Venture debt lenders are a key player in the world of startup financing. They offer a unique funding option that can help companies grow while minimizing equity dilution. But who exactly are these lenders, and how do they differ from traditional debt providers? In this article, we’ll take a closer look at the world of venture debt and explore the role that these lenders play in the startup ecosystem.

Who are Venture Debt Lenders?

Venture debt lenders are financial institutions that specialize in providing debt financing to early-stage and growth-stage companies. They offer a unique form of financing that combines aspects of both debt and equity financing, making it an attractive option for startups and growth-stage companies.

What is Venture Debt Financing?

Venture debt financing is a form of debt financing that is typically provided to early-stage and growth-stage companies. Unlike traditional debt financing, venture debt financing is often provided by specialized lenders who understand the unique needs of startups and growth-stage companies.

Venture debt financing is typically structured as a loan with a fixed interest rate and a set repayment schedule. It is often used to fund specific projects, such as product development or expansion, and can be an attractive alternative to equity financing, which dilutes the ownership stake of the company.

How do Venture Debt Lenders Work?

Venture debt lenders work by providing debt financing to early-stage and growth-stage companies. They typically focus on companies that have a high potential for growth but may not yet be profitable.

Venture debt lenders evaluate companies based on their business model, management team, financial performance, and growth potential. They also consider the company’s cash flow and collateral when determining the terms of the loan.

Venture debt lenders may also require equity warrants or other forms of equity participation as part of the loan agreement. This allows them to participate in the upside potential of the company while still providing debt financing.

The Benefits of Venture Debt Financing

There are several benefits to using venture debt financing, including:

1. Lower Cost of Capital – Venture debt financing is often less expensive than equity financing, which can help companies save money on financing costs.

2. Non-Dilutive Financing – Venture debt financing does not dilute the ownership stake of the company, which means founders can retain more control over their company.

3. Flexible Repayment Terms – Venture debt financing typically has more flexible repayment terms than traditional bank loans, which can help companies manage their cash flow more effectively.

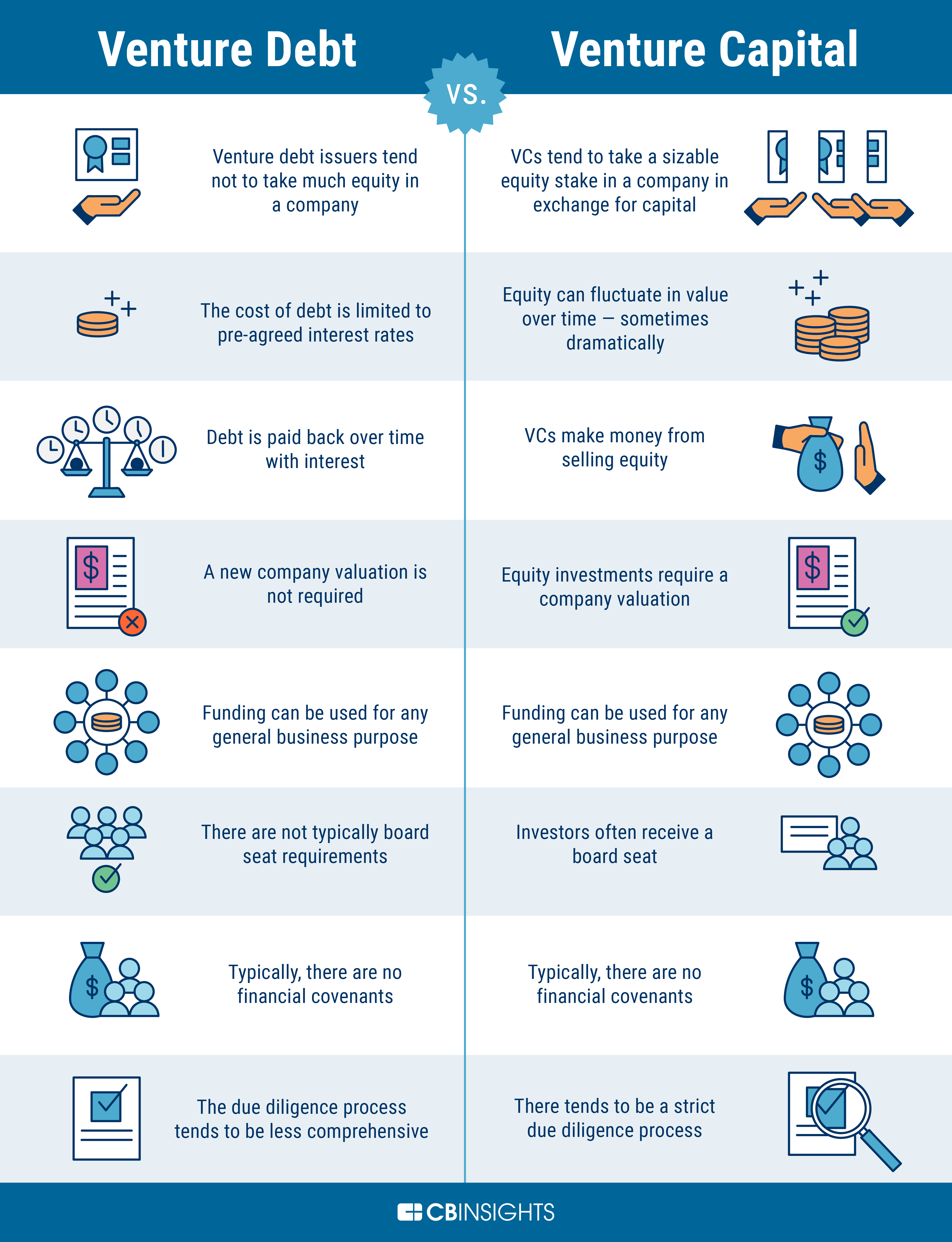

Venture Debt Financing vs. Equity Financing

Venture debt financing and equity financing are two different types of financing that can be used to fund early-stage and growth-stage companies.

Equity financing involves selling ownership stakes in the company in exchange for capital. This can be an attractive option for companies that are looking to raise a significant amount of capital quickly, but it also dilutes the ownership stake of the company.

Venture debt financing, on the other hand, is a form of debt financing that does not dilute the ownership stake of the company. It can be a good option for companies that want to retain more control over their company while still raising capital.

How to Qualify for Venture Debt Financing

To qualify for venture debt financing, companies typically need to meet certain criteria, including:

1. A Strong Business Model – Venture debt lenders look for companies with a strong business model that has the potential for high growth.

2. A Strong Management Team – Venture debt lenders look for companies with a strong management team that has the experience and expertise needed to execute on the company’s business plan.

3. A Proven Track Record – Venture debt lenders look for companies that have a proven track record of success, including revenue growth and profitability.

The Risks of Venture Debt Financing

While venture debt financing can be an attractive option for early-stage and growth-stage companies, there are also risks involved, including:

1. High Interest Rates – Venture debt financing typically has higher interest rates than traditional bank loans, which can make it more expensive for companies to borrow money.

2. Collateral Requirements – Venture debt lenders may require collateral, such as equipment or intellectual property, which can be risky for companies that do not have a lot of assets.

3. Equity Participation – Venture debt lenders may require equity participation as part of the loan agreement, which can dilute the ownership stake of the company.

The Role of Venture Debt Lenders in the Startup Ecosystem

Venture debt lenders play an important role in the startup ecosystem by providing an alternative form of financing to early-stage and growth-stage companies.

By providing debt financing with flexible repayment terms, venture debt lenders can help startups and growth-stage companies manage their cash flow more effectively. This can help them grow and expand their business more quickly.

Overall, venture debt financing can be an attractive option for early-stage and growth-stage companies that want to retain more control over their company while still raising capital. By working with a reputable venture debt lender, companies can access the capital they need to grow and succeed.

Frequently Asked Questions

Here are some commonly asked questions and answers about venture debt lenders:

What is venture debt?

Venture debt is a type of financing where a lender provides debt capital to a startup or emerging company. This debt is typically used to support growth and expansion initiatives, such as product development, marketing, or hiring. Venture debt is often used in combination with equity financing to help companies achieve their growth objectives.

Venture debt lenders are specialized financial institutions that provide debt financing to startups and emerging companies. These lenders typically have expertise in the technology, healthcare, or life sciences sectors and understand the unique challenges and opportunities faced by companies in these industries.

How do venture debt lenders differ from traditional lenders?

Unlike traditional lenders, venture debt lenders focus on providing debt financing to startups and emerging companies. These lenders are willing to take on more risk than traditional lenders and often offer more flexible terms and structures to accommodate the unique needs of these companies.

Additionally, venture debt lenders typically have a deep understanding of the industries in which they operate and can provide valuable strategic guidance and operational support to their portfolio companies.

What types of companies are good candidates for venture debt financing?

Venture debt financing is most appropriate for startups and emerging companies that have a proven business model and are generating revenue. These companies typically have a strong growth trajectory and are looking to accelerate their growth through strategic investments in areas such as product development, marketing, and sales.

Venture debt financing is less appropriate for companies that are still in the early stages of development and have not yet proven their business model or achieved significant revenue.

What are the advantages of working with a venture debt lender?

Working with a venture debt lender can provide several advantages for startups and emerging companies. First, venture debt financing can help companies achieve their growth objectives without diluting equity ownership or giving up control of the company.

Additionally, venture debt lenders can provide valuable strategic guidance and operational support to their portfolio companies, drawing on their expertise and experience in the industries in which they operate.

What should companies consider before working with a venture debt lender?

Before working with a venture debt lender, companies should carefully consider their financing needs and objectives. They should also evaluate the lender’s expertise, experience, and track record to ensure that they are a good fit for their business.

Companies should also carefully review the terms and structures of the financing arrangement to ensure that they are appropriate for their business needs and financial situation.

In conclusion, venture debt lenders are an increasingly popular source of financing for startups and growing companies. These lenders offer a unique blend of debt and equity financing that can provide businesses with the capital they need to grow without diluting their ownership or giving up control.

While venture debt isn’t the right choice for every company, it can be a great option for businesses that have demonstrated strong growth potential and are looking to scale quickly. By working with a venture debt lender, companies can access the capital they need to fuel their growth without sacrificing equity or control.

Ultimately, whether or not venture debt is the right choice for a particular business will depend on a variety of factors, including the company’s growth trajectory, its financial needs, and its long-term goals. However, for many startups and growing businesses, venture debt offers a flexible and attractive alternative to traditional financing options.