As a business owner, you may have heard of venture debt, a type of financing that can provide additional funds to help grow your business. But what exactly is venture debt and how can it impact your cash flow?

Venture debt can be a useful tool for businesses looking to expand, but it’s important to understand the potential impact it can have on your cash flow. In this article, we’ll explore the basics of venture debt and discuss how it might affect your business’s finances. So, let’s dive in!

Understanding the Impact of Venture Debt on Your Cash Flow

What is Venture Debt?

Venture debt is a type of debt financing that is specifically designed for startups and early-stage companies. It is a way for these companies to access capital without having to give up equity in their business. Venture debt is typically provided by specialized lenders who understand the unique needs of startups and are willing to take on more risk than traditional lenders.

Unlike traditional debt, venture debt often comes with a number of covenants and restrictions that are designed to protect the lender’s investment. These covenants can include things like revenue targets, cash balance requirements, and restrictions on how the company can spend its money.

Benefits of Venture Debt

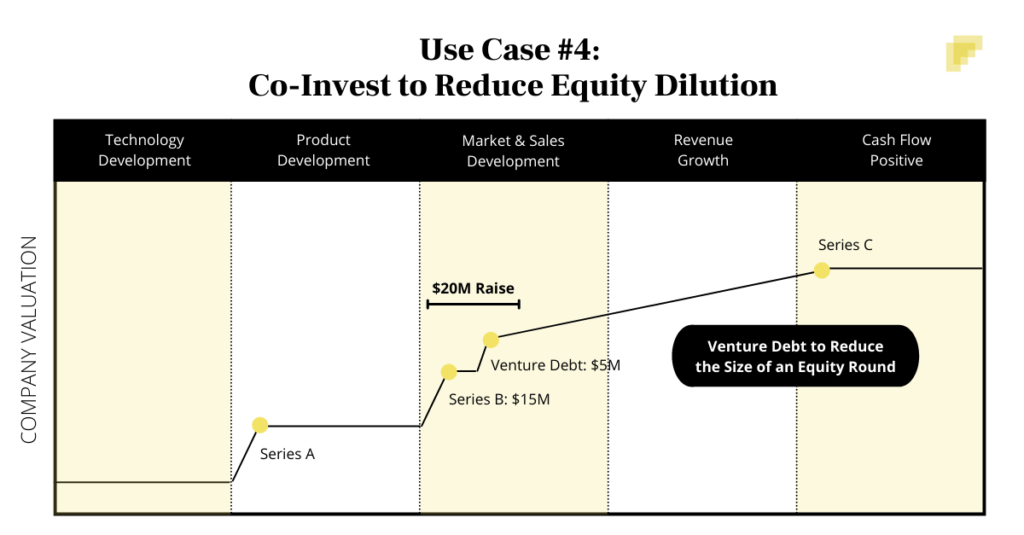

- Access to capital without diluting equity

- Flexible repayment terms

- Can help build relationships with investors and lenders

Venture Debt vs. Equity Financing

| Venture Debt | Equity Financing |

|---|---|

| Debt financing | Equity financing |

| No dilution of equity | Dilutes equity |

| Fixed repayment terms | No fixed repayment terms |

| May have covenants and restrictions | No covenants or restrictions |

How Does Venture Debt Affect Cash Flow?

While venture debt can be a valuable source of capital for startups and early-stage companies, it can also have an impact on cash flow. Because venture debt comes with repayment terms, it can be a drain on a company’s cash reserves.

For example, if a company takes on venture debt with a monthly repayment schedule, that company will need to make those payments regardless of their cash flow situation. This can put a strain on the company’s finances, especially if they experience a period of low or negative cash flow.

The Impact of Covenants and Restrictions

One of the ways that venture debt can affect cash flow is through the covenants and restrictions that are often included in these types of loans. These covenants can require a company to maintain a certain level of cash on hand, or to achieve specific revenue targets.

If a company is not able to meet these requirements, they may be in default of their loan agreement. This can result in penalties, higher interest rates, or even default on the loan.

Managing Venture Debt and Cash Flow

To manage the impact of venture debt on cash flow, it is important for companies to have a clear understanding of their financial situation. This includes having a comprehensive cash flow forecast that takes into account all of the company’s expenses and revenue streams.

Companies should also work closely with their venture debt lenders to negotiate repayment terms that are manageable and that take into account the company’s cash flow situation. This may include negotiating longer repayment terms or deferring payments during periods of low cash flow.

The Bottom Line

Venture debt can be a valuable source of capital for startups and early-stage companies, but it is important to understand the impact that it can have on cash flow. By carefully managing their cash flow and working closely with their lenders, companies can ensure that venture debt is a positive force for their business growth and success.

Frequently Asked Questions

How does venture debt work?

Venture debt is a type of financing where a lender provides a loan to a startup in exchange for interest and fees. This loan is typically secured by the company’s assets and is meant to provide additional capital to help the company grow. Venture debt is often used in conjunction with equity financing to give startups more runway to achieve profitability.

What are the advantages of venture debt?

Venture debt can be a great way to raise capital without diluting your ownership in the company. It also allows startups to extend their runway and achieve key milestones before needing to raise another round of funding. Additionally, venture debt can be structured to be less expensive than equity financing, making it an attractive option for companies looking to conserve cash.

What are the risks of venture debt?

Venture debt typically comes with higher interest rates and fees than traditional bank loans. Additionally, if the company is unable to make payments on the loan, the lender may have the right to seize the company’s assets. This can be especially problematic for startups that have not yet achieved profitability and may not have a significant asset base.

How does venture debt affect my balance sheet?

Venture debt is typically considered a liability on a company’s balance sheet. This means that it can affect your debt-to-equity ratio and potentially impact your ability to raise additional financing in the future. However, because venture debt is typically less expensive than equity financing, it can also help improve your cash position and overall financial health.

Are there alternatives to venture debt?

Yes, there are several alternative financing options available to startups, including revenue-based financing, crowdfunding, and grants. Each of these options has its own advantages and disadvantages, so it’s important to carefully evaluate which one is best for your company’s specific needs.

How Venture Debt Can Benefit Your Company’s Cash Flow

In conclusion, venture debt can have a significant impact on your company’s cash flow. While it may provide a valuable source of funding to help grow your business, it’s important to carefully consider the terms and conditions of any venture debt arrangement before signing on the dotted line.

One key factor to consider is the repayment schedule. Unlike equity financing, venture debt comes with a fixed repayment schedule, which means you’ll need to make regular payments regardless of whether or not your cash flow is strong.

Another important consideration is the interest rate. Venture debt typically comes with a higher interest rate than traditional bank loans, which can put a strain on your cash flow if you’re not prepared to manage the additional expense.

Ultimately, the decision to take on venture debt should be based on a careful analysis of your company’s financial situation, growth prospects, and overall goals. With the right strategy and planning, venture debt can be a valuable tool for achieving your business objectives and driving long-term success.