Entrepreneurship is a journey filled with uncertainties and risks. One of the biggest challenges that startups face is finding adequate funding to fuel their growth. While equity financing is the most common form of funding, venture debt has gained popularity in recent years. But how does venture debt impact startup valuations? In this article, we will explore the relationship between venture debt and startup valuations to help you make informed decisions as a startup founder or investor.

How Venture Debt Impacts Startup Valuations

Venture debt is a type of financing that has become increasingly popular among startups. It is a form of debt financing that allows startups to borrow money from investors, while also giving them the opportunity to raise additional equity capital. This article will explore how venture debt impacts startup valuations and why it is becoming an attractive option for startups looking to raise funds.

What is Venture Debt?

Venture debt is a type of financing that provides debt capital to startups, typically in the form of a loan. Unlike traditional bank loans, venture debt is provided by specialized lenders who understand the unique needs of startups and are willing to take on higher risk. Venture debt is usually provided to startups that have already raised equity capital from venture capitalists or angel investors.

Venture debt is a popular option for startups because it allows them to raise additional capital without diluting the ownership of their existing investors. For startups that have already raised equity capital, venture debt can be a way to extend their runway and give them more time to achieve their milestones without having to raise additional equity capital.

How Venture Debt Impacts Startup Valuations

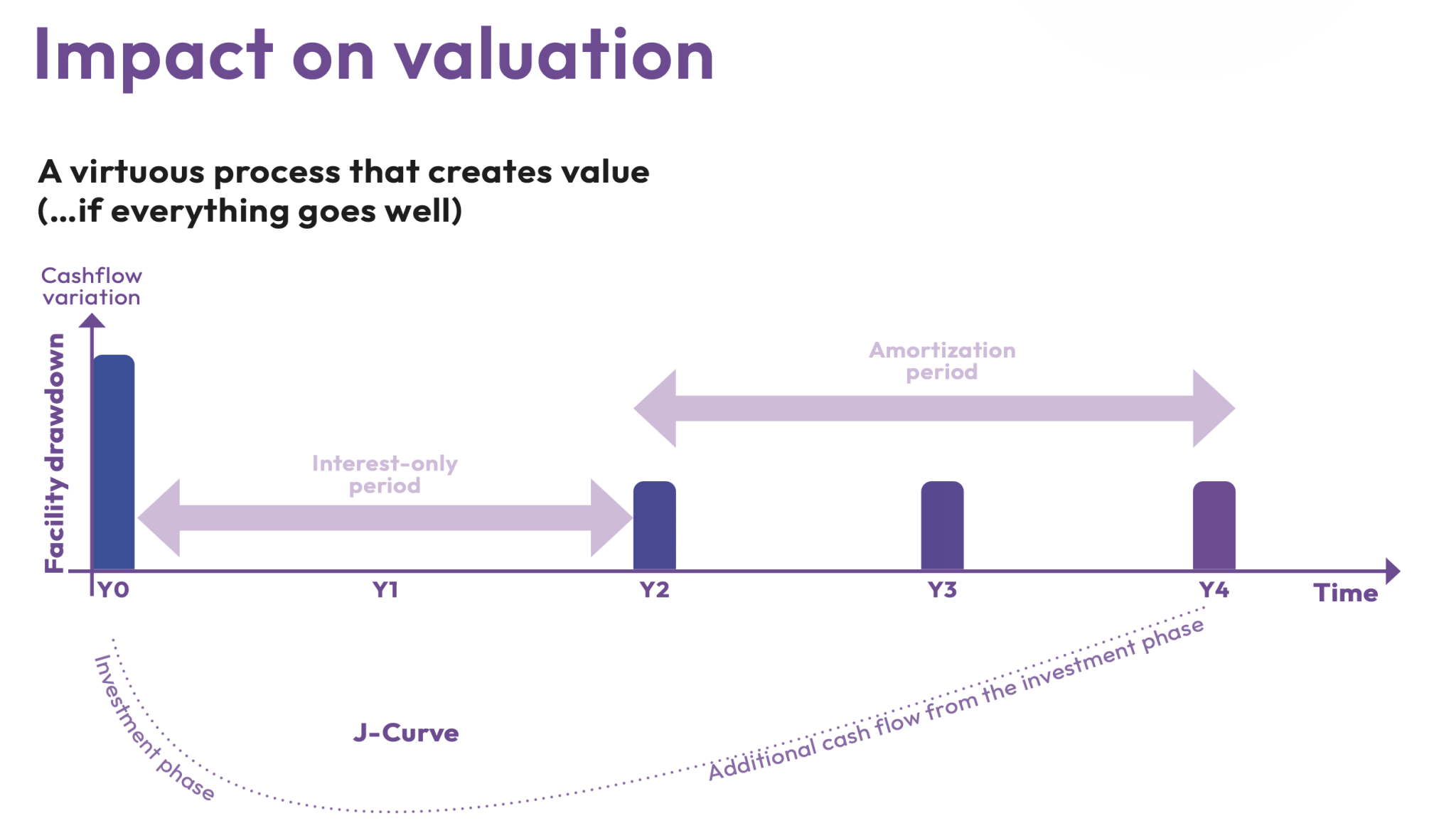

Venture debt can impact startup valuations in a number of ways. One of the most significant impacts is that it can increase the valuation of a startup by allowing it to extend its runway and achieve its milestones without having to raise additional equity capital. This can be especially important for startups that are pre-revenue or have not yet achieved profitability.

Another way that venture debt can impact startup valuations is by providing a lower cost of capital compared to equity financing. Venture debt typically has lower interest rates than equity financing, which can result in lower overall financing costs for startups. This can be especially important for startups that are looking to conserve cash and minimize their burn rate.

Benefits of Venture Debt

There are several benefits of venture debt for startups. One of the most significant benefits is that it allows startups to raise additional capital without diluting the ownership of their existing investors. This can be important for startups that want to maintain control over their company and avoid giving up too much equity.

Another benefit of venture debt is that it can provide startups with more flexibility than equity financing. With venture debt, startups are not required to give up board seats or control over their company. This can be important for startups that want to maintain their autonomy and control over their business.

Venture Debt vs. Equity Financing

Venture debt and equity financing are two different options for startups looking to raise capital. While both options provide funding for startups, there are some key differences between the two.

One of the biggest differences between venture debt and equity financing is the cost of capital. Venture debt typically has lower interest rates than equity financing, which can result in lower overall financing costs for startups.

Another difference between the two is the level of dilution. With equity financing, startups are required to give up ownership in their company in exchange for funding. With venture debt, startups are able to raise additional capital without diluting the ownership of their existing investors.

When to Consider Venture Debt

Venture debt can be a good option for startups in certain situations. One situation where venture debt can be a good option is when a startup has already raised equity capital and is looking to extend its runway without diluting the ownership of its existing investors.

Another situation where venture debt can be a good option is when a startup is pre-revenue or has not yet achieved profitability. In these situations, venture debt can provide the additional capital that is needed to achieve milestones without having to raise additional equity capital.

Key Takeaways

Venture debt is a type of financing that can impact startup valuations in a number of ways. It can provide startups with additional capital without diluting the ownership of their existing investors, and it can provide a lower cost of capital compared to equity financing. Venture debt can be a good option for startups that have already raised equity capital and are looking to extend their runway or for startups that are pre-revenue or have not yet achieved profitability.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing provided to startups and other high-growth companies that have already raised equity funding. It is typically used to finance working capital, fund acquisitions, or extend a company’s runway without diluting existing shareholders.

Venture debt is considered a less dilutive form of financing than equity funding, as it does not require the sale of any ownership in the company. Instead, venture debt is structured as a loan, with interest and principal payments due over a set period of time.

How does venture debt impact a startup’s capital structure?

Venture debt can impact a startup’s capital structure by increasing the amount of debt on its balance sheet. This can have both positive and negative effects on the company’s valuation.

On the one hand, the additional debt can provide the company with more flexibility to fund growth, without diluting existing shareholders. On the other hand, too much debt can make a company less attractive to potential investors, as it increases the risk of default and bankruptcy.

What are the advantages of using venture debt for startups?

There are several advantages of using venture debt for startups. First, it can provide a less dilutive form of financing than equity funding, allowing founders to maintain more ownership and control of their company. Second, venture debt can be used to extend a company’s runway, giving it more time to achieve profitability or raise additional funding. Finally, venture debt can be a useful tool for financing growth and expansion, without putting too much strain on a company’s balance sheet.

However, it’s important for startups to understand the risks associated with venture debt, including the potential for default and bankruptcy if the company is unable to make its debt payments.

How does venture debt impact a startup’s valuation?

Venture debt can impact a startup’s valuation in several ways. On the one hand, venture debt can be used to fund growth and expansion, which can increase the company’s overall value. On the other hand, too much debt can make a company less attractive to potential investors, as it increases the risk of default and bankruptcy.

Ultimately, the impact of venture debt on a startup’s valuation will depend on a variety of factors, including the amount of debt raised, the terms of the debt agreement, and the company’s overall financial health and growth prospects.

What are the risks associated with venture debt?

There are several risks associated with venture debt, including the potential for default and bankruptcy if the company is unable to make its debt payments. In addition, venture debt can be more expensive than traditional bank loans, with higher interest rates and fees.

Finally, venture debt can be a less flexible form of financing than equity funding, as it typically requires set interest and principal payments over a fixed period of time, which can put a strain on a company’s cash flow if it experiences unexpected challenges or setbacks.

In conclusion, venture debt can have a significant impact on the valuations of startups. While it can provide a much-needed injection of capital for businesses that are not yet profitable, it can also lead to higher valuations that may not be sustainable in the long run.

One of the key benefits of venture debt is that it allows startups to maintain more equity ownership without having to dilute their shares through additional rounds of funding. This can be especially important for companies that are still in the early stages of development and need to preserve as much ownership as possible.

However, it’s important to remember that venture debt comes with risks as well. If a startup is unable to meet its debt obligations, it could lead to a downward spiral of declining valuations and financial instability. Therefore, it’s important for founders and investors alike to carefully consider the potential impact of venture debt on their company’s valuation and overall financial health.