As an entrepreneur, taking on debt can be a daunting prospect. With venture debt, there may be a fear that you will lose control of your company. But is this really the case? In this article, we will explore the relationship between venture debt and control of your company, and provide some insights into how you can make the best decision for your business.

Venture debt can be a useful tool for growing your company, but it’s important to understand the potential risks and benefits before deciding if it’s right for you. While there are some instances where taking on debt can lead to a loss of control, it’s not always the case with venture debt. So, let’s dive in and explore what you need to know before making a decision about venture debt.

If I take venture debt, will I lose control of my company?

Venture debt is a type of financing that is becoming increasingly popular among startups who want to grow their business without giving up equity. However, there are concerns among entrepreneurs that taking on venture debt may result in a loss of control over their company. In this article, we will explore whether or not this is true and what you should know before taking on venture debt.

What is venture debt?

Venture debt is a type of debt financing that is offered to startups and growing businesses that have already raised funding from venture capital firms. It is typically used to fund growth initiatives such as hiring new employees, expanding into new markets, or investing in new products or services. Unlike traditional bank loans, venture debt comes with a higher interest rate and often includes warrants or equity options that give the lender the right to purchase equity in the company at a later date.

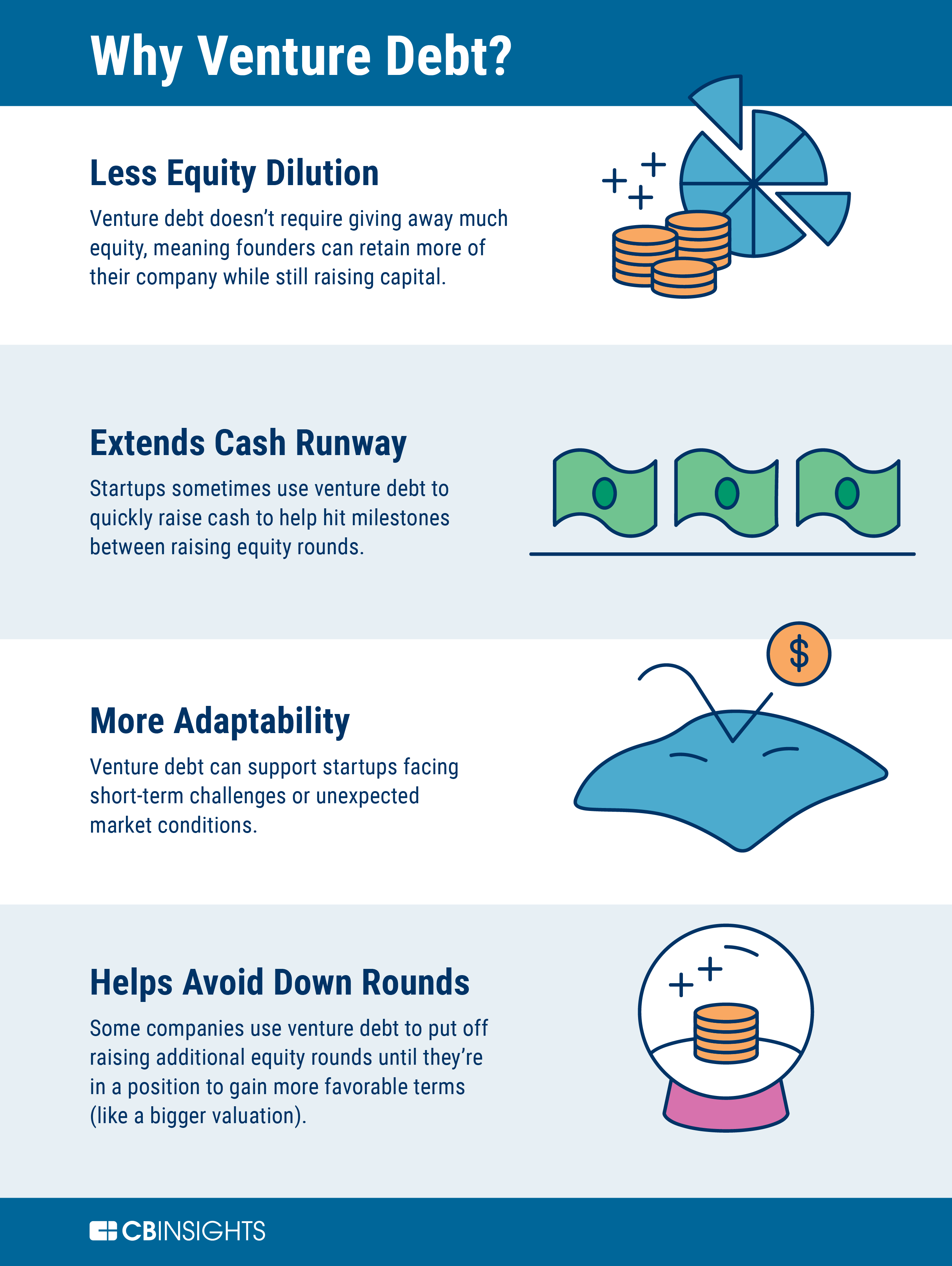

Benefits of venture debt

One of the main benefits of venture debt is that it allows startups to raise additional capital without giving up equity. This is especially important for founders who want to maintain control over their company and avoid dilution of their ownership stake. Venture debt can also be obtained more quickly and easily than equity financing, making it a good option for companies that need to raise money quickly. Additionally, because venture debt comes with warrants or equity options, it can provide additional upside potential for the lender and may be viewed more favorably by future investors.

Drawbacks of venture debt

While there are many benefits to venture debt, there are also some drawbacks that should be considered. One of the biggest risks is that if the company is not able to generate enough revenue to repay the debt, it may be forced to default. This could result in the lender taking ownership of the company’s assets or even liquidating the company. Additionally, because venture debt comes with a higher interest rate than traditional bank loans, it can be more expensive in the long run.

Will taking on venture debt result in a loss of control?

One of the biggest concerns that entrepreneurs have when it comes to taking on venture debt is that it may result in a loss of control over their company. While it is true that venture debt often comes with warrants or equity options that give the lender the right to purchase equity in the company, this does not necessarily mean that the founder will lose control.

Venture debt vs. equity financing

It is important to understand that venture debt is not the same as equity financing. With equity financing, the investor receives ownership in the company in exchange for their investment. This can result in the founder losing control over their company if they give up too much equity. With venture debt, on the other hand, the lender does not receive ownership in the company. Instead, they receive interest payments and may have the right to purchase equity in the future, but only if certain conditions are met.

Protecting your control

To protect their control over the company, founders can negotiate certain terms when taking on venture debt. For example, they can limit the amount of equity that can be purchased by the lender, or require the lender to obtain the founder’s approval before exercising their warrants or equity options. Additionally, founders can work with a lawyer to draft a strong agreement that protects their interests.

Conclusion

In conclusion, taking on venture debt does not necessarily mean that a founder will lose control over their company. While there are risks associated with venture debt, there are also many benefits, such as the ability to raise additional capital without giving up equity. By understanding the risks and benefits, and negotiating favorable terms, founders can make an informed decision about whether or not venture debt is the right choice for their business.

Frequently Asked Questions

What is venture debt?

Venture debt is a type of debt financing that is provided to startups and emerging businesses that have already raised equity funding. It is typically used to bridge the gap between equity rounds or to finance growth initiatives. Unlike traditional bank loans, venture debt often comes with equity warrants or options, which give the lender the right to purchase stock in the company at a predetermined price.

Venture debt can be a useful tool for startups that are looking to raise capital without diluting their equity or giving up control of their company. However, it is important to understand the terms and conditions of the loan agreement to ensure that it aligns with your business goals and objectives.

What are the benefits of venture debt?

Venture debt can provide several benefits to startups and emerging businesses. Firstly, it can provide a source of capital without diluting equity or requiring the founder to give up control of the company. Secondly, it can be a more flexible source of capital than traditional bank loans, as it often comes with more favorable terms and conditions. Thirdly, the equity warrants or options that are often included with venture debt can provide a potential upside for the lender and the company.

Overall, venture debt can be a useful tool for startups that are looking to finance growth initiatives or bridge the gap between equity rounds. However, it is important to carefully consider the terms and conditions of the loan agreement to ensure that it aligns with your business goals and objectives.

What are the risks of venture debt?

While venture debt can provide several benefits to startups and emerging businesses, it is not without its risks. Firstly, the interest rates on venture debt are typically higher than traditional bank loans, which can make it more expensive to borrow. Secondly, the equity warrants or options that are often included with venture debt can dilute the ownership of existing shareholders. Thirdly, if the company is unable to meet its debt obligations, the lender may have the right to seize assets or take control of the company.

Overall, venture debt can be a useful tool for startups that are looking to raise capital without diluting their equity or giving up control of their company. However, it is important to carefully consider the risks involved and ensure that the loan agreement aligns with your business goals and objectives.

How does venture debt differ from equity financing?

Venture debt and equity financing are two different types of financing that investors can use to invest in startups and emerging businesses. Equity financing involves the sale of ownership in the company in exchange for capital, while venture debt involves the borrowing of capital with interest and potential equity warrants or options.

The main difference between the two types of financing is that equity financing involves giving up ownership and control of the company, while venture debt allows the founder to maintain control and ownership. Additionally, equity financing typically involves a higher degree of risk for the investor, as they are investing in the potential of the company rather than the ability to repay the loan.

How can I ensure that I maintain control of my company if I take venture debt?

If you are considering taking venture debt, it is important to carefully review the terms and conditions of the loan agreement to ensure that you maintain control of your company. Firstly, you should ensure that the lender does not have the right to seize assets or take control of the company in the event of default. Secondly, you should carefully consider the equity warrants or options that are included in the loan agreement to ensure that they do not dilute existing shareholder ownership. Finally, you should ensure that the loan agreement aligns with your business goals and objectives to ensure that you maintain control of your company.

Overall, taking venture debt can be a useful tool for startups that are looking to finance growth initiatives or bridge the gap between equity rounds. However, it is important to carefully consider the terms and conditions of the loan agreement to ensure that it aligns with your business goals and objectives and that you maintain control of your company.

In conclusion, taking venture debt does not necessarily mean losing control of your company. While venture debt may come with certain covenants and restrictions, it is still a viable financing option for companies looking to grow and expand.

It is important to carefully review the terms and conditions of a venture debt agreement before signing, and to negotiate for terms that will allow you to maintain control over important aspects of your business.

Ultimately, taking on venture debt can be a strategic move that allows you to scale your business without diluting your equity or giving up management control. With the right approach and careful planning, venture debt can be a valuable tool for achieving your company’s growth objectives.