If you’re a startup founder or entrepreneur, you know that securing funding is critical to the success of your venture. While venture capital is often the go-to option, more and more startups are turning to venture debt as a way to finance their growth.

But how do you evaluate a venture debt offer? In this article, we’ll explore the key factors you need to consider when evaluating a venture debt offer, so you can make an informed decision and secure the funding you need to take your business to the next level.

How to Evaluate a Venture Debt Offer?

Venture debt is a financing option that is becoming increasingly popular among startups. It is a type of debt that is used to fund growth and expansion, and it is typically offered by specialty lenders who understand the unique needs of startups. Evaluating a venture debt offer can be a complex process, but it is essential to ensure that you are getting the best possible terms and conditions for your business. Here are ten key factors to consider when evaluating a venture debt offer.

1. Interest Rates and Fees

The first thing to consider when evaluating a venture debt offer is the interest rate and fees. These will determine how much you will need to pay back over the life of the loan. Interest rates for venture debt are typically higher than those for traditional bank loans, but they can still vary widely depending on the lender and the specific terms of the loan. In addition to interest rates, you should also consider any fees associated with the loan, such as origination fees, prepayment penalties, and late fees.

When evaluating interest rates and fees, it is important to compare offers from multiple lenders to ensure that you are getting the best possible deal. You should also try to negotiate with lenders to see if you can get better terms.

2. Loan Amount and Term

The loan amount and term are also important factors to consider when evaluating a venture debt offer. The loan amount should be sufficient to fund your growth plans, but not so much that you are burdened with excessive debt. The term of the loan should also be appropriate for your business needs. Short-term loans may be more appropriate for startups that are looking to fund a specific project, while longer-term loans may be better for businesses that are looking to fund ongoing growth and expansion.

When evaluating loan amount and term, it is important to consider your business’s cash flow and ability to repay the loan. You should also compare offers from multiple lenders to ensure that you are getting the best possible deal.

3. Repayment Schedule

The repayment schedule is another important factor to consider when evaluating a venture debt offer. This will determine how much you will need to pay back each month and for how long. Some lenders may offer flexible repayment schedules that are tied to your business’s revenue, while others may require fixed monthly payments.

When evaluating repayment schedules, it is important to consider your business’s cash flow and ability to make regular payments. You should also compare offers from multiple lenders to ensure that you are getting the best possible deal.

4. Collateral Requirements

Collateral requirements are another important factor to consider when evaluating a venture debt offer. Some lenders may require collateral, such as accounts receivable or inventory, to secure the loan. This can be a good option for businesses that have valuable assets, but it can also be risky if you are unable to repay the loan.

When evaluating collateral requirements, it is important to consider the value of your assets and your ability to repay the loan. You should also compare offers from multiple lenders to ensure that you are getting the best possible deal.

5. Covenants

Covenants are provisions in the loan agreement that outline certain requirements or restrictions that the borrower must adhere to. These may include financial covenants, such as maintaining a certain level of profitability or cash flow, or operational covenants, such as not making significant changes to the business without the lender’s approval.

When evaluating covenants, it is important to consider how they may impact your business’s operations and ability to grow. You should also compare offers from multiple lenders to ensure that you are getting the best possible deal.

6. Lender Experience and Reputation

The lender’s experience and reputation are also important factors to consider when evaluating a venture debt offer. You should research the lender’s track record and reputation in the industry to ensure that they are a good fit for your business.

When evaluating lender experience and reputation, it is important to consider factors such as their track record with similar businesses, their level of customer service, and their overall reputation in the industry.

7. Investor Relations

If the lender is also an investor in your business, you should consider their investor relations when evaluating a venture debt offer. This will determine how involved they are in your business and how much say they have in your operations.

When evaluating investor relations, it is important to consider how involved you want the lender to be in your business and how much control you are willing to give up.

8. Exit Strategy

The exit strategy is another important factor to consider when evaluating a venture debt offer. This will determine how you plan to repay the loan and exit the investment. Some lenders may require an equity stake in your business as part of the loan agreement, while others may simply require repayment of the loan plus interest.

When evaluating exit strategies, it is important to consider your long-term goals for the business and how you plan to exit the investment. You should also compare offers from multiple lenders to ensure that you are getting the best possible deal.

9. Other Terms and Conditions

Finally, it is important to consider any other terms and conditions that may be included in the loan agreement. These may include things like default provisions, change of control clauses, and more.

When evaluating other terms and conditions, it is important to carefully review the loan agreement and ensure that you understand all of the terms and conditions. You should also compare offers from multiple lenders to ensure that you are getting the best possible deal.

10. Conclusion

Evaluating a venture debt offer can be a complex process, but it is essential to ensure that you are getting the best possible terms and conditions for your business. By considering these ten key factors and comparing offers from multiple lenders, you can make an informed decision and secure the financing you need to grow and expand your business.

Frequently Asked Questions

Here are some frequently asked questions about evaluating a venture debt offer.

What is venture debt?

Venture debt is a type of debt financing that is specifically designed for startups and high-growth companies. Unlike traditional bank loans, venture debt typically comes from specialized lenders that understand the unique needs of early-stage companies. Venture debt can be a useful tool for companies that need to raise capital quickly, but don’t want to give up equity.

When evaluating a venture debt offer, it’s important to understand the terms of the loan, including interest rates, repayment schedules, and any covenants or restrictions that may be included.

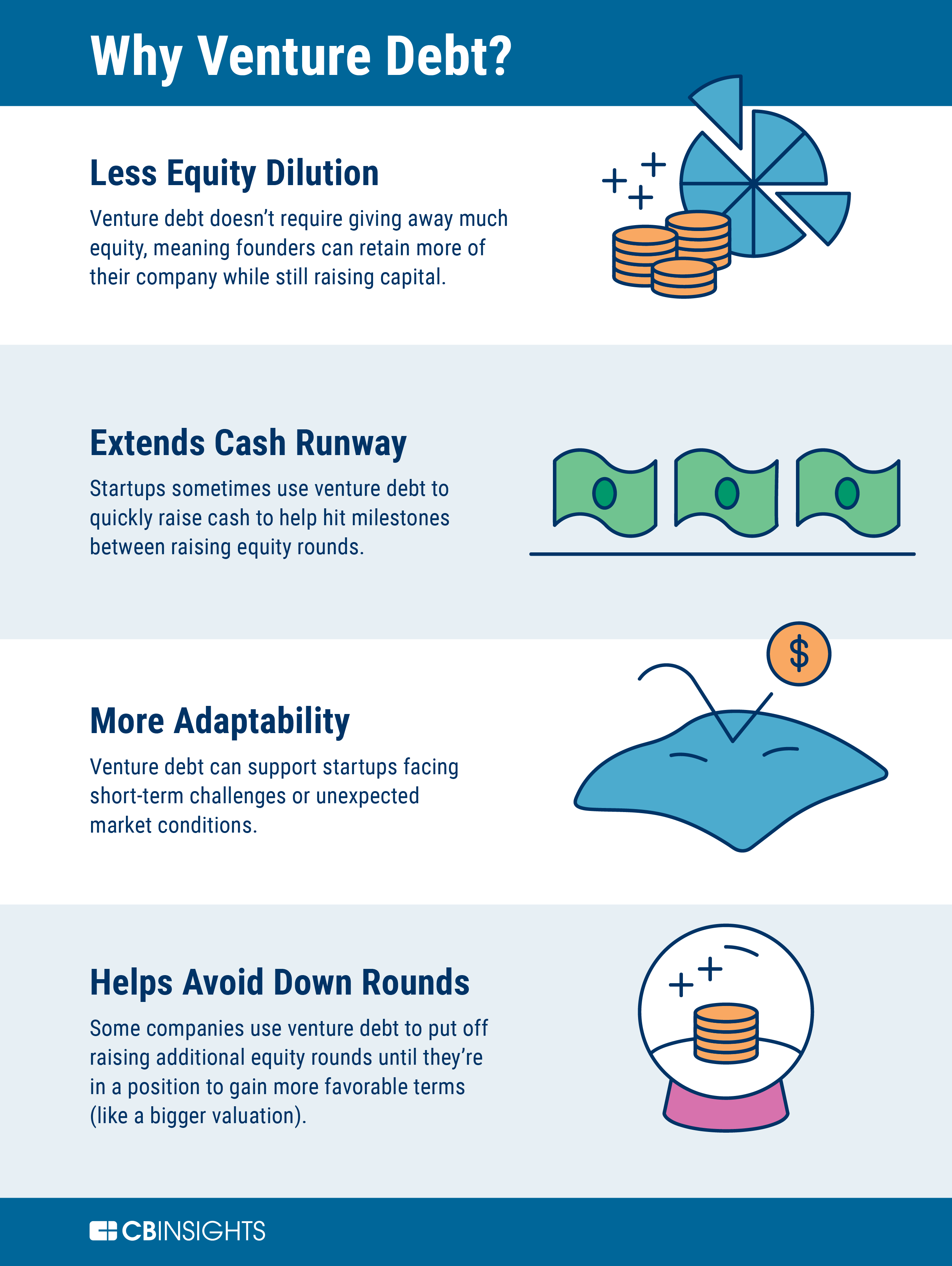

What are the benefits of venture debt?

Venture debt can offer a number of benefits for startups and high-growth companies. For one, it can provide a quick source of capital without diluting the ownership stake of existing shareholders. Venture debt lenders also tend to be more flexible than traditional banks, which can be helpful for companies that are still in the early stages of development.

However, it’s important to keep in mind that venture debt can also be more expensive than other forms of financing, and it may come with more stringent terms and conditions.

How do I evaluate the terms of a venture debt offer?

When evaluating a venture debt offer, there are several key factors to consider. First, you’ll want to look at the interest rate and any fees associated with the loan. You’ll also want to examine the repayment schedule and any covenants or restrictions that may be included.

It’s important to consider how the debt will impact your cash flow and financial projections, as well as any potential risks associated with the loan.

What are some common covenants in venture debt agreements?

Common covenants in venture debt agreements include restrictions on capital expenditures, limitations on the ability to take on additional debt, and requirements to maintain certain financial ratios. Other covenants may include restrictions on dividends and stock repurchases, as well as requirements to provide regular financial reporting to the lender.

It’s important to carefully review all of the covenants in a venture debt agreement to ensure that you understand your obligations and are able to comply with them.

What should I look for in a venture debt lender?

When choosing a venture debt lender, it’s important to look for a lender that has experience working with startups and early-stage companies. You’ll also want to consider the lender’s reputation and track record, as well as their willingness to be flexible and work with you to meet your needs.

It’s also a good idea to talk to other companies that have worked with the lender to get a sense of their experience and to see if they would recommend the lender.

The Value of Venture Debt Explained – Trinity Capital Inc.

In conclusion, evaluating a venture debt offer requires careful consideration of several factors. First, it is important to understand the terms and conditions of the offer, including interest rates, maturity dates, and covenants. Second, it is crucial to assess the reputation and track record of the lender, as well as their ability to provide ongoing support and guidance. Finally, it is essential to evaluate the potential impact of the debt on your business, including the ability to meet repayment obligations and maintain adequate cash flow.

Overall, taking the time to evaluate a venture debt offer can help you make informed decisions about financing your business. By considering these key factors, you can ensure that you choose a lender that will provide the support you need to succeed, while also protecting your long-term financial interests. So, whether you are just starting out or looking to grow your business, taking a thoughtful approach to venture debt can help you achieve your goals and build a successful future.