Venture debt is a popular financing option for startups that need quick cash. It often comes with lower interest rates and flexible repayment terms compared to other types of debt. However, as the business grows and evolves, it may become necessary to refinance the debt to better suit the company’s needs.

Many entrepreneurs wonder if venture debt can be refinanced, and the answer is yes! Refinancing can offer opportunities to improve repayment terms or extend the repayment period to make it more manageable. In this article, we will explore the ins and outs of venture debt refinancing and how it can benefit your startup.

Cannot Venture Debt be Refinanced?

Venture debt is a popular financing option for startups and small businesses. It is often used to supplement equity financing and provides a non-dilutive source of capital. However, as businesses grow and their financial needs change, they may consider refinancing their venture debt. But is this possible?

Understanding Venture Debt

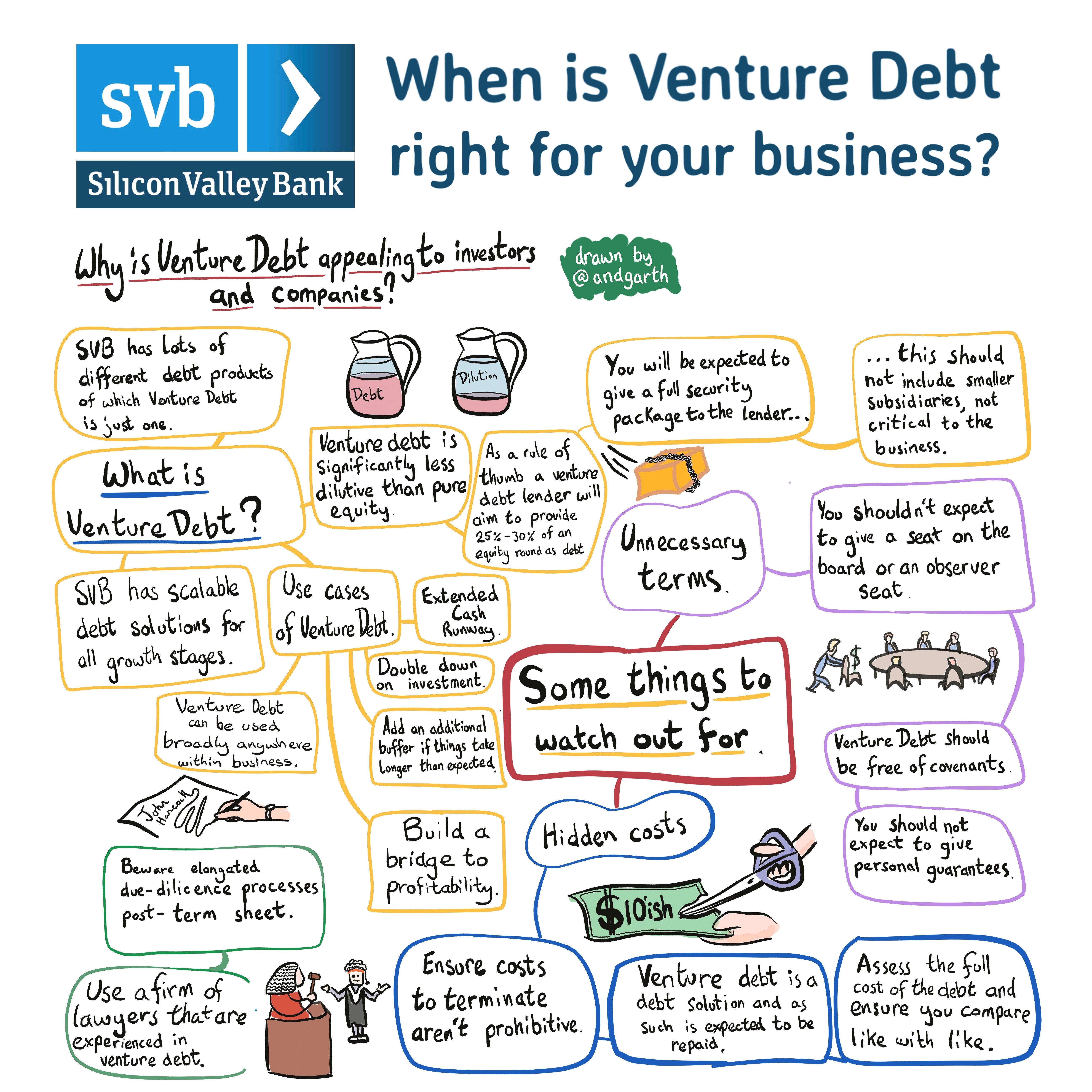

Venture debt is a type of debt financing that is typically provided by specialized lenders to early-stage and high-growth companies. It is structured as a loan with interest and principal payments, and often includes warrants or options that give the lender the right to purchase equity in the company at a later date.

Venture debt is often used to finance growth initiatives such as product development, marketing, and sales expansion. It is also commonly used to bridge the gap between equity rounds. The terms of venture debt are generally more favorable than traditional bank loans, but the interest rates and fees are typically higher.

The Limitations of Refinancing Venture Debt

Refinancing is the process of replacing an existing debt obligation with a new one. The goal of refinancing is to take advantage of a lower interest rate, better terms, or to free up cash flow. However, when it comes to venture debt, refinancing is not always an option.

One reason for this is that venture debt is often structured with covenants that restrict the borrower’s ability to take on additional debt. These covenants are designed to protect the lender’s investment and ensure that the borrower has sufficient cash flow to meet its obligations. If a borrower wants to refinance their venture debt, they may need to negotiate with their lender to modify or remove these covenants.

Another limitation of refinancing venture debt is that the lender may require the borrower to pay a prepayment penalty. This penalty is designed to compensate the lender for the loss of future interest payments that they would have received if the loan had not been refinanced. The prepayment penalty can be a significant expense and may make refinancing financially unfeasible.

The Benefits and Risks of Refinancing Venture Debt

Despite the limitations of refinancing venture debt, there are some potential benefits. For example, refinancing may allow a borrower to take advantage of lower interest rates or better terms. It may also free up cash flow, which can be used to invest in growth initiatives or pay down other debt.

However, refinancing also has its risks. It may require the borrower to provide additional collateral or security, which could put their assets at risk. It may also result in higher interest rates or fees, which could increase the overall cost of borrowing.

Alternatives to Refinancing Venture Debt

If refinancing is not an option, there are other alternatives that a borrower can consider. One option is to negotiate with the lender to modify the terms of the existing loan. For example, the borrower may be able to negotiate a lower interest rate or a longer repayment term.

Another option is to raise additional equity capital to pay off the venture debt. This can be done through a new round of fundraising or by selling equity to existing investors. However, raising equity capital can be time-consuming and may result in dilution of the existing shareholders.

The Bottom Line

In conclusion, while venture debt can be a valuable source of financing for startups and small businesses, refinancing is not always an option. The limitations of venture debt covenants, prepayment penalties, and other factors can make refinancing financially unfeasible. However, borrowers can explore alternative options such as negotiating with the lender or raising additional equity capital to pay off the debt. As with any financial decision, it is important to carefully weigh the benefits and risks of refinancing venture debt and to consult with a professional advisor before making a decision.

Frequently Asked Questions

Here are some common questions related to the topic of refinancing venture debt:

What is venture debt refinancing?

Venture debt refinancing is the process of paying off existing venture debt with a new loan. The new loan typically has better terms, such as lower interest rates or longer repayment periods, which can help a company manage its debt more effectively. Companies may choose to refinance venture debt if they want to improve their financial flexibility or reduce their overall debt burden.

However, it’s important to note that refinancing venture debt may not always be the best choice for every company. Factors such as the cost of the new loan, the company’s creditworthiness, and the overall market conditions should all be considered before making a decision.

Can all types of venture debt be refinanced?

Not all types of venture debt can be refinanced. Some venture debt agreements may include terms that prohibit or limit the ability of the borrower to refinance the debt. For example, a lender may require a prepayment penalty if the borrower repays the loan early or may charge a fee for early termination of the loan agreement.

Before considering refinancing venture debt, it’s important to review the terms of the existing loan agreement to determine if there are any restrictions or penalties that could make refinancing more costly or difficult.

What are the benefits of refinancing venture debt?

Refinancing venture debt can offer several benefits for companies, including lower interest rates, longer repayment periods, and improved cash flow. By securing better terms on a new loan, companies can reduce their overall debt burden and improve their financial flexibility. Refinancing can also help companies better manage their debt obligations and improve their creditworthiness.

However, it’s important to carefully consider the costs and risks associated with refinancing venture debt before making a decision.

What are the risks of refinancing venture debt?

Refinancing venture debt can also come with risks. For example, the cost of the new loan may be higher than the existing loan, or the company may not qualify for better terms due to changes in market conditions or its creditworthiness. Additionally, refinancing may require the company to provide additional collateral or personal guarantees, which could increase its financial risk.

Before refinancing venture debt, companies should carefully review the terms of the new loan and consider the potential costs and risks involved.

How can I determine if refinancing venture debt is right for my company?

Determining whether refinancing venture debt is the right choice for your company depends on a variety of factors, including the current terms of your existing debt, your company’s financial situation and creditworthiness, and the overall market conditions. Consulting with a financial advisor or lender can help you evaluate your options and determine whether refinancing makes sense for your company.

It’s important to carefully consider the costs and risks associated with refinancing before making a decision, and to review the terms of any new loan agreement carefully to ensure that it meets your company’s needs and goals.

What to do if you can’t raise Venture Debt?

In conclusion, venture debt is an important source of capital for startups looking to grow their business. While it may come with higher interest rates and shorter repayment terms, it can provide the necessary funding to propel a company forward. However, many startups may find themselves in a position where they are unable to meet their debt obligations.

Refinancing venture debt can be a viable solution for some companies. By renegotiating the terms of the debt, such as extending the repayment period or lowering the interest rate, startups can ease their financial burden and improve their chances of success. However, refinancing is not always an option, as it depends on various factors such as the lender’s willingness to renegotiate and the financial stability of the company.

Ultimately, it is important for startups to carefully consider their financing options and weigh the risks and benefits before taking on debt. While venture debt can be a valuable tool for growth, it is crucial to have a solid repayment plan in place and to be prepared for any unforeseen challenges that may arise. By being proactive and strategic in their financial planning, startups can position themselves for long-term success.