Venture debt has become a popular financing option for startups, giving them access to capital while minimizing equity dilution. However, it’s not uncommon for companies to repay their venture debt early, sometimes even before the maturity date.

So, why do companies choose to do this? In this article, we’ll explore some of the reasons why early repayment of venture debt can be beneficial for both the company and its investors.

Why Do Companies Repay Venture Debt Early?

Venture debt, also known as venture lending, is a form of debt financing provided to startups and early-stage companies. Unlike traditional bank loans, venture debt is typically provided by specialized lenders who understand the unique needs of startups and are willing to take on higher risks in exchange for higher returns. While venture debt can be a valuable source of funding for startups, many companies choose to repay their debt early. In this article, we will explore some of the reasons why companies choose to repay their venture debt early.

1. Reducing Interest Costs

One of the primary reasons why companies choose to repay their venture debt early is to reduce their interest costs. Venture debt can be an expensive form of financing, with interest rates typically ranging from 10% to 20% per year. By repaying their debt early, companies can save a significant amount of money on interest costs over the life of the loan.

Repaying venture debt early can also help companies improve their cash flow. By reducing their interest costs, companies can free up cash that can be used to invest in growth opportunities or pay down other debt.

2. Improving Creditworthiness

Another reason why companies choose to repay their venture debt early is to improve their creditworthiness. When companies have outstanding debt, it can negatively impact their credit score and make it more difficult to obtain additional financing in the future. By repaying their debt early, companies can improve their credit score and make it easier to obtain additional financing when they need it.

Repaying venture debt early can also help companies establish a track record of responsible borrowing. This can be especially important for startups and early-stage companies that are still building their reputation in the market.

3. Removing Restrictions

Venture debt agreements often come with restrictions on how companies can use their funds. For example, lenders may require companies to maintain certain financial ratios or limit their spending on certain types of expenses. By repaying their debt early, companies can remove these restrictions and gain more flexibility in how they use their funds.

Removing restrictions can also help companies take advantage of new opportunities as they arise. For example, if a company wants to pursue a new growth opportunity that requires additional spending, they may be limited by the restrictions in their venture debt agreement. By repaying their debt early, they can free up cash and take advantage of the new opportunity.

4. Avoiding Dilution

Venture debt is often provided in conjunction with equity financing. This means that lenders may require companies to issue warrants or other securities that can be converted into equity in the future. By repaying their debt early, companies can avoid dilution and maintain more control over their ownership structure.

Avoiding dilution can be especially important for startups and early-stage companies that are still building their value and reputation. By maintaining more control over their ownership structure, companies can retain more of the value they create and avoid giving away too much equity too early.

5. Improving Investor Relations

Finally, repaying venture debt early can help improve investor relations. When companies have outstanding debt, it can create uncertainty and risk for investors. By repaying their debt early, companies can demonstrate their commitment to financial responsibility and improve their reputation with investors.

Improving investor relations can also help companies attract new investors in the future. By demonstrating their ability to manage debt and maintain financial stability, companies can position themselves as attractive investment opportunities.

Conclusion

In conclusion, there are many reasons why companies choose to repay their venture debt early. Whether it’s to reduce interest costs, improve creditworthiness, remove restrictions, avoid dilution, or improve investor relations, repaying venture debt early can provide significant benefits for startups and early-stage companies. If you’re considering venture debt financing for your company, it’s important to carefully consider the terms of the agreement and weigh the potential benefits and risks before making a decision.

Frequently Asked Questions

What is venture debt?

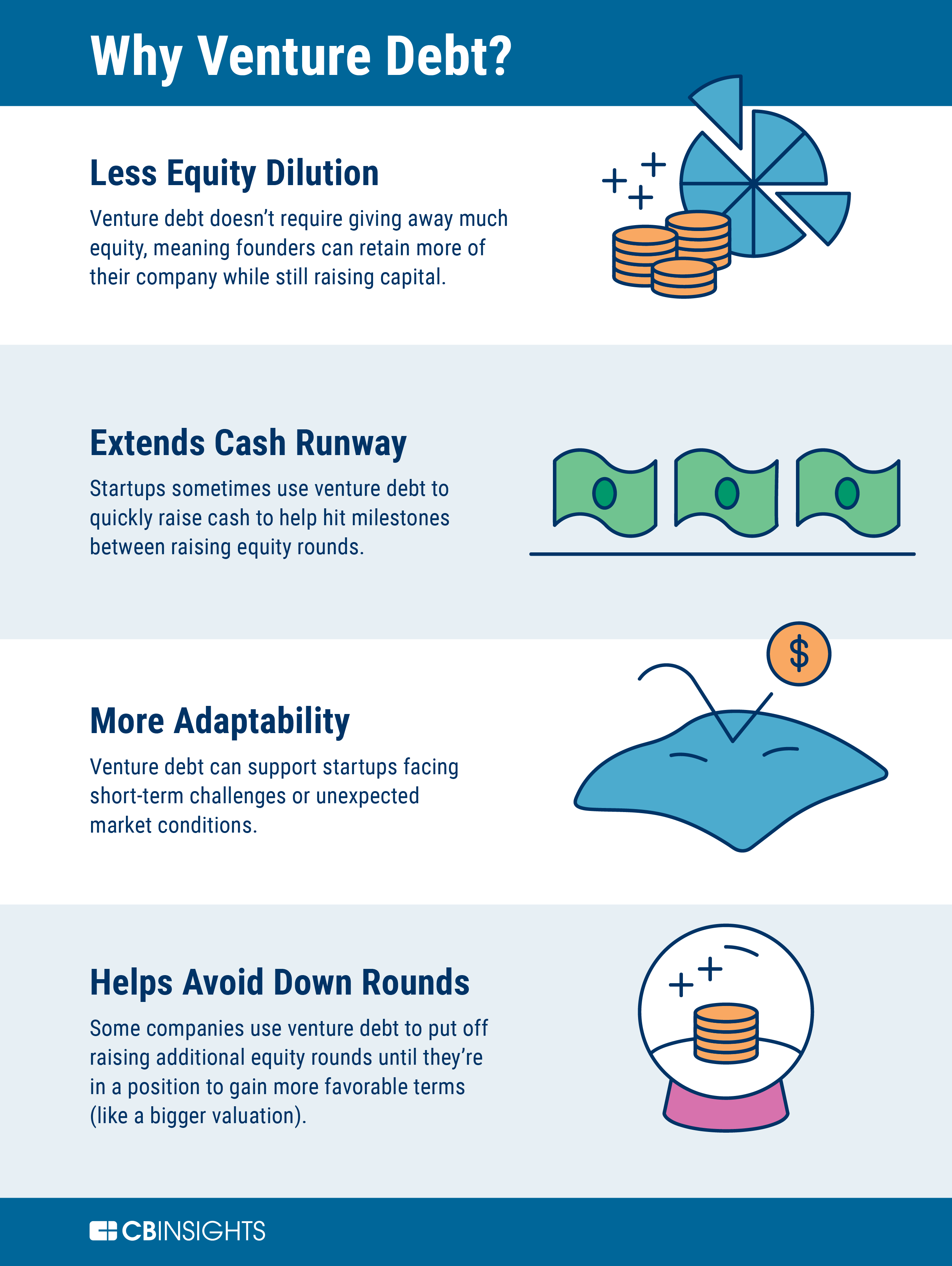

Venture debt is a type of debt financing provided to startups by venture debt firms. This type of financing allows startups to access capital without diluting their ownership. Venture debt is typically structured as a loan with interest rates, maturity dates, and covenants.

How is venture debt different from traditional debt?

Venture debt is different from traditional debt in a few ways. Firstly, venture debt is provided to startups that have limited operating history and may not have generated revenue yet. Secondly, venture debt is typically secured by the company’s assets, including intellectual property and equipment. Lastly, venture debt is often accompanied by warrants, which give the lender the right to purchase equity in the company at a future date.

What are the benefits of repaying venture debt early?

Repaying venture debt early can have several benefits for a company. Firstly, it can improve the company’s cash flow by reducing interest payments. Secondly, it can improve the company’s balance sheet by reducing its debt-to-equity ratio. Finally, it can increase the company’s credibility with investors and potentially improve its ability to raise additional capital in the future.

What are the risks of repaying venture debt early?

While there are benefits to repaying venture debt early, there are also risks to consider. Firstly, early repayment may result in prepayment penalties, which can be costly. Secondly, early repayment may leave the company with less cash on hand, which could impact its ability to fund operations or invest in growth. Lastly, early repayment may result in the loss of any accompanying warrants, which could limit the company’s ability to raise additional capital in the future.

How do companies decide whether to repay venture debt early?

Companies typically decide whether to repay venture debt early based on a number of factors, including their cash position, anticipated cash needs, and the terms of the loan. Companies may also consider the potential benefits and risks of early repayment. Ultimately, the decision to repay venture debt early should be made in consultation with the company’s financial advisors and in consideration of the company’s long-term financial goals.

The Value of Venture Debt Explained – Trinity Capital Inc.

In conclusion, companies repay venture debt early for a variety of reasons. First, it can help them save on interest payments and reduce their overall debt burden. Second, it can improve their financial standing and make them more attractive to potential investors. Finally, early repayment can demonstrate the company’s financial stability and responsibility, which can help it build a positive reputation in the marketplace.

Overall, early repayment of venture debt is a strategic decision that can have significant benefits for companies. By carefully evaluating their financial situation and considering the potential impact of early repayment, companies can make informed decisions that position them for success in the long term. Whether they choose to repay their debt early or not, it’s important for companies to prioritize financial responsibility and stay vigilant about managing their debt and finances effectively.