As an entrepreneur seeking funding for your startup, you may have come across the term “venture debt.” Venture debt can be a great financing option for high-growth companies, but where do you find information about venture debt lenders? In this article, we’ll explore some of the top resources for finding venture debt lenders and what to consider when evaluating them. So, let’s dive in!

Where to Find Information About Venture Debt Lenders?

When it comes to financing your business, venture debt can be an attractive option. Unlike traditional loans, venture debt provides funding without diluting equity. However, finding the right venture debt lender can be a daunting task. In this article, we’ll explore where to find information about venture debt lenders and what factors to consider when choosing one.

Industry Associations

One of the best places to start your search for venture debt lenders is industry associations. These associations often have lists of member lenders who specialize in providing venture debt financing. For example, the National Venture Capital Association (NVCA) has a directory of venture debt lenders on its website. Similarly, the National Association of Small Business Investment Companies (NASBIC) has a list of member lenders that provide venture debt financing.

It’s important to note that not all industry associations will have lists of venture debt lenders. However, they can still be a valuable resource for networking and getting referrals.

Online Directories

Another way to find information about venture debt lenders is through online directories. There are several directories that specialize in listing venture debt lenders, such as VentureDeal and GrowthCapitalist. These directories provide information on the lender’s investment criteria, portfolio companies, and contact information.

While online directories can be a good starting point, it’s important to do your research and verify the information provided. Some directories may have outdated or inaccurate information.

Financial Advisors

Financial advisors are another resource for finding venture debt lenders. They have relationships with various lenders and can help you navigate the financing process. When choosing a financial advisor, look for one with experience in venture debt financing.

It’s important to note that financial advisors typically charge a fee for their services. Make sure you understand their fee structure before engaging their services.

Investment Banks

Investment banks can also be a valuable resource for finding venture debt lenders. They often have relationships with lenders and can help you structure your financing. Additionally, investment banks can provide advice on valuation and deal terms.

Keep in mind that investment banks typically work with larger companies and may not be the best fit for startups.

Peer Networks

Peer networks can also be a valuable resource for finding venture debt lenders. These networks, such as YPO and Vistage, provide opportunities for entrepreneurs to connect with each other and share resources.

Through peer networks, you can get referrals to venture debt lenders and learn from the experiences of other entrepreneurs.

Angel Networks

Angel networks are groups of high net worth individuals who invest in early-stage companies. While angel investors typically provide equity financing, some may also provide venture debt financing.

By connecting with angel networks, you can get access to potential lenders and investors.

Incubators and Accelerators

Incubators and accelerators are programs that provide resources and support to startups. Some of these programs may also have relationships with venture debt lenders.

By participating in an incubator or accelerator program, you can get access to potential lenders and investors.

Online Platforms

Online platforms, such as AngelList and SeedInvest, provide a marketplace for startups to connect with investors and lenders. While these platforms typically focus on equity financing, some may also provide venture debt financing.

When using online platforms, it’s important to do your due diligence and verify the credibility of the lenders and investors.

Referrals

Referrals can be one of the most valuable resources for finding venture debt lenders. Talk to other entrepreneurs in your industry and ask for referrals to lenders they have worked with.

Additionally, you can reach out to your network of advisors, investors, and mentors for referrals.

Research and Due Diligence

Once you have a list of potential venture debt lenders, it’s important to do your research and due diligence. Look for lenders with experience in your industry and a track record of success. Additionally, consider factors such as interest rates, repayment terms, and covenants.

By doing your due diligence, you can find the right lender for your business and increase your chances of success.

In conclusion, finding the right venture debt lender can be a challenging task. However, by utilizing industry associations, online directories, financial advisors, investment banks, peer networks, angel networks, incubators and accelerators, online platforms, referrals, and conducting thorough research and due diligence, you can find the right lender for your business.

Frequently Asked Questions

What is venture debt?

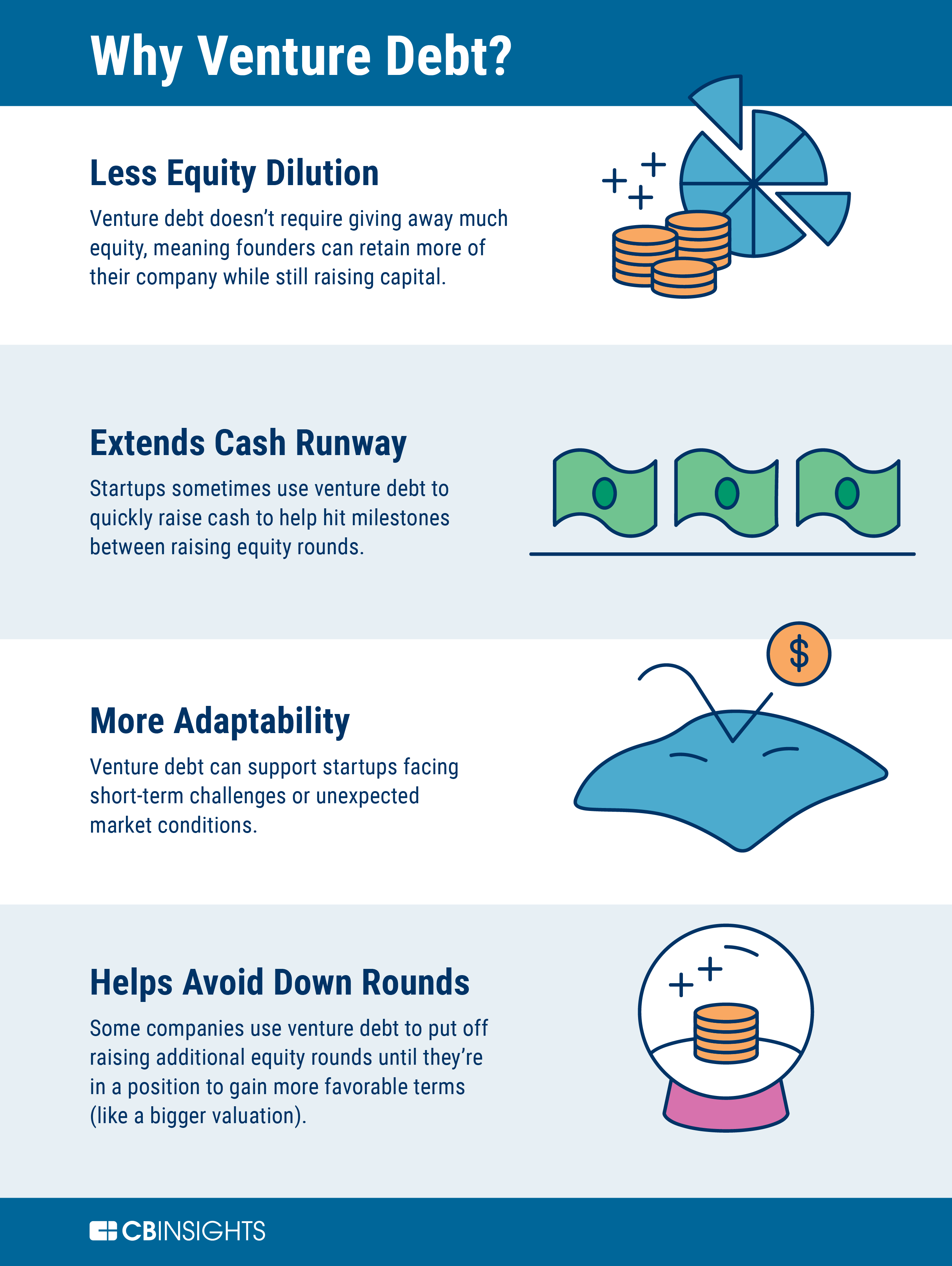

Venture debt is a form of financing that is typically offered to startups and growing businesses that have already raised a significant amount of equity financing. The debt is structured to be repaid over a set period of time, usually with interest, and may include warrant coverage or other equity kickers.

Venture debt can be a useful tool for companies that need additional capital to fuel growth, but don’t want to dilute their equity ownership by raising more equity financing.

What are venture debt lenders?

Venture debt lenders are financial institutions or specialized lenders that provide venture debt financing to startups and growing businesses. These lenders typically have experience working with early-stage companies and understand the unique challenges and risks associated with investing in them.

Some venture debt lenders operate nationally, while others may focus on specific regions or industries. It’s important for companies to do their research and find a lender that is a good fit for their needs.

What are the benefits of working with venture debt lenders?

Working with venture debt lenders can provide a number of benefits for startups and growing businesses. These lenders often offer more flexible terms than traditional banks or other lenders, and may be more willing to work with companies that are still in the early stages of their development.

Additionally, venture debt lenders may be able to provide access to a network of investors and other resources that can help companies grow and succeed.

Where can I find information about venture debt lenders?

There are a number of resources available for companies that are looking to find venture debt lenders. One option is to search online for lenders that specialize in venture debt financing.

Additionally, companies can reach out to industry associations or other organizations that work with early-stage companies to get recommendations and advice on finding the right lender.

How do I evaluate venture debt lenders?

When evaluating venture debt lenders, it’s important to consider a number of factors, including their experience working with early-stage companies, their track record of success, and the terms and conditions of their financing.

Companies should also consider the lender’s reputation in the industry, as well as any fees or other costs associated with the financing. It’s a good idea to talk to other companies that have worked with the lender and get their feedback before making a decision.

In conclusion, finding information about venture debt lenders can be a daunting task, but there are several resources available to help you in your search.

Firstly, you can start by checking out industry publications, such as VentureBeat or TechCrunch, which often feature news and analysis on venture debt lenders.

Secondly, you can also look into online directories and databases that specialize in connecting entrepreneurs with venture debt lenders. These directories can provide you with a comprehensive list of lenders and their contact information, making it easier for you to reach out and start the funding process.

Lastly, don’t be afraid to reach out to your network of industry contacts for recommendations and referrals. Personal connections can often lead to valuable insights and introductions to potential lenders.

By utilizing these resources, you can take the first steps towards securing venture debt financing and growing your business.