Venture debt is a type of financing that has become increasingly popular among startups and early-stage companies. Unlike traditional equity financing, venture debt allows companies to borrow money without having to give up equity in the company. This type of financing can have a significant impact on a company’s cash flow, but what exactly is that impact? In this article, we’ll explore the world of venture debt and how it can help or hinder a company’s cash flow.

Understanding The Impact of Venture Debt on Cash Flow

What is Venture Debt?

Venture debt is a type of financing for startups that combines debt and equity. It is a loan that is structured like a bond, but it also gives the lender the option to convert the loan into equity in the company. This type of financing is typically used by startups that have already raised equity funding and are looking for additional capital to fund their growth.

Venture debt can be a good option for startups because it allows them to raise capital without diluting their ownership. It also typically comes with lower interest rates than traditional bank loans, making it a more attractive option for companies that are looking to conserve cash.

How Does Venture Debt Impact Cash Flow?

Venture debt can have a positive impact on a company’s cash flow because it provides additional capital that can be used to fund growth initiatives. However, it is important to understand that venture debt is still debt, and it will need to be repaid with interest.

One benefit of venture debt is that it typically has a longer repayment period than traditional bank loans, which can help to reduce the monthly payments and improve cash flow. Additionally, because venture debt is structured like a bond, the interest payments are typically tax-deductible, which can further improve cash flow.

On the other hand, venture debt can also have a negative impact on cash flow if the company is unable to generate enough revenue to cover the interest payments. In this case, the company may be forced to use its cash reserves to make the payments, which can limit its ability to invest in growth initiatives.

The Benefits of Venture Debt

There are several benefits to using venture debt as a financing option for startups. One of the biggest benefits is that it allows startups to raise capital without diluting their ownership. This can be particularly important for founders who want to retain control of their companies.

Another benefit of venture debt is that it typically comes with lower interest rates than traditional bank loans. This can help to reduce the company’s overall cost of capital and improve cash flow.

Finally, venture debt can be a good option for companies that are looking to conserve cash. Because the interest payments are typically tax-deductible and the repayment period is longer, the monthly payments can be lower than traditional bank loans, which can help to improve cash flow.

Venture Debt vs. Equity Financing

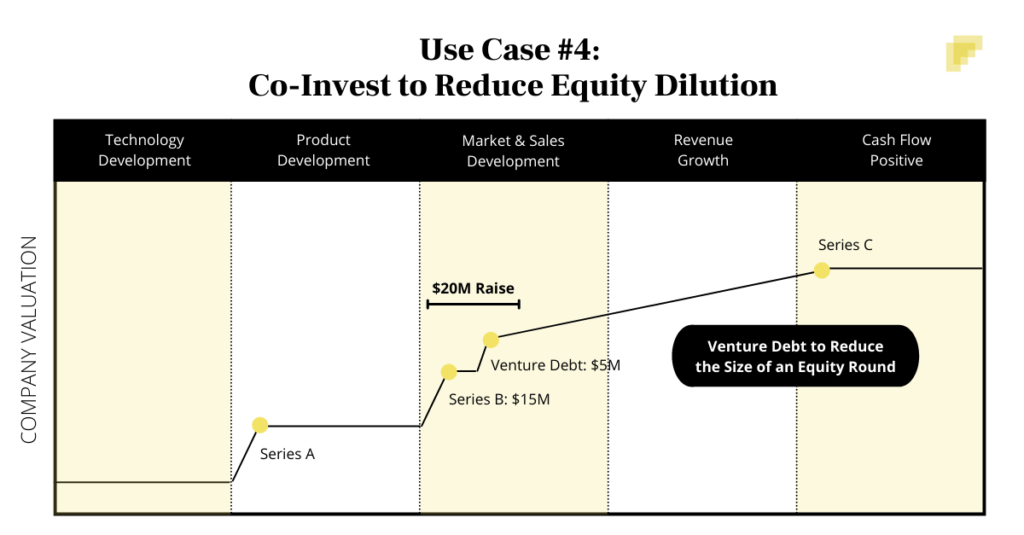

Venture debt and equity financing are two common financing options for startups. While both options can provide capital to fund growth initiatives, there are some key differences to consider.

One of the biggest differences is that equity financing involves selling ownership in the company, while venture debt does not. This means that with equity financing, the investors become shareholders in the company and are entitled to a share of the profits. With venture debt, the lender is simply providing a loan and does not become an owner of the company.

Another difference is that equity financing typically comes with a higher cost of capital than venture debt. This is because the investors are taking on more risk by investing in the company. With venture debt, the lender is taking on less risk because they are providing a loan that is secured by the company’s assets.

When is Venture Debt a Good Option?

Venture debt can be a good option for startups that have already raised equity financing and are looking for additional capital to fund their growth initiatives. It can also be a good option for companies that are looking to conserve cash and want to avoid diluting their ownership.

However, it is important to consider the risks of venture debt before deciding to use it as a financing option. If the company is unable to generate enough revenue to cover the interest payments, it could limit its ability to invest in growth initiatives and could ultimately lead to financial difficulties.

Conclusion

Venture debt can be a good financing option for startups that are looking for additional capital to fund their growth initiatives. It allows companies to raise capital without diluting their ownership and typically comes with lower interest rates than traditional bank loans.

However, it is important to understand the risks of venture debt and to carefully consider whether it is the right financing option for your company. By doing so, you can make an informed decision that will help to improve your company’s cash flow and set it up for long-term success.

Frequently Asked Questions

In this section, we provide answers to some frequently asked questions about the impact of venture debt on cash flow.

What is venture debt?

Venture debt refers to loans provided to early-stage companies that have already raised equity financing from venture capitalists. This type of debt is usually structured as a term loan with a fixed interest rate and a maturity period of 2-4 years. Unlike equity financing, venture debt does not require the company to issue new shares or dilute existing ownership.

While venture debt can provide additional capital to fuel growth, it also increases the company’s debt burden and repayment obligations. As such, it is important for companies to carefully consider the impact of venture debt on their cash flow before taking on this type of financing.

How does venture debt affect cash flow?

Venture debt can have both positive and negative impacts on a company’s cash flow. On the one hand, it can provide additional capital to fund growth initiatives without diluting ownership or reducing control. This can help companies avoid raising additional equity financing or selling assets to raise cash.

On the other hand, venture debt also increases the company’s debt burden and interest expense, which can reduce cash flow available for other purposes. Additionally, if the company is unable to generate sufficient cash flow to meet its debt obligations, it may need to raise additional equity financing or restructure its debt to avoid default.

What are the advantages of venture debt?

Venture debt can provide several advantages to companies that are looking to raise additional capital. First, it can be easier and faster to obtain than traditional bank loans or equity financing. Second, it can provide additional capital without diluting ownership or control. Third, it can help companies extend their cash runway and fund growth initiatives without selling assets or issuing new equity.

Finally, venture debt can also help companies build relationships with lenders and establish credit history, which can be useful for future fundraising efforts.

What are the disadvantages of venture debt?

While venture debt can be useful for companies that are looking to raise additional capital, it also has several disadvantages. First, it increases the company’s debt burden and interest expense, which can reduce cash flow available for other purposes. Second, the terms of venture debt can be more restrictive and onerous than traditional bank loans or equity financing.

Finally, if the company is unable to generate sufficient cash flow to meet its debt obligations, it may need to raise additional equity financing or restructure its debt to avoid default.

How should companies evaluate the impact of venture debt on cash flow?

Companies should carefully evaluate the impact of venture debt on their cash flow before taking on this type of financing. They should consider the amount of debt they can afford to take on based on their projected cash flow and growth prospects. They should also evaluate the terms of the debt, including the interest rate, maturity period, and any covenants or restrictions.

Finally, companies should consider alternative sources of financing, such as equity financing or traditional bank loans, and evaluate the relative costs and benefits of each option.

How Venture Debt Can Benefit Your Company’s Cash Flow

In conclusion, venture debt can have a significant impact on a company’s cash flow. By providing access to additional capital without diluting equity, venture debt can help startups extend their runway and achieve growth without giving up ownership. However, it’s important to understand the terms and conditions of the loan, including the interest rate, repayment schedule, and covenants.

While venture debt can be a valuable tool for startups, it’s not without risks. If a company is unable to meet the terms of the loan, it could face default and potentially even bankruptcy. Therefore, it’s important for companies to have a clear understanding of their cash flow and financial projections before taking on debt.

Ultimately, the impact of venture debt on cash flow will depend on the specific circumstances of the company and the terms of the loan. By carefully weighing the benefits and risks, startups can make informed decisions about whether venture debt is the right choice for them. With careful planning and management, venture debt can be a valuable tool for achieving growth and success.