Entrepreneurs and business owners often find themselves in a challenging position when seeking financing options. One option that has gained popularity in recent years is venture debt, a type of financing that allows companies to borrow money in exchange for equity. While venture debt can be a useful tool for growing companies, it’s important to understand when it may not be the best choice.

Venture debt can be a double-edged sword, offering benefits like lower interest rates and increased flexibility, but also carrying risks such as dilution of ownership and high fees. In this article, we will explore some of the situations where venture debt may not be the best choice for your business, and what alternatives you can consider.

When is Venture Debt Considered a Bad Choice?

Venture debt is a popular financing option for startups that need capital to grow their business. However, just like any other financial decision, there are instances when venture debt may not be the best choice for a startup. In this article, we will explore some scenarios where venture debt may be a bad choice for startups.

1. When a Startup is Already Highly Leveraged

If a startup already has a significant amount of debt, adding more debt through venture debt may not be a wise decision. This is because the more debt a company has, the higher the risk of defaulting on payments. In addition, having too much debt can limit a company’s ability to secure additional financing in the future.

It is important for startups to carefully evaluate their current debt situation before taking on additional debt through venture debt. If a startup is already highly leveraged, it may be better to explore alternative financing options.

2. When a Startup is Not Generating Enough Revenue to Cover Debt Payments

Venture debt typically comes with higher interest rates than traditional bank loans. This means that startups need to generate enough revenue to cover their debt payments and still have enough cash flow to operate their business.

If a startup is not generating enough revenue to cover their debt payments, it may be a bad choice to take on additional debt through venture debt. This can lead to a situation where a startup is struggling to make their debt payments and is forced to cut back on other areas of their business.

3. When a Startup Has Uncertain Revenue Streams

Startups that have uncertain or inconsistent revenue streams may not be a good fit for venture debt. This is because venture debt typically requires regular and consistent debt payments, which can be difficult for startups with unpredictable revenue streams.

If a startup is still in the early stages of development and has not yet established consistent revenue streams, it may be better to explore equity financing options instead.

4. When a Startup Has Limited Growth Potential

Venture debt is typically used by startups that have ambitious growth plans and need capital to scale their business. However, if a startup has limited growth potential, taking on venture debt may not be a wise decision.

If a startup has already reached its growth potential, adding more debt through venture debt may not provide the expected return on investment. In this case, it may be better to explore other financing options or focus on optimizing the existing business.

5. When a Startup Has Poor Financial Management

Venture debt can be a good option for startups that have strong financial management and are able to meet their debt payments. However, if a startup has poor financial management and struggles to manage their cash flow, taking on additional debt through venture debt may not be a wise decision.

If a startup has poor financial management, it may be better to focus on improving financial processes before taking on additional debt through venture debt.

6. When a Startup Has a Short-Term Investment Horizon

Venture debt is typically a longer-term financing option, with debt payments spread out over several years. If a startup has a short-term investment horizon and plans to exit the market within a few years, taking on venture debt may not be a wise decision.

If a startup has a short-term investment horizon, it may be better to explore other financing options that align better with their investment timeline.

7. When a Startup is in a Highly Competitive Market

Startups that are in highly competitive markets may not be a good fit for venture debt. This is because venture debt typically requires regular debt payments, which can be difficult for startups in highly competitive markets that may experience fluctuations in revenue.

If a startup is in a highly competitive market, it may be better to explore alternative financing options that are more flexible and can better accommodate revenue fluctuations.

8. When a Startup Has Limited Collateral

Venture debt typically requires some form of collateral to secure the debt. If a startup has limited collateral, it may be difficult to secure venture debt financing.

Startups that have limited collateral may need to explore alternative financing options or focus on building up collateral before taking on additional debt through venture debt.

9. When Venture Debt Terms Are Unfavorable

Not all venture debt terms are created equal. If a startup is presented with unfavorable venture debt terms, it may not be a wise decision to take on the debt.

Startups should carefully evaluate venture debt terms before accepting funding. If the terms are unfavorable, it may be better to explore alternative financing options.

10. When Venture Debt Will Dilute Equity Too Much

Venture debt typically comes with warrants or options, which can dilute a startup’s equity. If a startup is concerned about diluting equity too much, taking on additional debt through venture debt may not be a wise decision.

Startups should carefully evaluate the potential dilution of equity before accepting venture debt financing. If the dilution is too high, it may be better to explore alternative financing options.

In conclusion, venture debt can be a great financing option for startups that need capital to grow their business. However, startups need to carefully evaluate their current financial situation and potential for growth before taking on additional debt through venture debt. By understanding when venture debt may be a bad choice, startups can make better financing decisions and set themselves up for long-term success.

Frequently Asked Questions

What is venture debt?

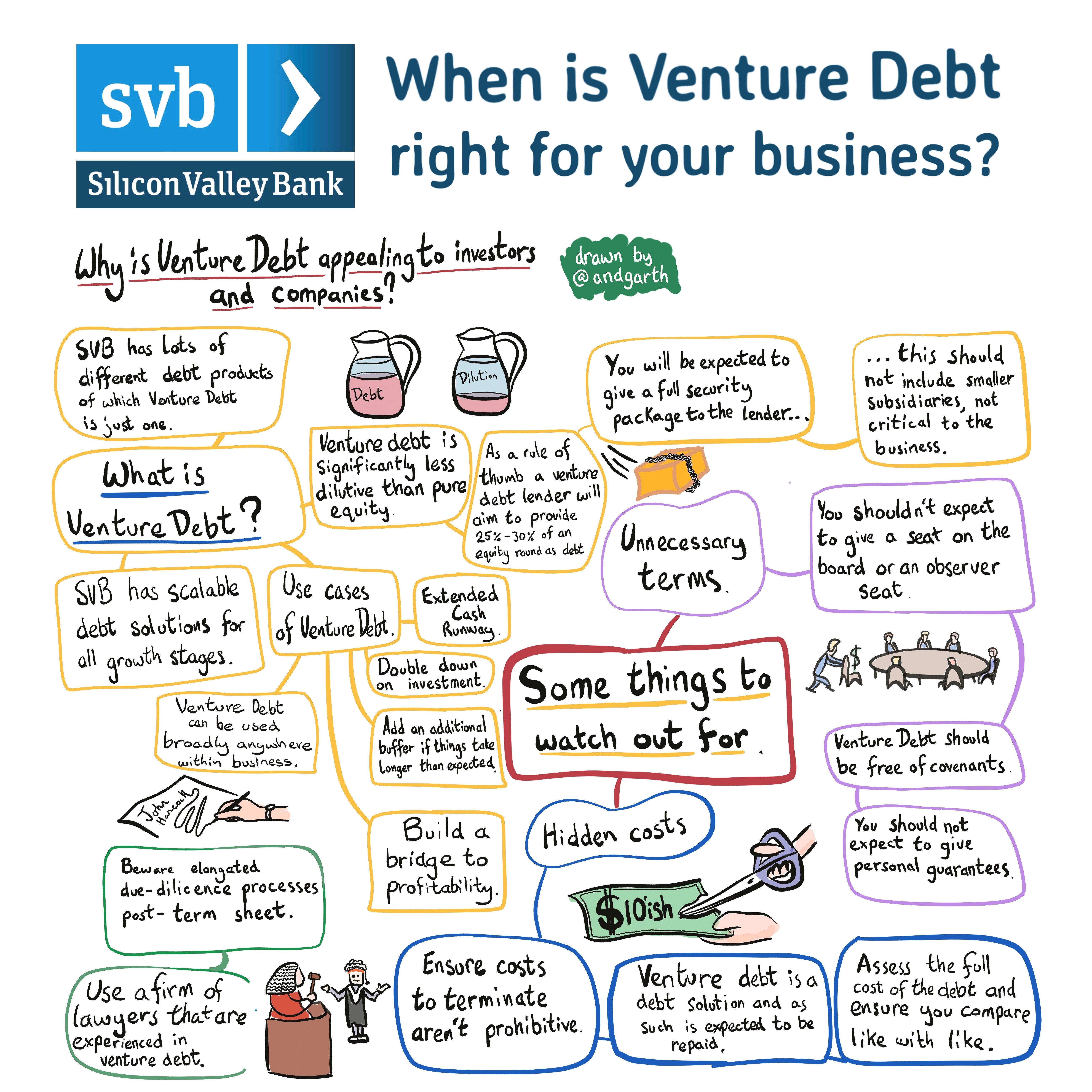

Venture debt is a type of debt financing offered to startups and other high-growth companies that have already raised venture capital. It typically involves a lender providing a loan to a company in exchange for interest payments and potentially some equity or warrants.

Venture debt is often used by startups to extend their runway and finance growth initiatives without diluting their ownership or control.

How does venture debt differ from traditional bank loans?

Venture debt is typically provided by specialized lenders that have experience working with startups. These lenders are often more flexible than traditional banks when it comes to collateral and covenants, and may be willing to provide debt financing to companies with negative cash flow or other risk factors. Additionally, venture debt lenders may offer equity or warrants as part of the financing package.

Traditional bank loans, on the other hand, are less flexible and typically require more collateral and financial covenants. They are also generally less willing to work with startups and other high-growth companies with less established financial track records.

When is venture debt a good choice for startups?

Venture debt can be a good choice for startups when they have already raised significant amounts of venture capital and are looking to extend their runway or finance growth initiatives without diluting their ownership or control. It can also be a good choice for startups that have strong revenue and cash flow, but need additional capital to finance growth initiatives.

Additionally, venture debt can be a good choice for startups that may not qualify for traditional bank loans due to their risk profile or lack of collateral.

When is venture debt considered a bad choice?

Venture debt may be considered a bad choice for startups that have weak revenue and cash flow, as it can add additional debt service obligations without providing sufficient cash flow to cover interest payments. Additionally, venture debt may be a bad choice for startups that are highly leveraged or have already taken on too much debt.

Finally, venture debt may be a bad choice for startups that are not able to use the additional capital to generate sufficient returns on investment.

What are some alternatives to venture debt?

Alternatives to venture debt include traditional bank loans, equity financing, and revenue-based financing. Traditional bank loans may be a good choice for startups that have established cash flow and collateral. Equity financing can be a good choice for startups that are willing to dilute their ownership in exchange for additional capital. Revenue-based financing can be a good choice for startups with strong revenue and cash flow that are looking to avoid dilution.

Other alternatives to venture debt include crowdfunding, grants, and bootstrapping.

The Value of Venture Debt Explained – Trinity Capital Inc.

In conclusion, venture debt can be a great option for startups looking to raise capital without diluting their ownership. However, there are certain scenarios where it may not be the best choice.

Firstly, if the company has not yet achieved profitability or is not generating enough cash flow to cover the debt payments, venture debt can quickly become a burden. This can result in missed payments, default, and potential bankruptcy.

Secondly, if the company is experiencing significant market or industry changes, venture debt may not be flexible enough to allow for pivoting or adapting to these changes. In this case, equity financing may be a better fit to provide the necessary capital and flexibility.

Lastly, if the company has already taken on a significant amount of debt, adding more through venture debt may not be a wise decision. This can lead to a high debt-to-equity ratio, negatively impacting the company’s creditworthiness and ability to secure future financing.

Overall, while venture debt can be a useful tool for startups, it’s important to carefully consider the company’s financial situation and long-term goals before deciding to take on this type of financing.