Are you considering venture debt to finance your business? Venture debt can be a useful tool for startups, but it also comes with its own set of challenges. In this article, we’ll explore the ins and outs of managing venture debt, so you can make informed decisions for the future of your company.

We’ll cover everything from understanding the different types of venture debt, to developing a repayment plan that works for you. Whether you’re a seasoned entrepreneur or just starting out, this guide will give you the tools you need to navigate the world of venture debt with confidence. So, let’s dive in!

How to Manage Venture Debt?

Venture debt is a type of funding that provides startups with additional capital to grow their businesses without having to give up equity. However, managing venture debt can be challenging, especially for new entrepreneurs who are not familiar with the process. In this article, we will discuss some tips on how to manage venture debt effectively.

Understand the Terms of the Debt

Before you take on venture debt, it is essential to understand the terms of the debt. You need to know the interest rate, repayment period, and any covenants that come with the debt. Covenants are conditions that you must meet to keep the debt in good standing. Failure to meet the covenants can result in default or higher interest rates. Therefore, it is essential to read the loan agreement carefully and seek legal advice if necessary.

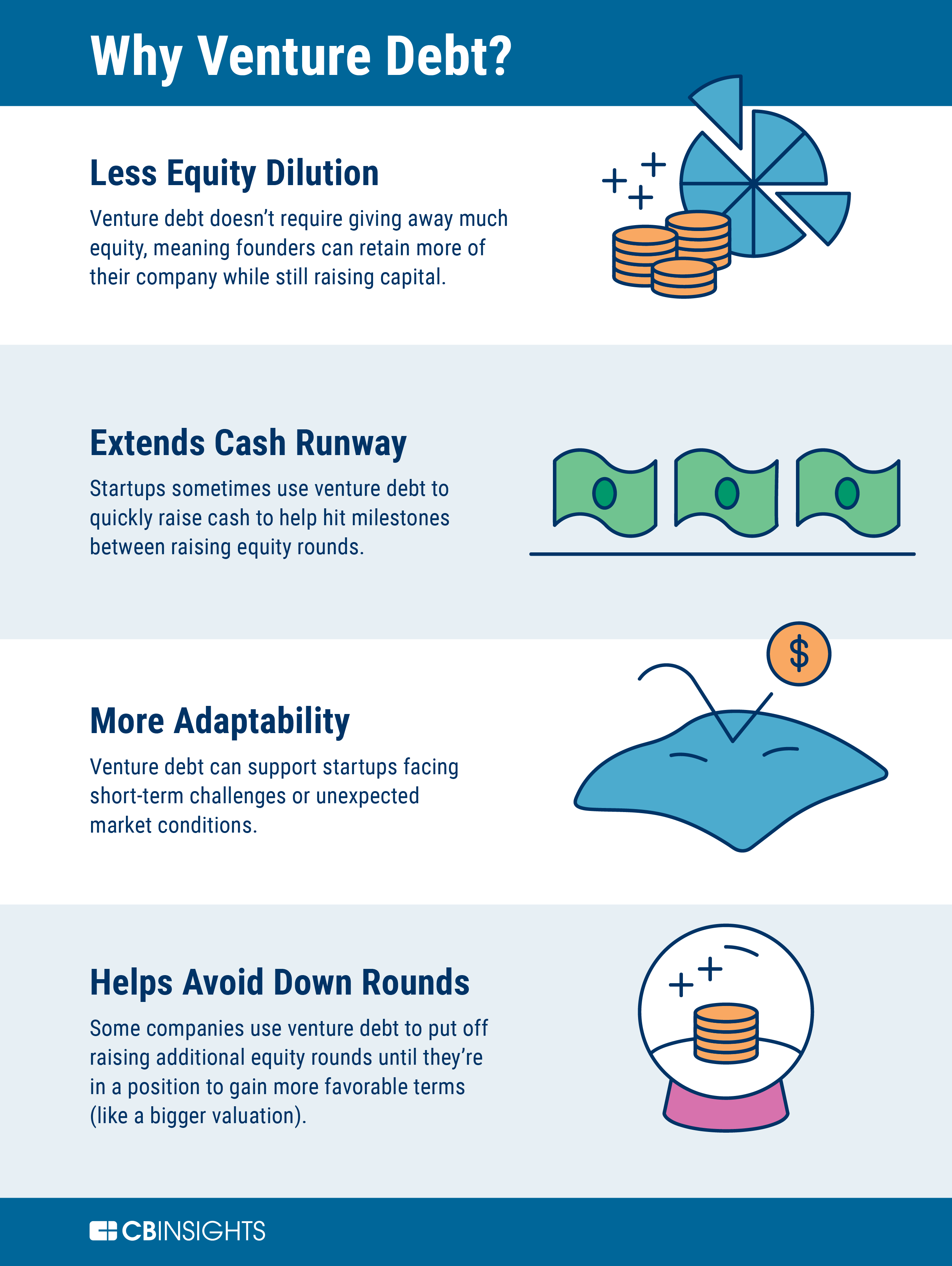

Benefits of Venture Debt

Venture debt allows startups to raise capital without diluting their ownership or control. It is also less expensive than equity financing and can be used to bridge the gap between funding rounds. Furthermore, venture debt lenders are more flexible than equity investors and do not require a seat on the board or management team.

Types of Venture Debt

There are two types of venture debt: term loans and lines of credit. Term loans are fixed-term loans with regular payments, while lines of credit are revolving credit lines that can be drawn upon as needed. Each type of debt has its advantages and disadvantages, and you need to choose the one that is best for your business.

Manage Cash Flow Effectively

One of the most critical aspects of managing venture debt is managing cash flow effectively. You need to ensure that you have enough cash on hand to make the regular loan payments and meet the covenants. It is also crucial to have a cash reserve for unexpected expenses or downturns in the market. Therefore, you need to have a solid financial plan and monitor your cash flow regularly.

Benefits of Managing Cash Flow

Managing cash flow effectively can help you avoid default and maintain good relationships with lenders. It can also help you make informed decisions about your business and identify areas where you can improve your profitability.

Tools for Managing Cash Flow

There are several tools that you can use to manage your cash flow effectively, such as accounting software, budgeting tools, and financial forecasting models. These tools can help you track your expenses, revenues, and cash flow projections and make informed decisions about your business.

Communicate with Lenders

Communication is key to managing venture debt effectively. You need to communicate regularly with your lenders and keep them informed about your business. If you encounter any issues or problems, you need to address them promptly and work with your lenders to find a solution. It is also essential to be transparent and honest with your lenders about your financial situation.

Benefits of Communication

Communication can help you build trust and maintain good relationships with your lenders. It can also help you avoid misunderstandings and resolve issues before they become major problems.

Effective Communication Strategies

To communicate effectively with your lenders, you need to be clear, concise, and honest. You also need to be prepared to answer any questions that they may have and provide them with regular updates on your business.

Plan for Growth

Venture debt can be an effective tool for financing growth, but you need to have a plan in place to use the funds effectively. You need to have a clear understanding of your business goals and how the additional capital will help you achieve those goals. It is also essential to have a contingency plan in place in case things do not go as planned.

Benefits of Planning for Growth

Planning for growth can help you use your venture debt effectively and avoid wasting resources. It can also help you identify new opportunities and make informed decisions about your business.

Tools for Planning for Growth

There are several tools that you can use to plan for growth effectively, such as business planning software, financial modeling tools, and market research. These tools can help you identify new opportunities, evaluate your options, and make informed decisions about your business.

Monitor Your Debt

Monitoring your venture debt is crucial to managing it effectively. You need to track your loan payments, interest rates, and covenants regularly and ensure that you are meeting your obligations. If you encounter any issues or problems, you need to address them promptly and work with your lenders to find a solution.

Benefits of Monitoring Your Debt

Monitoring your debt can help you avoid default and maintain good relationships with your lenders. It can also help you identify potential issues before they become major problems.

Tools for Monitoring Your Debt

There are several tools that you can use to monitor your debt effectively, such as loan management software, financial tracking tools, and reporting tools. These tools can help you keep track of your loan payments, interest rates, and covenants and make informed decisions about your business.

Conclusion

Managing venture debt effectively requires careful planning, effective communication, and close monitoring. You need to understand the terms of the debt, manage your cash flow effectively, communicate regularly with your lenders, plan for growth, and monitor your debt closely. By following these tips, you can use venture debt to finance your growth effectively and avoid common pitfalls.

Frequently Asked Questions

Here are some common questions and answers about managing venture debt:

1. What is venture debt?

Venture debt is a type of financing that provides companies with additional capital to grow their business. Unlike equity financing, where investors receive equity in the company in exchange for their investment, venture debt is a loan that must be paid back with interest.

Managing venture debt involves ensuring that the company has the cash flow to make the required payments on time, while also continuing to invest in growth opportunities. This may require careful financial planning and budgeting to ensure that the company can continue to operate and expand while still meeting its debt obligations.

2. How can I determine if venture debt is right for my company?

The decision to pursue venture debt financing depends on a number of factors, including the company’s stage of growth, its financial goals, and the availability of other financing options. Companies that are already generating revenue and have a clear path to profitability may be good candidates for venture debt.

Before pursuing venture debt, it is important to carefully evaluate the terms of the loan and ensure that the company has a clear plan for paying it back. This may involve consulting with financial experts or conducting a thorough financial analysis of the company’s operations and cash flow.

3. What are some tips for managing venture debt?

One important tip for managing venture debt is to ensure that the company has a clear plan for paying back the loan and managing cash flow. This may involve developing a detailed financial plan that accounts for all sources of revenue and expenses, and setting aside a portion of profits to make regular loan payments.

It is also important to maintain strong relationships with lenders and other stakeholders, and to communicate regularly about the company’s progress and financial performance. This can help build trust and ensure that everyone is aligned around the company’s goals and priorities.

4. What are some common challenges associated with managing venture debt?

One common challenge associated with managing venture debt is balancing the need for growth with the need to meet debt obligations. This may require careful financial planning and budgeting to ensure that the company is investing in growth opportunities while still generating enough revenue to make loan payments.

Another challenge is managing relationships with lenders and other stakeholders, particularly in cases where the company may be experiencing financial difficulties or other challenges. In these situations, it is important to be transparent and communicative about the company’s situation, and to work collaboratively to find solutions that benefit all parties involved.

5. What resources are available to help companies manage venture debt?

There are a number of resources available to help companies manage venture debt, including financial advisors, accounting firms, and other consulting services. These resources can provide valuable insights and guidance on topics like financial planning, cash flow management, and debt repayment.

In addition, many venture debt lenders offer support and resources to their borrowers, including access to networks of other entrepreneurs and investors, as well as educational materials and training programs designed to help companies succeed and grow.

In conclusion, managing venture debt requires careful planning and execution. It is important to understand the terms and conditions of the debt, as well as the potential risks and rewards. By maintaining a strong relationship with the lender and communicating regularly, entrepreneurs can navigate the challenges of venture debt and use it to their advantage.

One key strategy for managing venture debt is to maintain a strong cash flow. This can be achieved by carefully managing expenses, increasing revenue streams, and securing additional funding if necessary. By staying on top of cash flow, entrepreneurs can ensure that they are able to meet their debt obligations and avoid defaulting on their loans.

Finally, it is important to remember that venture debt is just one tool in an entrepreneur’s toolkit. While it can be a valuable source of funding, it is not a silver bullet. Entrepreneurs should also consider other funding options, such as equity financing or crowdfunding, and weigh the pros and cons of each before making a decision. With the right approach, however, venture debt can be a powerful tool for fueling growth and taking a business to the next level.