In recent years, there has been a noticeable shift in the way startups and entrepreneurs raise funds. While equity financing has been the traditional go-to method, there has been a surge in popularity for a relatively new form of financing: venture debt.

So, what exactly is venture debt and why is it becoming increasingly popular? In this article, we will delve into the world of venture debt and explore the reasons behind its growth in popularity among startups and investors alike.

Why is Venture Debt Growing in Popularity?

Venture capital is one of the most popular ways for startups to secure funding. However, in recent years, venture debt has been gaining popularity. So, why is venture debt growing in popularity?

1. Lower Cost of Capital

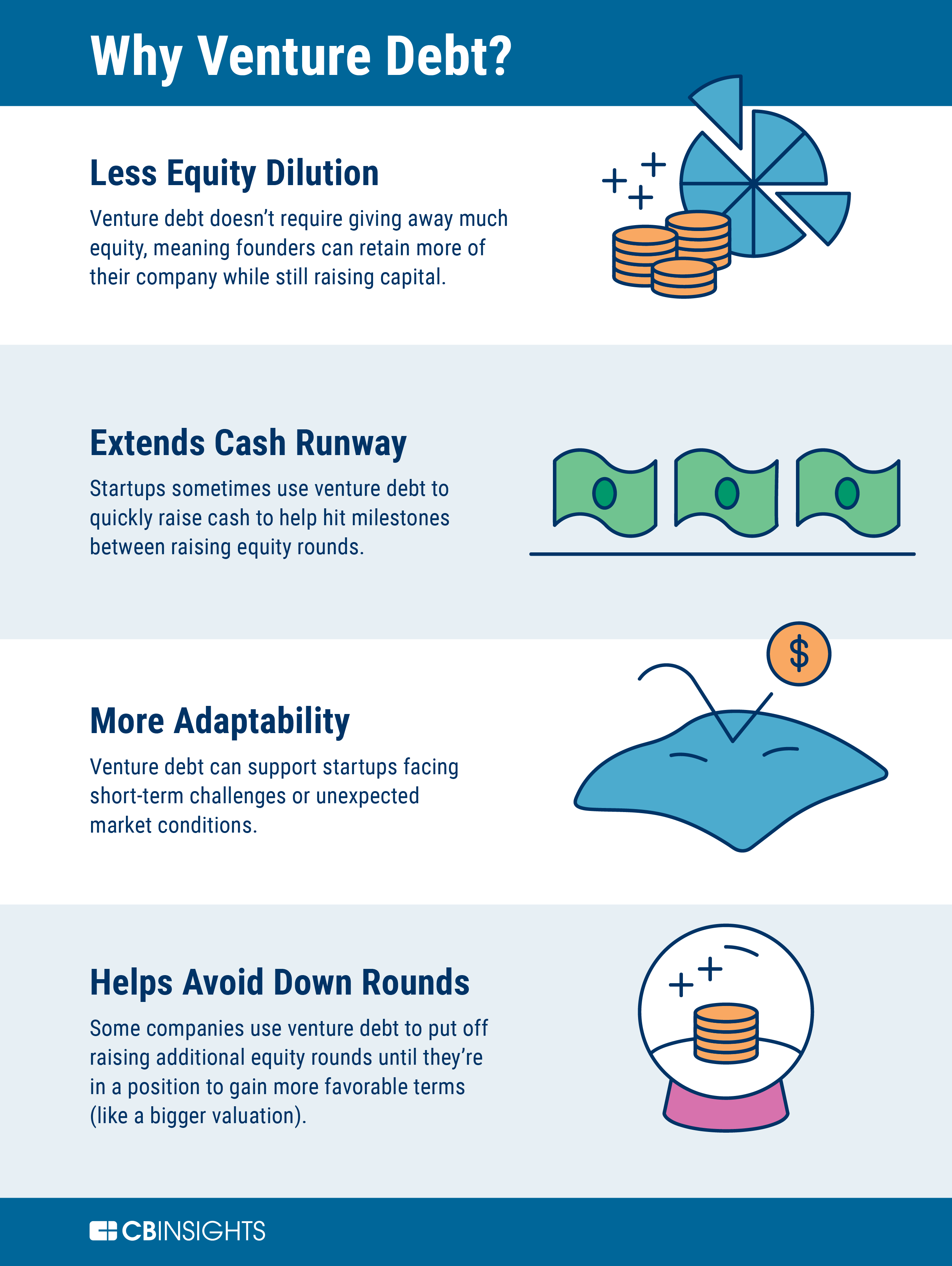

One of the biggest advantages of venture debt is that the cost of capital is lower than equity financing. This is because the interest rates on venture debt are typically lower than the return on equity investments. Additionally, venture debt does not dilute the ownership of the company, which is a huge advantage for founders.

Furthermore, venture debt can also be structured with warrants or equity kickers, which give the lender the option to purchase equity in the company at a later date. This can be a win-win situation for both the lender and the borrower, as the lender has the potential to earn a higher return, while the borrower can secure lower interest rates.

2. Flexibility

Another advantage of venture debt is its flexibility. Unlike equity financing, which typically requires a significant percentage of ownership, venture debt can be structured in a way that is more favorable to the borrower. This can include interest-only payments, deferred principal payments, and more.

Additionally, venture debt can be used for a variety of purposes. This includes financing growth, funding acquisitions, and even bridge financing between funding rounds.

3. Non-Dilutive Funding

Venture debt is a form of non-dilutive funding, which means that the ownership of the company is not diluted. This is a huge advantage for founders, as they are able to retain control of the company and its future. Additionally, venture debt can be structured with warrants or equity kickers, which give the lender the option to purchase equity in the company at a later date.

4. Funding for Non-Traditional Startups

Venture debt is not just for traditional tech startups. It can be used by a variety of companies, including those in the life sciences, energy, and even consumer goods industries. This means that even non-traditional startups can secure funding through venture debt.

5. Lower Risk for Lenders

Compared to equity financing, venture debt is a lower-risk investment for lenders. This is because the lender has a senior claim on the assets of the company, which means that if the company fails, the lender is more likely to recoup their investment. This makes venture debt an attractive option for lenders who are looking for lower-risk investments.

6. Complements Equity Financing

Venture debt can be used in conjunction with equity financing to provide a more balanced funding structure. This is especially useful for startups that are looking to grow quickly, as it allows them to secure more funding without diluting their ownership. Additionally, venture debt can help bridge the gap between funding rounds, providing startups with the capital they need to continue growing.

7. Faster Access to Capital

Compared to equity financing, venture debt can be secured much more quickly. This is because the due diligence process is typically less rigorous, and the paperwork is much simpler. This means that startups can secure funding more quickly, which can be a huge advantage when it comes to scaling quickly.

8. Increased Valuation

Venture debt can help increase the valuation of a company. This is because the additional funding can be used to fuel growth, which can in turn lead to higher revenues and a higher valuation. Additionally, venture debt can help startups achieve key milestones, which can also contribute to a higher valuation.

9. Lower Pressure to Exit

When startups secure equity financing, there is typically a lot of pressure to exit the company quickly. This is because investors are looking for a return on their investment, and the only way to achieve this is through an exit. With venture debt, there is less pressure to exit quickly, as the lender is not looking for an equity return. This means that founders can take the time they need to build a successful company.

10. Drawbacks of Venture Debt

While there are many advantages to venture debt, there are also some drawbacks that startups should be aware of. One of the biggest drawbacks is the risk of default. If the company is unable to make the payments on the debt, the lender has the right to seize the assets of the company. Additionally, if the company is not able to secure additional funding, it may be forced to take on more debt, which can be a vicious cycle.

In conclusion, venture debt is growing in popularity for a variety of reasons. It offers lower cost of capital, flexibility, non-dilutive funding, and faster access to capital. Additionally, venture debt can be used in conjunction with equity financing to provide a more balanced funding structure. However, it is important for startups to be aware of the risks of default and the potential for a vicious debt cycle. Overall, venture debt can be an attractive option for startups that are looking to secure funding without diluting their ownership.

**Frequently Asked Questions**

Venture debt has been gaining popularity as a financing option among startups and growing businesses. Here are some questions and answers to help you understand why.

What is venture debt?

Venture debt is a type of financing that provides debt capital to startups and growing businesses. Unlike traditional bank loans, venture debt is typically provided by specialized lenders who understand the unique needs and risks of startups. Venture debt is often used in combination with equity financing to help startups and growing businesses extend their runway and achieve key milestones.

Venture debt is typically structured as a loan with a fixed interest rate and a repayment schedule. In some cases, venture debt may include warrants or other equity-like features that give the lender the option to convert the debt into equity at a later date.

How does venture debt differ from equity financing?

Equity financing involves selling ownership in a company in exchange for capital. This means that investors become shareholders and have a say in how the company is run. In contrast, venture debt does not involve selling ownership in a company. Instead, it involves borrowing money that must be repaid with interest.

Equity financing is typically used to raise larger sums of capital and is often used for high-growth startups that have the potential for significant returns. Venture debt, on the other hand, is often used to extend a company’s runway and achieve key milestones without diluting existing shareholders.

What are the benefits of venture debt?

Venture debt can provide several benefits for startups and growing businesses. First, it can help extend a company’s runway and achieve key milestones without diluting existing shareholders. This can be especially important for startups that have a longer development cycle or are in capital-intensive industries.

Second, venture debt can provide more flexibility than equity financing. With equity financing, investors become shareholders and have a say in how the company is run. With venture debt, however, the lender does not become a shareholder and has no say in how the company is run. This can be beneficial for companies that want to maintain control of their business.

What are the risks of venture debt?

Like any type of financing, venture debt has its risks. One of the biggest risks is that the company may not be able to repay the loan if it does not achieve its milestones or generate enough revenue. This can lead to default and potentially bankruptcy.

Another risk is that the lender may have the option to convert the debt into equity at a later date. This can dilute existing shareholders and reduce their ownership in the company.

When is venture debt a good option?

Venture debt can be a good option for startups and growing businesses that have a clear path to revenue and profitability but need additional capital to achieve key milestones. It can also be a good option for companies that want to maintain control of their business and avoid diluting existing shareholders through equity financing.

However, venture debt may not be a good option for companies that are not generating revenue or have a longer development cycle. It may also not be a good option for companies that are in a highly competitive industry where there is a risk of market disruption or a significant change in market conditions.

The Value of Venture Debt Explained – Trinity Capital Inc.

In conclusion, there are a number of reasons why venture debt is growing in popularity. Firstly, it allows startups to access additional financing without having to dilute their equity. This is particularly important for companies that are still in the early stages of development and are not yet ready to give up a significant portion of their ownership.

Secondly, venture debt is often more flexible than traditional debt financing. This means that startups are able to customize the terms of their financing to better suit their needs. For example, they may be able to negotiate more favorable interest rates or repayment schedules.

Finally, venture debt is often seen as a vote of confidence in a startup’s potential for success. By securing debt financing, startups are able to demonstrate to investors and other stakeholders that they have a solid business plan and are committed to achieving their goals.

Overall, the rise of venture debt is a positive trend for the startup ecosystem. It provides startups with a much-needed alternative to traditional equity financing and allows them to access the capital they need to grow and succeed. As the startup landscape continues to evolve, it is likely that we will see even more innovation in the financing space, including new types of debt and equity financing that are tailored to the needs of early-stage companies.