Venture debt has become a popular financing option for startups and growing companies. Unlike traditional forms of debt, venture debt offers lower interest rates and flexible repayment terms. However, how does venture debt affect a company’s balance sheet? In this article, we will explore the impact of venture debt on a company’s financial health and its balance sheet.

How Venture Debt Impacts a Company’s Balance Sheet

When a company needs funding, there are various options available, including raising equity capital, taking on debt, or a combination of both. One type of debt financing that has become increasingly popular is venture debt. Venture debt can have a significant impact on a company’s balance sheet, and it’s essential to understand how it works.

What is Venture Debt?

Venture debt is a type of debt financing that is typically provided by banks or specialized venture debt firms to startups or high-growth companies. Unlike traditional bank loans, venture debt is tailored to the needs of startups and high-growth companies and is structured to help them grow without diluting their equity.

Venture debt can take various forms, including term loans, lines of credit, and convertible debt. It is typically used to fund growth initiatives, such as expanding operations, hiring new staff, or investing in research and development.

How Does Venture Debt Impact a Company’s Balance Sheet?

When a company takes on venture debt, it appears as a liability on the balance sheet. This liability is offset by the cash received from the loan, which appears as an asset. The impact of venture debt on a company’s balance sheet depends on the terms of the loan.

For example, if a company takes on a term loan, the principal and interest payments will appear as liabilities on the balance sheet. The loan’s interest expense will also appear on the income statement as an expense, reducing the company’s net income.

If a company takes on a line of credit, the amount drawn down will appear as a liability on the balance sheet. The interest expense will only appear on the income statement when the company draws down on the line of credit.

The Benefits of Venture Debt

There are several benefits to taking on venture debt, including:

- Lower cost of capital compared to equity financing

- No dilution of ownership

- Flexible repayment terms

- Access to working capital to fund growth initiatives

Venture debt can also be a useful tool for startups and high-growth companies that have limited assets to use as collateral for traditional bank loans. Venture debt firms are more willing to take on higher risk, which can be attractive to companies that may not qualify for traditional bank loans.

Venture Debt Vs. Equity Financing

Venture debt is often used in conjunction with equity financing, and understanding the differences between the two is essential. Equity financing involves selling ownership in a company in exchange for funding. The company’s shareholders bear the risk and reward associated with the investment.

Venture debt, on the other hand, does not dilute ownership, and the lender does not share in the upside potential of the investment. Venture debt is also typically less expensive than equity financing, making it an attractive option for companies that want to preserve their equity.

Conclusion

Venture debt can be an attractive option for startups and high-growth companies that want to fund growth initiatives without diluting their equity. While venture debt appears as a liability on the balance sheet, it can provide access to working capital and flexible repayment terms. It’s essential to understand the differences between venture debt and equity financing and how they impact a company’s balance sheet.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing that is typically provided by a venture capital firm or a specialized lender to startups and early-stage companies. Unlike traditional bank loans, venture debt is structured as a loan with equity-like features, such as warrants or conversion rights.

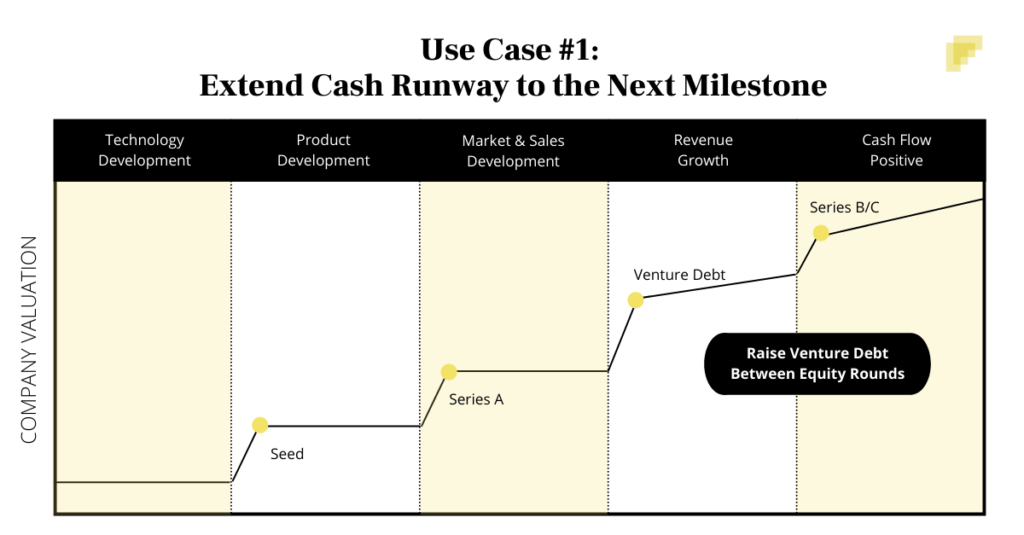

Venture debt can be used to finance growth initiatives, such as expanding into new markets, hiring additional staff, or launching new products or services. It can also be used to bridge the gap between equity financing rounds or to extend a company’s cash runway.

What are the advantages of venture debt?

One of the main advantages of venture debt is that it allows companies to raise capital without diluting their equity. This can be particularly important for startups and early-stage companies that may not want to give up a significant portion of their ownership to outside investors.

In addition, venture debt can provide companies with more flexible financing terms than traditional bank loans, such as longer repayment periods and lower interest rates. This can be especially beneficial for companies that are still in the early stages of their growth and may not have significant revenue or assets to use as collateral.

How does venture debt affect a company’s balance sheet?

Venture debt is typically structured as a loan with equity-like features, which means that it is recorded on a company’s balance sheet as both debt and equity. The debt portion of the financing will appear as a liability on the balance sheet, while the equity portion will appear as additional paid-in capital.

While venture debt can increase a company’s debt-to-equity ratio, it can also provide a boost to the company’s balance sheet by increasing its cash reserves and providing additional working capital. This can be especially important for companies that are looking to finance growth initiatives or bridge the gap between equity financing rounds.

What are the risks of venture debt?

Like any type of debt financing, venture debt comes with risks. One of the main risks is that it can be more expensive than traditional bank loans, due to the equity-like features that are included in the financing. In addition, if a company is unable to make its debt payments, the lender may have the right to convert the debt into equity, which could result in dilution for existing shareholders.

Another risk of venture debt is that it may be harder to obtain than traditional bank loans, due to the higher risk profile of startups and early-stage companies. This can make it more difficult for companies to secure the financing they need to grow their business.

How can companies mitigate the risks of venture debt?

Companies can mitigate the risks of venture debt by carefully evaluating their financing needs and choosing a lender that is experienced in working with startups and early-stage companies. It is also important for companies to have a solid business plan and a clear path to profitability, as this can help to reassure lenders that the company is a good investment.

In addition, companies should carefully review the terms of any venture debt financing agreement before signing, paying close attention to the interest rate, repayment terms, and any equity-like features that are included. Finally, companies should have a plan in place for how they will use the funds from the venture debt financing to ensure that they are able to achieve their growth objectives.

The Value of Venture Debt Explained – Trinity Capital Inc.

In conclusion, venture debt can have both positive and negative effects on a company’s balance sheet. On the one hand, it can provide a source of funding that does not dilute the ownership of the company and can help to reduce the overall cost of capital. On the other hand, it can increase the company’s debt-to-equity ratio and affect its credit rating, which could make it more difficult to secure additional financing in the future.

Despite these potential drawbacks, venture debt can be an attractive option for companies that are looking to grow quickly and need additional capital to do so. By carefully considering the terms of the debt agreement and ensuring that the company has a solid plan for repaying the debt, businesses can use venture debt to their advantage and achieve their growth goals without sacrificing ownership or control.

Overall, venture debt can be a valuable tool for companies that are looking to expand their operations and take advantage of new business opportunities. By understanding the effects that venture debt can have on a company’s balance sheet and taking steps to mitigate any potential risks, businesses can use this financing option to their advantage and achieve long-term success.