Venture debt has become an increasingly popular financing option for startups looking to raise capital. However, some entrepreneurs are hesitant to take on this type of debt because they fear it may give more control to lenders.

While it’s true that venture debt does come with certain covenants and restrictions, it’s important to understand the nuances of the agreement before making any assumptions. In this article, we’ll explore the topic of venture debt and whether or not it truly gives more control to lenders.

Doesn’t Venture Debt Give More Control to Lenders?

Understanding Venture Debt

Venture debt is a type of financing that provides capital to startups and early-stage companies. Unlike traditional equity financing, venture debt does not involve selling ownership in the company. Instead, it provides a loan that the company must repay with interest.

Venture debt can be an attractive option for companies that are not yet profitable or that have not yet reached their full growth potential. It can help these companies to finance operations, expand their product lines, and accelerate their growth without diluting their equity.

The Role of Lenders in Venture Debt

Lenders play an important role in venture debt financing. They provide the capital that companies need to grow and expand, and they expect to be repaid with interest. However, lenders do not typically have the same level of control over the company as equity investors.

In most cases, venture debt lenders do not have voting rights or board seats, and they do not have the ability to make strategic decisions for the company. They are primarily focused on minimizing their risk and maximizing their return on investment.

The Benefits of Venture Debt for Companies

Venture debt can provide a number of benefits for companies that are looking to grow and expand. Some of the key benefits include:

- Access to capital without diluting equity

- Lower cost of capital compared to equity financing

- Faster and easier to obtain than traditional bank loans

- Flexible repayment terms

The Benefits of Venture Debt for Lenders

Venture debt can also be an attractive option for lenders. Some of the benefits of venture debt for lenders include:

- Higher returns on investment compared to traditional fixed-income securities

- Lower risk compared to equity investments

- Collateralized debt that is secured by the company’s assets

Venture Debt vs. Traditional Bank Loans

Venture debt and traditional bank loans are both sources of financing for companies, but they have some key differences.

While traditional bank loans typically require collateral and a personal guarantee from the borrower, venture debt is often unsecured and does not require a personal guarantee. In addition, venture debt lenders are typically more willing to work with startups and early-stage companies that may not have a long track record of profitability or a significant asset base.

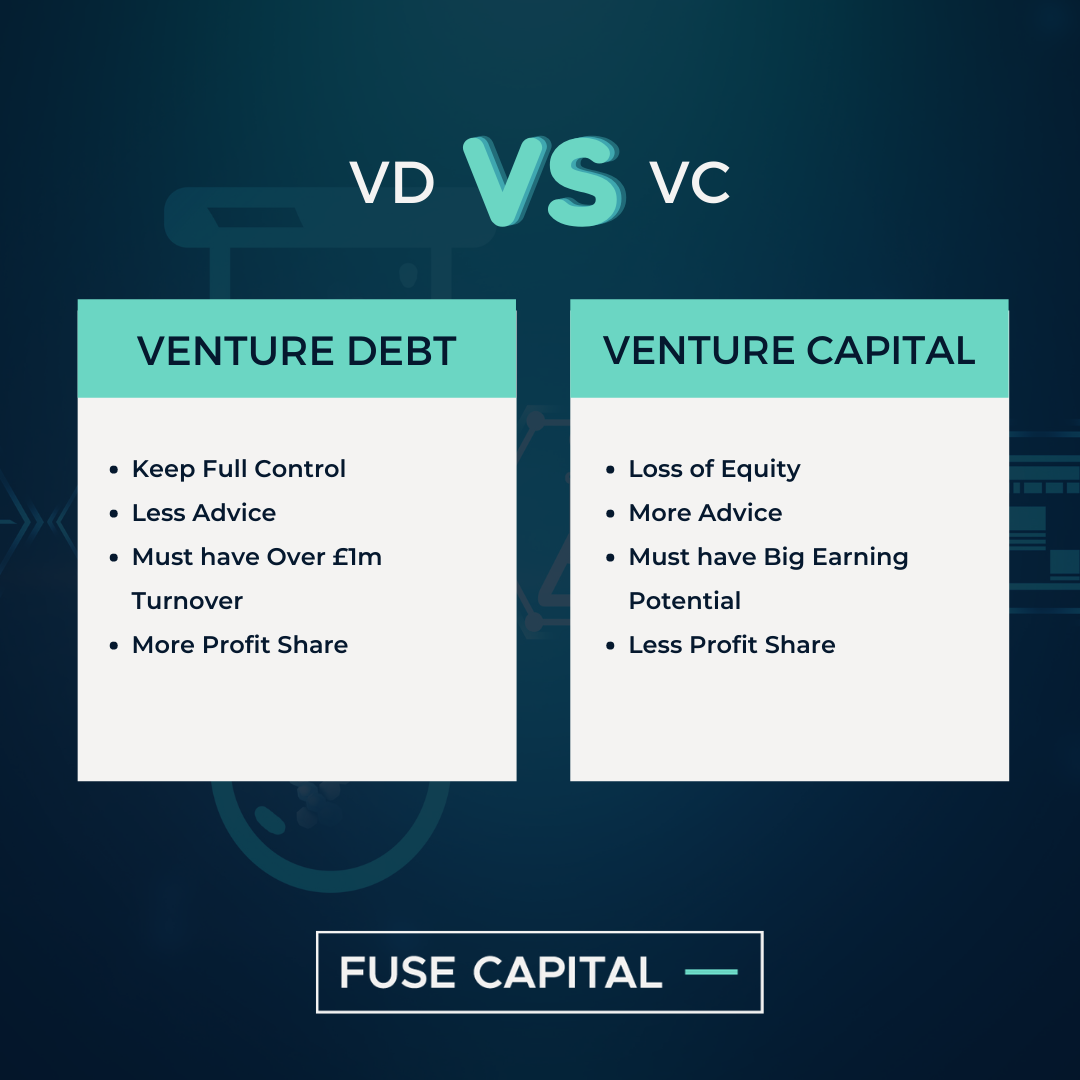

Venture Debt vs. Equity Financing

Venture debt and equity financing are also different sources of funding for companies. While equity financing involves selling ownership in the company, venture debt provides a loan that must be repaid with interest.

One of the key benefits of venture debt is that it allows companies to raise capital without diluting their equity. This can be particularly attractive for companies that have a promising product or service but do not yet have the revenue or profitability to support a high valuation.

Conclusion

In conclusion, while venture debt does involve lenders providing capital to companies, it does not necessarily give them more control over the company. Lenders in venture debt financing are primarily focused on minimizing their risk and maximizing their return on investment, while companies benefit from the access to capital, lower cost of capital, and flexible repayment terms that venture debt provides.

Frequently Asked Questions

What is venture debt?

Venture debt is a form of debt financing that is tailored to venture-backed companies. Unlike traditional bank loans, venture debt is typically provided by specialized lenders who understand the unique needs and risks of early-stage companies.

While venture debt often involves higher interest rates and stricter repayment terms than traditional bank loans, it can be a useful tool for companies that are looking to maximize growth while minimizing equity dilution.

How does venture debt work?

Venture debt is typically structured as a loan with interest and principal repayment obligations. Some venture debt lenders may also receive equity or warrants in the borrower company as part of the financing package.

Because venture debt lenders are typically more familiar with the risks and opportunities of early-stage companies, they may be willing to offer financing at lower interest rates than traditional banks. However, venture debt lenders may also require more stringent covenants and collateral requirements to mitigate their risk exposure.

What are the benefits of venture debt?

Venture debt can provide several benefits to early-stage companies, including access to capital without diluting equity, lower cost of capital than equity financing, and the ability to extend runway and achieve key milestones.

Additionally, venture debt can be a useful tool for companies that have already raised equity financing and are looking to balance their capital structure or bridge to the next equity financing round.

What are the risks of venture debt?

While venture debt can provide several benefits to early-stage companies, it also carries several risks. Venture debt lenders may require strict repayment terms and covenants, which can limit a company’s flexibility and growth potential.

In addition, if a company is unable to meet its repayment obligations, the venture debt lender may have the right to foreclose on the company’s assets or convert the debt to equity, which can dilute existing shareholders.

How much control do venture debt lenders have?

While venture debt lenders may require more stringent covenants and collateral requirements than traditional banks, they typically do not have more control over a company’s operations or strategic decisions.

In most cases, venture debt lenders do not have board seats or voting rights, and they do not have the power to dictate a company’s business strategy or day-to-day operations. However, if a company defaults on its debt obligations, the venture debt lender may have the right to take action to protect its investment.

Top 6 Mistakes Startups Make When Raising Venture Debt

In conclusion, while it may seem that venture debt gives more control to lenders, this is not necessarily the case. Venture debt can actually provide valuable financing options for startups and emerging companies, allowing them to grow and expand their operations. By working with the right lender and negotiating favorable terms, startups can maintain control over their business while still accessing the capital they need to succeed.

It is important to note that venture debt is not without risk. Startups should carefully consider their financing options and work with experienced lenders to ensure they are getting the best deal possible. By doing so, they can avoid the pitfalls of high interest rates, restrictive covenants, and other challenges that can come with debt financing.

Ultimately, the decision to pursue venture debt or other financing options will depend on the unique needs and goals of each startup. By weighing the pros and cons and working with trusted advisors, startups can make informed decisions that will help them achieve their long-term objectives and thrive in a competitive business environment.