Are you a startup founder or investor looking to learn more about venture debt? Look no further! In this article, we will explore the best venture debt blogs and resources available to help you stay informed and up-to-date on this topic.

Venture debt can be a valuable financing option for startups looking to sustain their growth without giving up equity. However, it can also be a complex and nuanced topic. That’s why we have compiled a list of the top venture debt blogs and resources to help you navigate this exciting and dynamic field.

Discover the Best Venture Debt Blogs and Resources

If you’re an entrepreneur looking to grow your business, you may have heard of venture debt. It’s a popular financing option for startups and small businesses that don’t want to give up equity. But finding the right information about venture debt can be challenging. In this article, we’ll explore the best venture debt blogs and resources to help you make informed decisions.

1. Venture Debt 101: What You Need to Know

Venture debt is a form of financing that allows startups and small businesses to borrow money without giving up equity. It’s typically used to fund growth, such as hiring more employees or expanding into new markets. If you’re considering venture debt, it’s important to understand the basics.

One of the best resources for learning about venture debt is Venture Debt 101 by Lighter Capital. This blog post provides an overview of venture debt, including how it works, the pros and cons, and how to decide if it’s right for your business. It also includes a helpful infographic that breaks down the different types of venture debt.

2. The Venture Debt Handbook

If you’re looking for a comprehensive guide to venture debt, The Venture Debt Handbook by OpenView is an excellent resource. This ebook covers everything from the basics of venture debt to the different types of debt providers and how to negotiate a deal.

The Venture Debt Handbook also includes case studies and interviews with venture debt providers and entrepreneurs who have used venture debt to grow their businesses. If you’re serious about using venture debt as a financing option, this ebook is a must-read.

3. Venture Debt Providers: Who to Work With

Choosing the right venture debt provider can be a daunting task. There are many factors to consider, such as the provider’s reputation, terms, and fees. To make the process easier, it’s helpful to have a list of reputable venture debt providers.

The NVCA (National Venture Capital Association) provides a list of venture debt providers on their website. This list includes established providers such as Silicon Valley Bank and newer providers like TIMIA Capital. It’s a great starting point for researching venture debt providers.

4. The Benefits of Venture Debt

Venture debt offers several benefits over other forms of financing, such as equity and traditional debt. One of the biggest benefits is that it allows you to fund growth without giving up equity. This means you can maintain control of your business while still accessing the capital you need to grow.

Another benefit of venture debt is that it’s typically faster and easier to obtain than equity financing. This means you can get the capital you need without the long and complex fundraising process.

5. Venture Debt vs. Equity Financing

While venture debt has many benefits, it’s important to understand how it compares to equity financing. Equity financing involves selling ownership in your company to investors in exchange for capital. This means you give up a portion of your company’s ownership and control.

Venture debt, on the other hand, does not involve giving up ownership. Instead, you borrow money and pay it back with interest. This means you maintain control of your business while still accessing the capital you need.

6. The Risks of Venture Debt

Like any form of financing, venture debt comes with risks. One of the biggest risks is that if your business fails, you’re still on the hook for repaying the debt. This can be a significant burden, especially if you’ve borrowed a large amount of money.

Another risk of venture debt is that it can be expensive. Interest rates are typically higher than traditional debt, and there may be additional fees involved. It’s important to carefully consider the costs before taking on venture debt.

7. Venture Debt Case Studies

One of the best ways to learn about venture debt is to read case studies of businesses that have used it successfully. Case studies can provide insight into how venture debt works in practice and what the benefits and risks are.

One great resource for venture debt case studies is the blog of venture debt provider, Hercules Capital. They have a series of case studies that showcase how their clients have used venture debt to fund growth and achieve their goals.

8. Venture Debt News and Updates

To stay up-to-date on the latest in venture debt, it’s important to follow the news and trends. There are several blogs and websites that cover the venture debt industry and provide news, updates, and insights.

One such blog is VentureBeat. They cover all aspects of the startup and venture capital world, including venture debt. Their coverage includes news on the latest deals, trends in the industry, and interviews with industry leaders.

9. Venture Debt Podcasts

If you prefer to consume information through audio, there are several podcasts that cover venture debt. Podcasts can be a great way to learn about venture debt while on the go or during your commute.

One great podcast is the Venture Debt Podcast by Brett Fox. Brett is a former CEO who now helps startups and entrepreneurs navigate the world of venture debt. His podcast features interviews with industry leaders and entrepreneurs who have used venture debt to grow their businesses.

10. Venture Debt Resources for Entrepreneurs

Finally, if you’re an entrepreneur looking to learn more about venture debt, there are several resources specifically designed for you. These resources provide practical advice and tips on how to navigate the world of venture debt.

One such resource is the blog of venture debt provider, Lighter Capital. They provide regular updates on the venture debt industry and offer advice on how to prepare for and negotiate a venture debt deal. They also offer a free ebook on venture debt for entrepreneurs.

In conclusion, venture debt can be a valuable financing option for startups and small businesses. By using the best venture debt blogs and resources, you can make informed decisions and successfully grow your business.

Frequently Asked Questions

What are some popular venture debt blogs?

If you’re looking for popular venture debt blogs, then you should check out Venture Debt Guide, Venture Debt Summit, and Venture Debt Blog. These blogs offer a wealth of knowledge on venture debt, including information on how to get started, how to raise capital, and how to grow your business.

Venture Debt Guide, in particular, is a great resource for entrepreneurs who are looking to raise venture debt. The blog offers a step-by-step guide on how to get started, as well as tips and tricks for navigating the venture debt landscape.

What are some venture debt resources for startups?

For startups looking for venture debt resources, there are several options available. First and foremost, you should check out the National Venture Capital Association (NVCA) website. The NVCA offers a wealth of information on venture debt, including industry statistics, news and analysis, and educational resources.

In addition to the NVCA, you should also check out the websites of venture capital firms and lenders. Many of these firms offer resources for startups, including blog posts, webinars, and whitepapers on venture debt.

How can I learn more about venture debt?

If you’re interested in learning more about venture debt, there are several resources available online. One great place to start is with the websites of venture capital firms and lenders. These firms often offer educational resources on venture debt, including blog posts, webinars, and whitepapers.

You can also check out industry publications like VentureBeat, TechCrunch, and Forbes. These publications offer news and analysis on the venture debt landscape, as well as insights into the latest trends and developments.

How do I know if venture debt is right for my business?

Venture debt can be a great option for businesses looking to raise capital without diluting equity. However, it’s important to carefully consider whether venture debt is right for your business before pursuing it.

To determine whether venture debt is a good fit for your business, you should consider factors like your growth trajectory, cash flow, and risk tolerance. You should also consult with a financial advisor or venture debt expert to help you make an informed decision.

What are some common pitfalls to avoid when pursuing venture debt?

When pursuing venture debt, there are several common pitfalls that entrepreneurs should avoid. These include taking on too much debt, not understanding the terms and conditions of the debt, and neglecting to consider the impact of the debt on future fundraising rounds.

To avoid these pitfalls, it’s important to work with a reputable lender or venture debt expert who can help you navigate the venture debt landscape. You should also carefully review all terms and conditions before signing on the dotted line, and consider the long-term impact of the debt on your business.

In conclusion, finding valuable and reliable resources on venture debt can be a daunting task. However, with the right blogs and sources, you can stay informed and up-to-date on the latest trends and insights in the industry.

Firstly, the Venture Debt Guide is a comprehensive resource that covers everything from the basics of venture debt to strategies for entrepreneurs and investors. With a wide range of articles and resources, this blog is a must-read for anyone looking to learn more about venture debt.

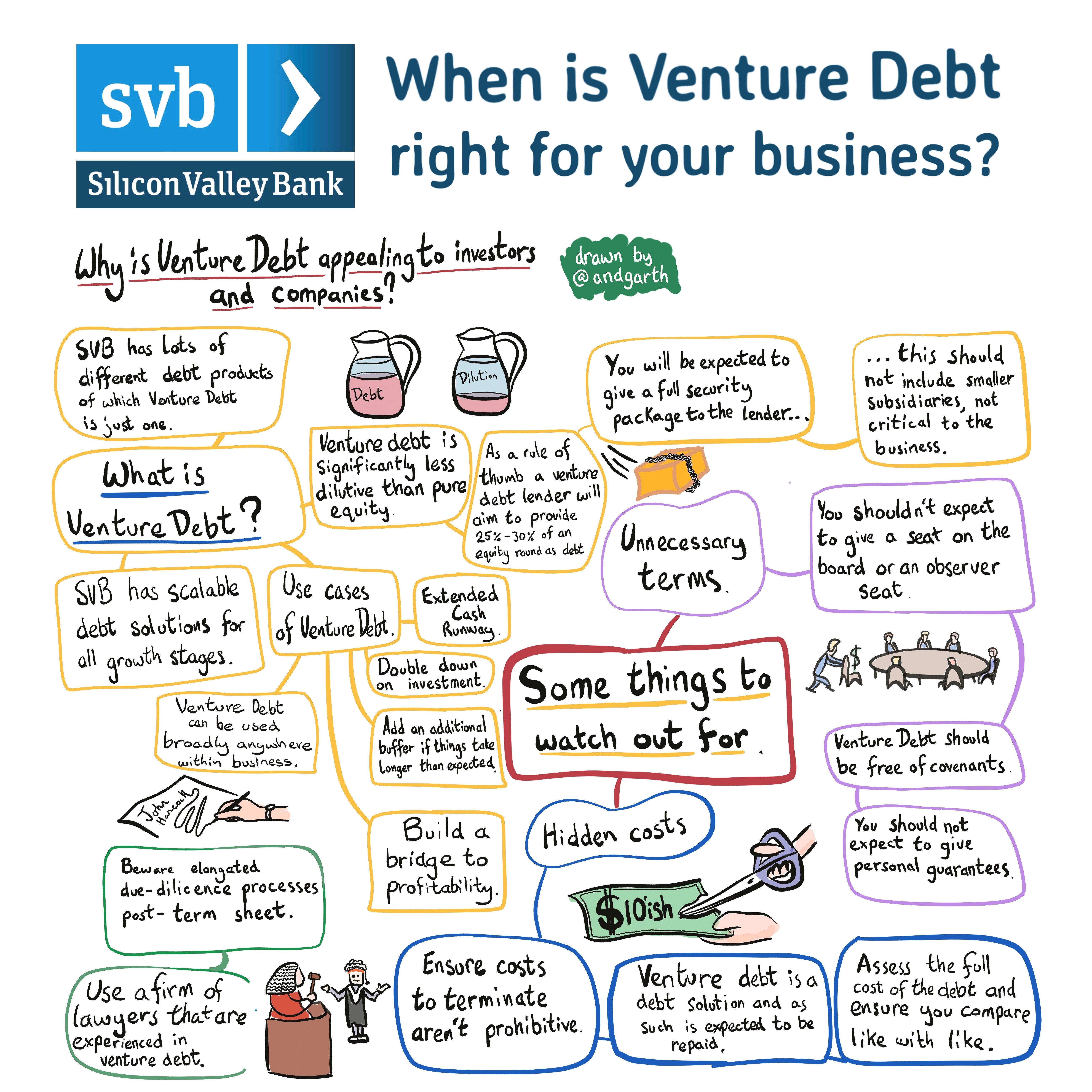

Secondly, the Silicon Valley Bank blog is another great resource for venture debt information. This blog offers insights and analysis from industry experts, as well as tips and strategies for startups and investors.

Finally, the National Venture Capital Association is an excellent resource for venture debt news and updates. With a focus on the entire venture capital industry, this organization provides valuable insights and analysis on the latest trends and developments in the field.

In conclusion, whether you’re an entrepreneur, investor, or simply interested in the venture debt industry, these blogs and resources are sure to provide valuable insights and information. So, start exploring and stay ahead of the game!