As a startup founder, you are always looking for ways to finance your business. One option to consider is venture debt, a form of financing that can provide quick access to funds without diluting equity.

However, before you decide whether venture debt is right for your startup, it’s important to understand the benefits and potential drawbacks. In this article, we’ll take a closer look at venture debt and examine whether it was beneficial for startups like yours.

Was venture debt beneficial for my startup?

Venture debt is a type of financing that can be beneficial for startups. It’s a form of debt financing that allows startups to obtain capital without giving up equity. This article will explore the benefits and drawbacks of venture debt and whether it was beneficial for my startup.

What is Venture Debt?

Venture debt is a type of financing that is available to startups. It’s a form of debt financing that allows startups to obtain capital without giving up equity. Venture debt is typically provided by specialty lenders who understand the risks associated with startup investing.

Venture debt can come in the form of a loan or a line of credit. The loan comes with a fixed interest rate and has a set repayment schedule. The line of credit is similar to a credit card and allows startups to borrow money as needed.

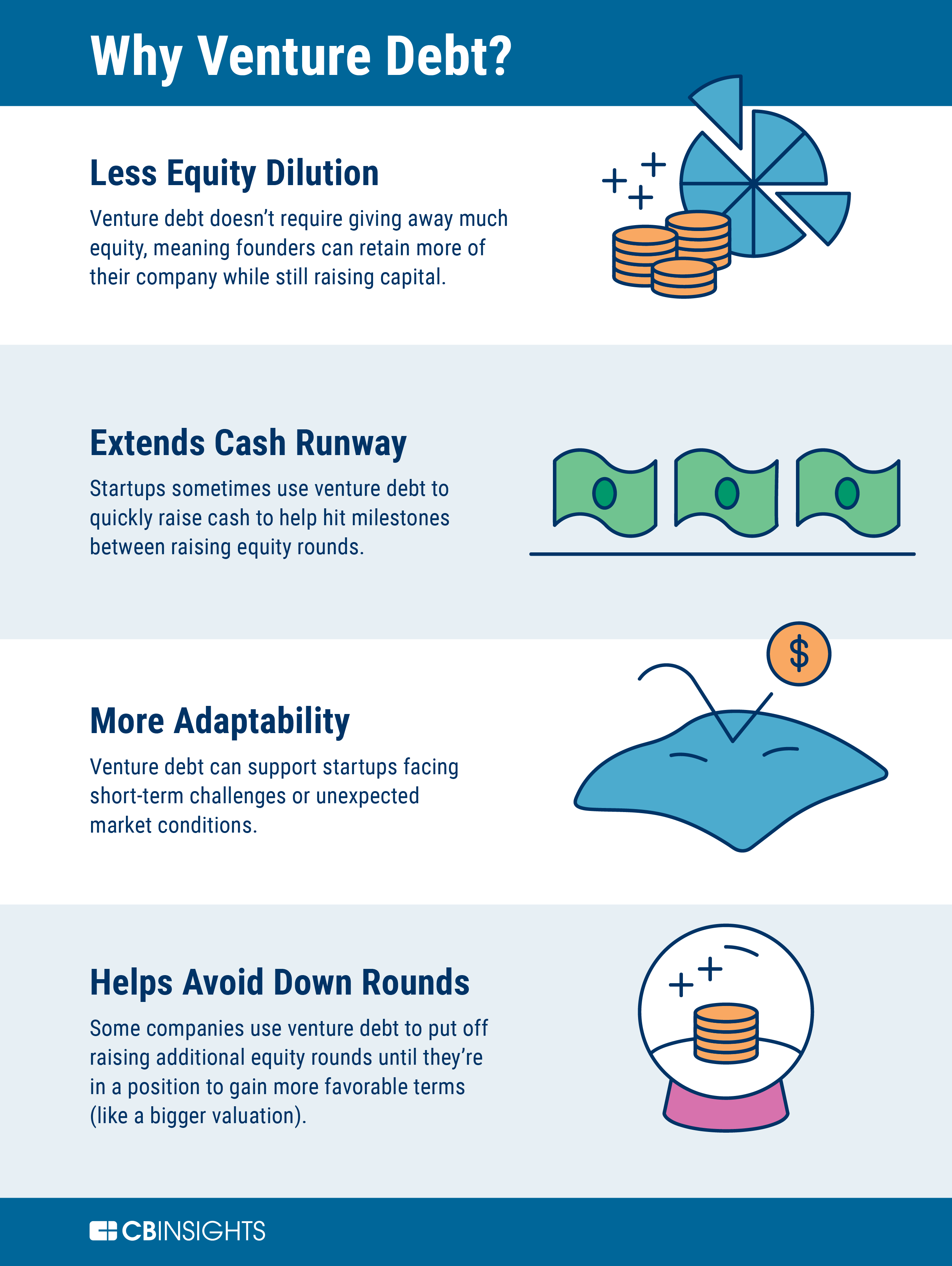

Benefits of Venture Debt

There are several benefits to using venture debt for startups. The most significant benefit is that it allows startups to obtain capital without giving up equity. This means that startups can maintain control over their company and avoid diluting their ownership.

Another benefit of venture debt is that it can be used to bridge the gap between funding rounds. Startups often need capital to continue operating between funding rounds, and venture debt can provide the necessary capital.

Venture debt also allows startups to leverage their existing resources. The debt can be used to finance growth without requiring additional equity investment.

Drawbacks of Venture Debt

There are also drawbacks to using venture debt for startups. The most significant drawback is the cost of the debt. Venture debt comes with higher interest rates than traditional debt financing.

Another drawback is that venture debt can be restrictive. The debt typically comes with covenants that require startups to meet certain financial metrics. If the startup fails to meet these metrics, the lender can demand repayment, which can be detrimental to the startup.

Venture Debt vs. Equity Financing

Venture debt and equity financing are two different types of financing. Equity financing involves selling a portion of the company in exchange for capital. Venture debt, on the other hand, involves borrowing money without giving up equity.

The benefit of equity financing is that it provides startups with significant capital. However, it also dilutes the ownership of the company. Venture debt doesn’t dilute ownership, but it also doesn’t provide as much capital.

When to Use Venture Debt

Venture debt is best used when a startup needs capital but doesn’t want to give up equity. It’s also useful when a startup needs to bridge the gap between funding rounds.

Venture debt can also be used to finance growth. It allows startups to leverage their existing resources and finance growth without diluting their ownership.

Case Study: Was Venture Debt Beneficial for My Startup?

My startup used venture debt to bridge the gap between funding rounds. We needed capital to continue operating while we were raising our next round of funding.

The venture debt allowed us to continue operating and growing our business without diluting our ownership. The interest rate was higher than traditional debt financing, but it was worth it to maintain control over our company.

Overall, venture debt was beneficial for our startup. It allowed us to obtain the necessary capital to continue operating and growing our business without giving up equity.

Conclusion

Venture debt can be a beneficial form of financing for startups. It allows startups to obtain capital without giving up equity and can be used to bridge the gap between funding rounds. However, it’s important to consider the drawbacks, such as the cost of the debt and the restrictive covenants.

When deciding whether to use venture debt, startups should consider their specific needs and goals. Venture debt can be a useful tool for financing growth and maintaining control over the company.

Frequently Asked Questions

What is venture debt and how does it work?

Venture debt is a type of debt financing that is provided to startups and early-stage companies that have already raised equity funding. It is typically structured as a loan with interest payments and a set repayment schedule. Unlike traditional bank loans, venture debt is often provided by specialty lenders who have experience working with startups and are willing to take on more risk. Venture debt can be a useful tool for startups that need additional capital to fuel growth without diluting equity.

What are the benefits of venture debt for startups?

Venture debt can provide several benefits for startups. First, it can be a lower cost of capital compared to equity financing. Second, it can help extend the runway of a startup by providing additional capital without diluting equity. Third, it can help startups reach key milestones that may make them more attractive to investors in future funding rounds. Additionally, venture debt lenders may provide strategic support and introductions to potential investors or customers.

What are the risks of venture debt for startups?

While venture debt can be a useful tool for startups, it also comes with risks. One of the main risks is that the interest payments and repayment schedule can put additional strain on a startup’s cash flow. Additionally, if a startup is unable to meet its repayment obligations, it may face default and potentially lose control of its assets. Finally, the terms of venture debt agreements can be complex, and startups should thoroughly review and understand all of the terms before entering into an agreement.

How can startups determine if venture debt is right for them?

Startups should consider several factors when deciding whether to pursue venture debt. First, they should assess their cash flow needs and determine if they can realistically meet the repayment obligations. Second, they should evaluate the cost of capital and compare it to other financing options. Third, they should consider the potential benefits of venture debt, such as strategic support and introductions to investors. Finally, startups should carefully review the terms of any venture debt agreement and seek the advice of experienced advisors.

What are some alternatives to venture debt for startups?

While venture debt can be a useful tool for startups, it is not the only financing option available. Other alternatives include traditional bank loans, equity financing, crowdfunding, and revenue-based financing. Each of these options has its own advantages and disadvantages, and startups should carefully evaluate each option before making a decision. Ultimately, the best financing option will depend on a startup’s specific needs and goals.

In conclusion, venture debt can be a valuable tool for startups looking to grow their businesses without diluting their ownership. However, it is important to carefully consider the terms of the loan and ensure that the company can comfortably make the required payments.

For my startup, venture debt provided the necessary capital to expand our operations and develop new products. It allowed us to maintain control of our company while still accessing the funding we needed to take our business to the next level.

Ultimately, whether or not venture debt is beneficial for your startup will depend on your specific circumstances and goals. It is important to weigh the pros and cons and make an informed decision that aligns with your vision for your business.