In the world of entrepreneurship, funding is a crucial element for a business to grow and expand. While equity financing is commonly known, venture debt is also gaining popularity among startups. In this article, we will explore the situations where venture debt is preferred over equity and its advantages. So, let’s delve deeper into the world of venture debt and discover the circumstances where it can be a better option for your business.

When is Venture Debt Preferred over Equity?

Venture capital is a great way to raise money for a startup, but it’s not always the best option. Venture debt can be a better choice for some companies. In this article, we’ll explore when venture debt is preferred over equity.

1. Startups with Strong Cash Flows

Venture debt is a good option for startups with strong cash flows. These companies have a steady stream of revenue and can easily make their debt payments. They don’t need to give up equity in their company to raise money, which means they can retain more ownership and control. Additionally, venture debt can help these startups extend their runway, giving them more time to grow and become profitable.

For example, let’s say a startup has $1 million in revenue and $500,000 in expenses each year. They can take out a $500,000 venture debt loan with a 10% interest rate and a 3-year term. They’ll have to pay back $166,667 each year, but they’ll still have $333,333 in cash flow to invest in their business.

2. Companies with a Clear Path to Profitability

Venture debt is also a good option for companies with a clear path to profitability. These companies have a solid business model and know how to make money. They don’t need to raise a lot of money to achieve their goals, so they don’t want to give up too much equity. Venture debt can help them bridge the gap between where they are now and where they need to be.

For example, let’s say a company has a product that costs $5 to make and they sell it for $10. They have 1,000 customers and want to grow to 10,000 customers. They need $500,000 to achieve this goal, but they don’t want to give up 20% equity. They can take out a $500,000 venture debt loan with a 10% interest rate and a 3-year term. They’ll have to pay back $166,667 each year, but they’ll still have $333,333 in cash flow to invest in their business.

3. Companies with High Growth Potential

Venture debt can also be a good option for companies with high growth potential. These companies have a product or service that is in high demand and can grow quickly. They need money to scale their business, but they don’t want to give up too much equity. Venture debt can help these companies grow without diluting their ownership.

For example, let’s say a company has a product that is in high demand. They need $1 million to expand their production capacity and meet customer demand. They don’t want to give up 30% equity to raise this money. They can take out a $1 million venture debt loan with a 12% interest rate and a 5-year term. They’ll have to pay back $240,000 each year, but they’ll still have $760,000 in cash flow to invest in their business.

4. Companies with a Need for Flexibility

Venture debt can also be a good option for companies that need flexibility. These companies may not want to give up equity or take on more investors. They may have a unique business model or product that doesn’t fit the typical venture capital mold. Venture debt can help these companies raise money without having to change their business strategy.

For example, let’s say a company has a unique business model that doesn’t fit the typical venture capital mold. They need $500,000 to launch their product, but they don’t want to give up equity. They can take out a $500,000 venture debt loan with a 10% interest rate and a 3-year term. They’ll have to pay back $166,667 each year, but they’ll still have $333,333 in cash flow to invest in their business.

5. Benefits of Venture Debt

- Retain more ownership and control

- Extend runway

- Bridge the gap between where you are now and where you need to be

- Grow without diluting ownership

- Raise money without changing your business strategy

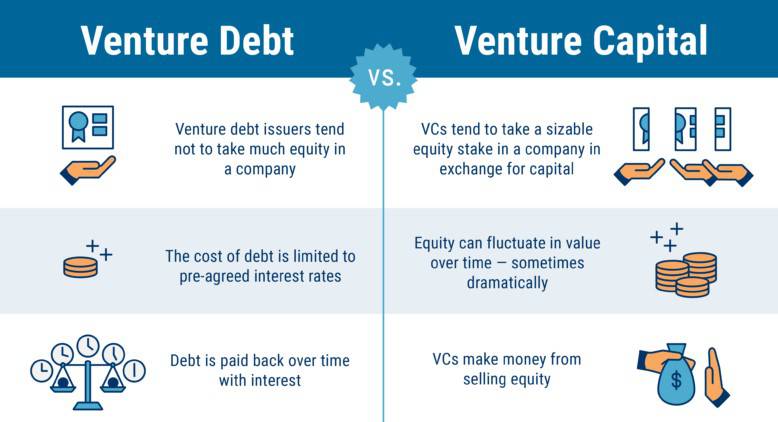

6. Venture Debt vs. Equity

| Venture Debt | Equity |

|---|---|

| Retain ownership and control | Give up ownership and control |

| Fixed payments | No payments, but dilution of ownership |

| Lower cost of capital | Higher cost of capital |

7. Risks of Venture Debt

While venture debt can be a good option for some companies, it’s not without its risks. Venture debt typically has higher interest rates and shorter terms than traditional bank loans. Additionally, if a company is unable to make its debt payments, the lender may have the right to take ownership of the company’s assets.

8. When to Avoid Venture Debt

Venture debt may not be the best option for all companies. Startups that don’t have strong cash flows or a clear path to profitability may struggle to make their debt payments. Additionally, companies that need a lot of money to achieve their goals may be better off raising equity. Finally, companies that are not comfortable with the risks associated with debt financing may want to avoid venture debt.

9. Working with a Venture Debt Lender

If you’re considering venture debt, it’s important to work with a reputable lender. Look for a lender that has experience working with startups and understands the unique challenges they face. Additionally, make sure you understand the terms of the loan, including the interest rate, term, and any covenants or restrictions.

10. Conclusion

Venture debt can be a great way for startups to raise money without giving up equity. It’s a good option for companies with strong cash flows, a clear path to profitability, high growth potential, a need for flexibility, and more. However, it’s not without its risks, and it may not be the best option for all companies. If you’re considering venture debt, make sure you understand the risks and benefits and work with a reputable lender.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing provided to early-stage companies that have the potential to grow rapidly. This type of financing is typically used to supplement equity financing and is often provided by specialized lenders who understand the unique needs of startups.

Venture debt is structured as a loan with interest and principal payments, and may also include warrants or other equity-like features that provide the lender with the opportunity to participate in the company’s future growth.

What is equity financing?

Equity financing is a type of financing that involves selling ownership in a company in exchange for capital. This type of financing is typically used by early-stage companies that do not have the cash flow or assets to secure traditional debt financing.

Equity financing can take many forms, including angel investments, venture capital, and initial public offerings (IPOs). Unlike debt financing, equity financing does not require the company to make regular payments to investors, but instead provides investors with a share of the company’s profits.

What are the advantages of venture debt?

One advantage of venture debt is that it allows companies to raise capital without diluting their ownership stake. This means that founders and early investors can maintain a larger share of the company’s equity, which can be important for long-term value creation.

Additionally, venture debt can provide companies with a longer runway to achieve their growth objectives. Because debt financing does not require the company to give up ownership, it can be a more attractive option for companies that have a clear path to profitability but need additional capital to get there.

When is venture debt preferred over traditional debt?

Venture debt is typically preferred over traditional debt when a company has a high growth potential but does not have the assets or cash flow to secure traditional debt financing. This is because venture debt lenders are typically more willing to take on risk and understand the unique needs of startup companies.

Additionally, venture debt lenders may be more flexible in their repayment terms, which can be important for companies that are still in the early stages of growth and may not have predictable cash flows or revenue streams.

When is venture debt preferred over equity financing?

Venture debt is typically preferred over equity financing when a company wants to raise capital without diluting its ownership stake. This can be particularly important for companies that have a clear path to profitability and do not want to give up a larger share of their equity than necessary.

Additionally, venture debt can be a more attractive option for companies that want to maintain control over their strategic direction. Because debt financing does not provide lenders with an ownership stake, it does not come with the same level of control or influence as equity financing.

The Value of Venture Debt Explained – Trinity Capital Inc.

In conclusion, venture debt and equity both have their own advantages and disadvantages. However, when it comes to choosing between the two, venture debt may be preferred over equity in certain situations.

Firstly, venture debt is a suitable option when a company needs additional funding without diluting its ownership. This is especially important when the company has already raised a significant amount of equity and wants to maintain control over its operations.

Secondly, venture debt allows companies to leverage their assets and cash flows to secure financing. This is particularly useful for companies with strong revenue streams and assets that can be used as collateral.

Lastly, venture debt also provides companies with more flexibility in terms of repayment and interest rates compared to equity financing. This allows companies to better manage their cash flows and financial obligations.

In summary, venture debt may be preferred over equity when a company wants to maintain ownership, leverage its assets, and have more flexibility in repayment and interest rates.