In times of economic uncertainty, it can be challenging for businesses to secure the funding they need to keep operations going. That’s where venture debt comes in. Venture debt is a type of financing that can help startups and other businesses bridge the gap between equity rounds or other sources of capital. But how does it work during a downturn? Let’s take a closer look.

During a downturn, traditional lenders may be hesitant to lend to businesses, especially those without a proven track record. Venture debt, however, is often provided by specialized lenders who understand the unique needs of startups and other high-growth companies. In this article, we’ll explore how venture debt can help businesses weather a downturn and what entrepreneurs need to know before pursuing this type of financing.

How Does Venture Debt Work in a Downturn?

Venture debt is a type of debt financing used by early-stage companies to fund their growth. Unlike traditional bank loans, venture debt is typically provided by specialized lenders who understand the unique needs of startups and are willing to take on more risk than traditional lenders. In a downturn, venture debt can be a valuable tool for startups looking to weather the storm.

What is Venture Debt?

Venture debt is a form of debt financing that is typically used by early-stage companies to fund their growth. Unlike equity financing, where investors receive a stake in the company in exchange for their investment, venture debt is a loan that must be repaid with interest. However, venture debt lenders often provide more flexible terms and are willing to take on more risk than traditional lenders.

Venture debt can be used for a variety of purposes, including funding growth initiatives, financing capital expenditures, and extending a startup’s runway. It can also be used as a bridge to the next round of equity financing.

How Does Venture Debt Work?

Venture debt is typically structured as a term loan with a fixed interest rate and a maturity date. The loan is usually secured by the startup’s assets, such as its intellectual property, equipment, or accounts receivable. The lender may also require a personal guarantee from the startup’s founders.

In addition to the interest rate, venture debt lenders may also charge fees, such as an origination fee or a prepayment penalty. These fees can add to the overall cost of the loan and should be taken into consideration when evaluating the financing option.

Benefits of Venture Debt

Venture debt can provide several benefits to startups, especially in a downturn. First, it can help extend a startup’s runway, allowing it to continue operating while it looks for additional funding. This can be especially valuable during a downturn, when funding may be harder to come by.

Second, venture debt can provide a source of non-dilutive financing. Unlike equity financing, where investors receive a stake in the company, venture debt does not dilute the ownership stake of the startup’s founders or existing investors.

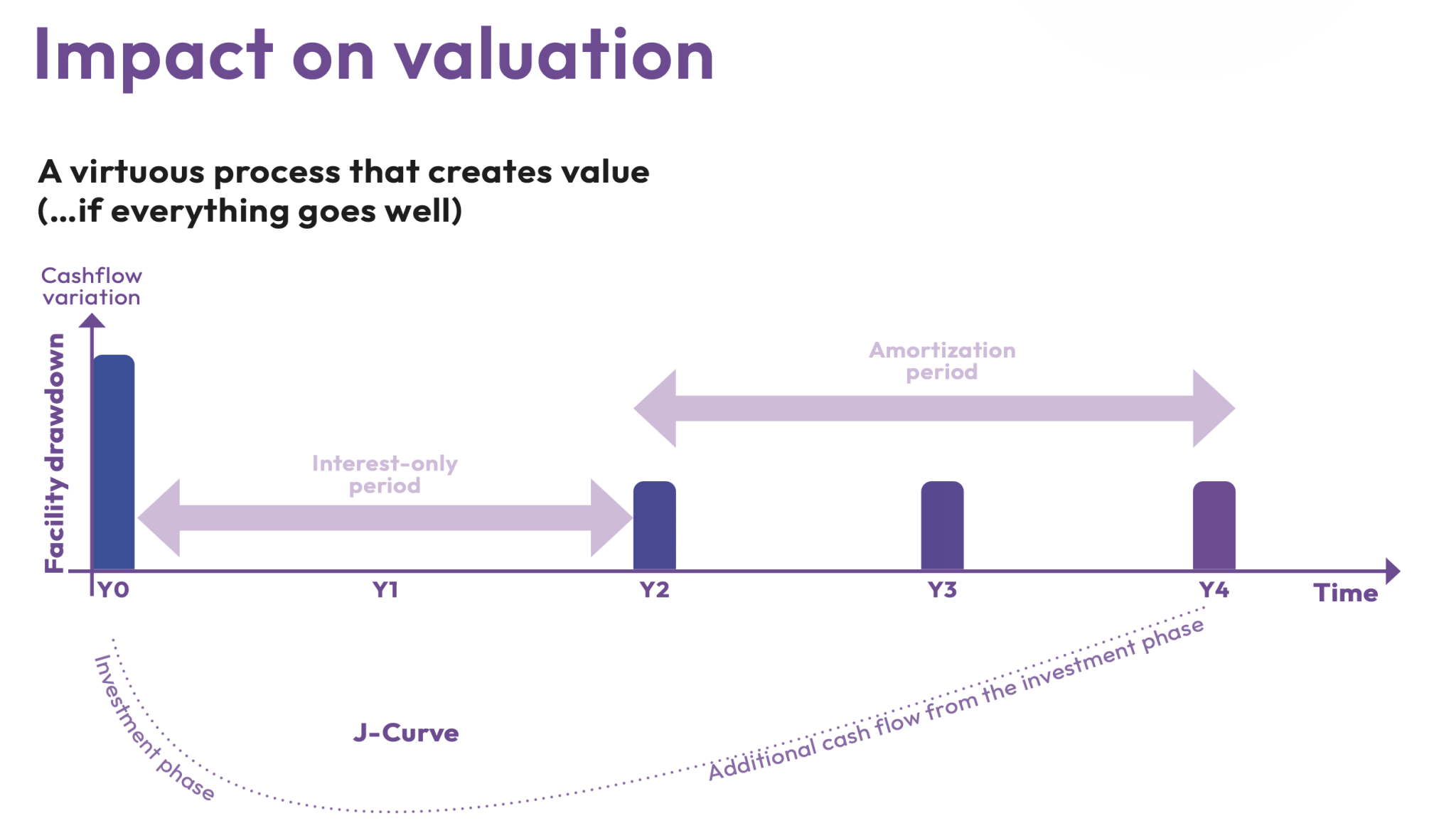

Finally, venture debt can be a more flexible financing option than traditional bank loans. Venture debt lenders are often more willing to work with startups and provide more flexible terms, such as interest-only payments or deferred principal payments.

When is Venture Debt a Good Option?

Venture debt can be a good option for startups that have a clear path to profitability and are looking to extend their runway or fund growth initiatives. It can also be a good option for startups that have a strong balance sheet and are looking to add non-dilutive financing to their capital structure.

However, venture debt may not be a good option for startups that are still in the early stages of development and do not have a clear path to profitability. In these cases, equity financing may be a better option.

What are the Risks of Venture Debt?

Venture debt is a higher-risk financing option than traditional bank loans. The startup is required to make interest payments and repay the loan on a set schedule, regardless of its financial performance. If the startup is unable to make the required payments, it may default on the loan and the lender may seize its assets.

In addition, venture debt lenders may require a personal guarantee from the startup’s founders, which could put their personal assets at risk if the startup defaults on the loan.

Venture Debt vs. Equity Financing

Venture debt and equity financing are two different ways to raise capital for a startup. Equity financing involves selling a stake in the company to investors in exchange for their investment, while venture debt involves borrowing money that must be repaid with interest.

The main advantage of equity financing is that it does not require the startup to make interest payments or repay the investment on a set schedule. However, equity financing dilutes the ownership stake of the startup’s founders and existing investors.

Venture debt, on the other hand, does not dilute ownership and can be a more flexible financing option. However, it requires the startup to make interest payments and repay the loan on a set schedule, which can be challenging if the startup is not generating sufficient cash flow.

Conclusion

In a downturn, venture debt can be a valuable tool for startups looking to extend their runway and fund growth initiatives. It can provide non-dilutive financing and be a more flexible option than traditional bank loans. However, venture debt is a higher-risk financing option than equity financing and requires the startup to make interest payments and repay the loan on a set schedule. Startups should carefully evaluate the costs and benefits of venture debt before deciding if it is the right financing option for their business.

Frequently Asked Questions

Here are some frequently asked questions about how venture debt works in a downturn:

What is venture debt?

Venture debt is a form of financing that provides companies with debt capital in exchange for equity or warrants. Unlike traditional bank loans, venture debt is typically offered by specialized lenders who understand the unique needs and risks associated with early-stage and high-growth companies. Venture debt can be a useful source of capital for startups that need to scale quickly but may not yet be generating significant revenue or profits.

In a downturn, venture debt can be particularly attractive to companies that may not be able to raise equity financing or secure traditional bank loans. However, it’s important to note that venture debt is not a substitute for equity financing and should not be relied on as the sole source of capital.

How does venture debt work?

When a company takes on venture debt, they receive a loan from the lender that is typically structured as a term loan or line of credit. The loan is usually secured by the company’s assets, including intellectual property, equipment, and accounts receivable. In exchange for the loan, the lender may also receive equity or warrants in the company.

During a downturn, venture debt lenders may become more cautious about the companies they lend to and may require additional collateral or higher interest rates to compensate for the increased risk. Companies that are already carrying a significant amount of debt may find it difficult to secure venture debt financing, as lenders may be concerned about the company’s ability to repay the loan.

What are the advantages of venture debt?

Venture debt can be an attractive financing option for companies because it allows them to raise capital without giving up as much equity as they would in an equity financing round. This can be particularly useful for companies that are already well-capitalized but need additional funding to support their growth.

Venture debt can also be structured to provide more flexibility than traditional bank loans, with terms that are tailored to the specific needs of the company. For example, venture debt may include flexible repayment schedules or the ability to convert the debt into equity at a later date.

What are the risks of venture debt?

Like any form of debt financing, venture debt comes with risks. Companies that take on venture debt are responsible for repaying the loan, along with any interest or fees that accrue. If the company is unable to repay the loan, the lender may be able to seize the company’s assets to recover their investment.

In a downturn, companies that have taken on venture debt may find it difficult to meet their repayment obligations if their revenue or profits decline. Additionally, if the company is unable to secure additional equity financing to support their growth, they may be forced to take on additional debt or face significant challenges in continuing to operate.

How can companies manage venture debt in a downturn?

If a company has taken on venture debt and is facing a downturn, there are several strategies they can use to manage their debt and preserve their cash flow. One approach is to negotiate with their lenders to restructure their debt, which may include extending the repayment schedule, reducing the interest rate, or converting the debt into equity.

Another approach is to focus on generating revenue and cutting costs to improve the company’s financial position. This may involve reducing headcount, renegotiating contracts with suppliers, or pivoting the company’s business model to focus on more profitable products or services.

How to think about venture debt

In conclusion, venture debt can be a lifeline for startups during a downturn. The ability to access quick capital without diluting equity can be crucial for companies in need of funding. However, it’s important to note that venture debt comes with its own set of risks, such as higher interest rates and covenants that can restrict the company’s ability to operate.

To mitigate these risks, startups should be diligent in their research and choose a lender who understands their business and can offer flexible terms. Additionally, companies should have a solid plan in place for how they will use the funds and ensure they have a clear path to profitability.

Despite the challenges, venture debt can be a valuable tool for startups navigating a downturn. By carefully weighing the risks and benefits and working with a trusted lender, companies can secure the funding they need to weather the storm and emerge stronger on the other side.