which can provide valuable insights and connections that traditional lenders may not have.

Overall, venture debt can be a useful tool for companies looking to raise capital without sacrificing equity, while also benefiting from flexible repayment terms and access to valuable expertise. However, it’s important to carefully consider the terms and conditions of any debt financing option before making a decision, to ensure that it aligns with the company’s long-term goals and financial strategy. With the right approach and guidance, venture debt can be a valuable source of funding for companies at every stage of their growth journey.