Venture capitalists are often seen as the gatekeepers to success for startups. They provide the necessary funding, mentorship, and networking opportunities that can take a company from an idea to a household name. However, venture capital isn’t the only way that VCs can support startups. In recent years, venture debt has become an increasingly popular way for venture capitalists to invest in their portfolio companies.

So why do venture capitalists provide venture debt? What benefits does it offer to both the VC and the startup? In this article, we’ll explore the reasons behind this trend and the impact it can have on the startup ecosystem. From providing additional runway to reducing dilution, venture debt can be a valuable tool for startups looking to grow and scale their business.

Why Do Venture Capitalists Provide Venture Debt?

Venture capitalists are known for providing funding to startups and early-stage companies. However, in addition to equity investments, they also offer venture debt. Venture debt is a form of financing that provides debt capital to startups and early-stage companies. In this article, we will explore why venture capitalists provide venture debt.

1. Diversifying Portfolio Risk

Venture capitalists invest in a portfolio of companies to minimize the risk of any one company failing. Venture debt provides an additional way to diversify their portfolio risk. By providing debt capital, venture capitalists can earn steady interest income from their portfolio companies.

Moreover, venture debt is a less risky investment than equity because it’s senior to equity in the capital structure. This means that in case of a company’s failure, the venture capitalist recovers its investment before the equity investors.

2. Providing More Capital to Portfolio Companies

Venture debt allows startups and early-stage companies to raise additional capital without diluting their equity. This is especially important for companies that are not yet ready for equity financing or want to avoid equity financing due to valuation concerns.

Moreover, venture debt provides a cushion to companies that are going through a difficult period, enabling them to weather the storm without diluting their equity. It also gives them more time to reach key milestones that would improve their valuation.

3. Enhancing Returns

Venture capitalists are constantly looking for ways to enhance their returns. Venture debt is an attractive option for them because it provides a higher return than traditional debt investments.

Moreover, venture debt investments are usually short-term, which means that the venture capitalist can recycle the capital quickly and earn a higher return on their investment. This helps them to achieve their desired return on investment (ROI) and maximize their profits.

4. Building Strong Relationships with Portfolio Companies

Venture capitalists invest not only in companies but also in the people behind them. By providing venture debt, they build a strong relationship with the management team of the portfolio companies.

This relationship can be beneficial in the long term, especially when the company needs additional equity financing in the future. The venture capitalist can leverage this relationship to negotiate better terms for themselves and their investors.

5. Supporting Portfolio Companies through Difficult Times

Startups and early-stage companies often face difficult times, especially when they are going through a rapid growth phase. Venture debt provides a cushion to these companies during such times, enabling them to continue operating without diluting their equity.

This support can be critical for the survival of the company and can help the venture capitalist to protect their investment. By providing this support, the venture capitalist can also build goodwill with the management team and position themselves as a valuable partner for the future.

6. Lowering Cost of Capital

Venture debt is cheaper than equity financing because it has a lower cost of capital. This is because venture debt is less risky than equity and the venture capitalist has a senior position in the capital structure.

Moreover, venture debt usually has a lower interest rate than traditional debt financing because the venture capitalist can earn additional returns through equity kickers or warrants. This helps the company to raise capital at a lower cost, which is beneficial for them in the long term.

7. Offering More Control over the Investment

Venture capitalists usually have a minority stake in the companies they invest in. This means that they have limited control over the company’s operations and decision-making.

However, by providing venture debt, the venture capitalist can negotiate additional covenants and control provisions that give them more control over the investment. This allows them to protect their investment and ensure that the company is moving in the right direction.

8. Providing More Flexibility to the Company

Equity financing comes with a lot of restrictions and obligations. On the other hand, venture debt provides more flexibility to the company.

Venture debt usually has fewer restrictions and covenants than traditional debt financing. This gives the company more freedom to operate and make decisions without the fear of breaching any covenants or defaulting on their debt.

9. Offering More Upside Potential

Venture debt investments usually come with equity kickers or warrants, which give the venture capitalist the right to purchase equity in the company at a discounted price.

This provides the venture capitalist with more upside potential than traditional debt financing. If the company performs well and the valuation increases, the venture capitalist can exercise their equity kickers or warrants and earn additional returns on their investment.

10. Providing a Competitive Advantage

Finally, venture debt provides a competitive advantage to the venture capitalist. By offering venture debt, they can differentiate themselves from other venture capitalists and attract more startups and early-stage companies to their portfolio.

Moreover, venture debt can enable the venture capitalist to get a foot in the door with a company that they might not have been able to invest in through equity financing. This can be beneficial in the long term when the company needs additional equity financing.

In conclusion, venture capitalists provide venture debt for a variety of reasons. It allows them to diversify their portfolio risk, provide more capital to portfolio companies, enhance their returns, build strong relationships with portfolio companies, support portfolio companies through difficult times, lower the cost of capital, offer more control over the investment, provide more flexibility to the company, offer more upside potential, and provide a competitive advantage.

Frequently Asked Questions

What is venture debt?

Venture debt is a form of debt financing provided to early-stage, high-growth companies by specialized lenders. It is typically structured as a loan with warrants or equity kickers and is often used to extend the runway of a company’s cash reserves.

Unlike traditional lenders, venture debt lenders are willing to take on higher risk in return for the potential for higher returns. The terms of venture debt are typically more favorable to the borrower than equity financing, as it does not dilute the ownership of the existing shareholders.

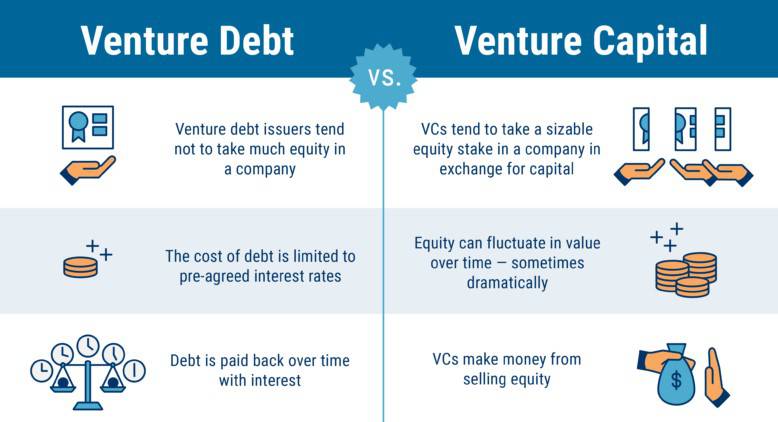

How does venture debt differ from equity financing?

Venture debt is a form of debt financing, while equity financing involves selling ownership shares in the company. Equity financing dilutes the ownership of the existing shareholders, while venture debt does not.

Venture debt is typically used to extend the runway of a company’s cash reserves, while equity financing is used to raise capital for growth initiatives. Venture debt is also typically less expensive than equity financing, as the interest rates are lower and there are no broker fees or commissions.

What are the benefits of venture debt for early-stage companies?

Venture debt provides early-stage companies with additional capital to extend their cash reserves, which can be critical for companies that are not yet generating significant revenue. It is also typically less expensive than equity financing, as the interest rates are lower and there are no broker fees or commissions.

Venture debt can also be less dilutive to the ownership of the existing shareholders, as it does not involve selling ownership shares in the company. This can be important for companies that want to maintain control over their business and decision-making processes.

What are the risks associated with venture debt?

The main risk associated with venture debt is the potential for default. If a company is unable to make its debt payments, it may be forced to liquidate its assets or file for bankruptcy.

Another risk is that the terms of the debt may be too onerous for the company, such as high interest rates or restrictive covenants. This can limit the company’s ability to raise additional capital or make strategic decisions.

Why do venture capitalists sometimes provide venture debt?

Venture capitalists may provide venture debt as a way to extend the runway of their portfolio companies’ cash reserves without diluting their ownership. It can also be a way to maintain their relationship with the company and potentially provide future equity financing.

Venture capitalists may also provide venture debt as a way to differentiate themselves from other investors and win deals. By offering both equity and debt financing, they can provide a more comprehensive financing solution to early-stage companies.

What is Venture Debt and why invest in it?

In conclusion, venture capitalists provide venture debt for several reasons. First, venture debt can help maximize the value of their investment by providing additional capital for growth and expansion. Second, venture debt can also help mitigate risk by allowing companies to take on debt without diluting equity ownership. Finally, venture debt can be a useful tool for companies that don’t want to give up as much equity as they would with traditional equity financing.

Overall, venture debt is a valuable financing option for startups and growth-stage companies. It provides flexibility and helps companies achieve their goals without sacrificing equity or control. Venture capitalists recognize the benefits of venture debt and are increasingly using it as part of their investment strategy. As the startup ecosystem continues to evolve, venture debt is likely to become an even more important part of the investment landscape.