Are you a startup founder looking for funding? Have you considered venture debt financing? While it may not be as well-known as traditional equity financing, venture debt can offer unique benefits to growing companies. In this article, we’ll explore when it makes sense to consider venture debt financing, and how it can help your business reach its goals. So, let’s dive in!

When to Opt for Venture Debt Financing?

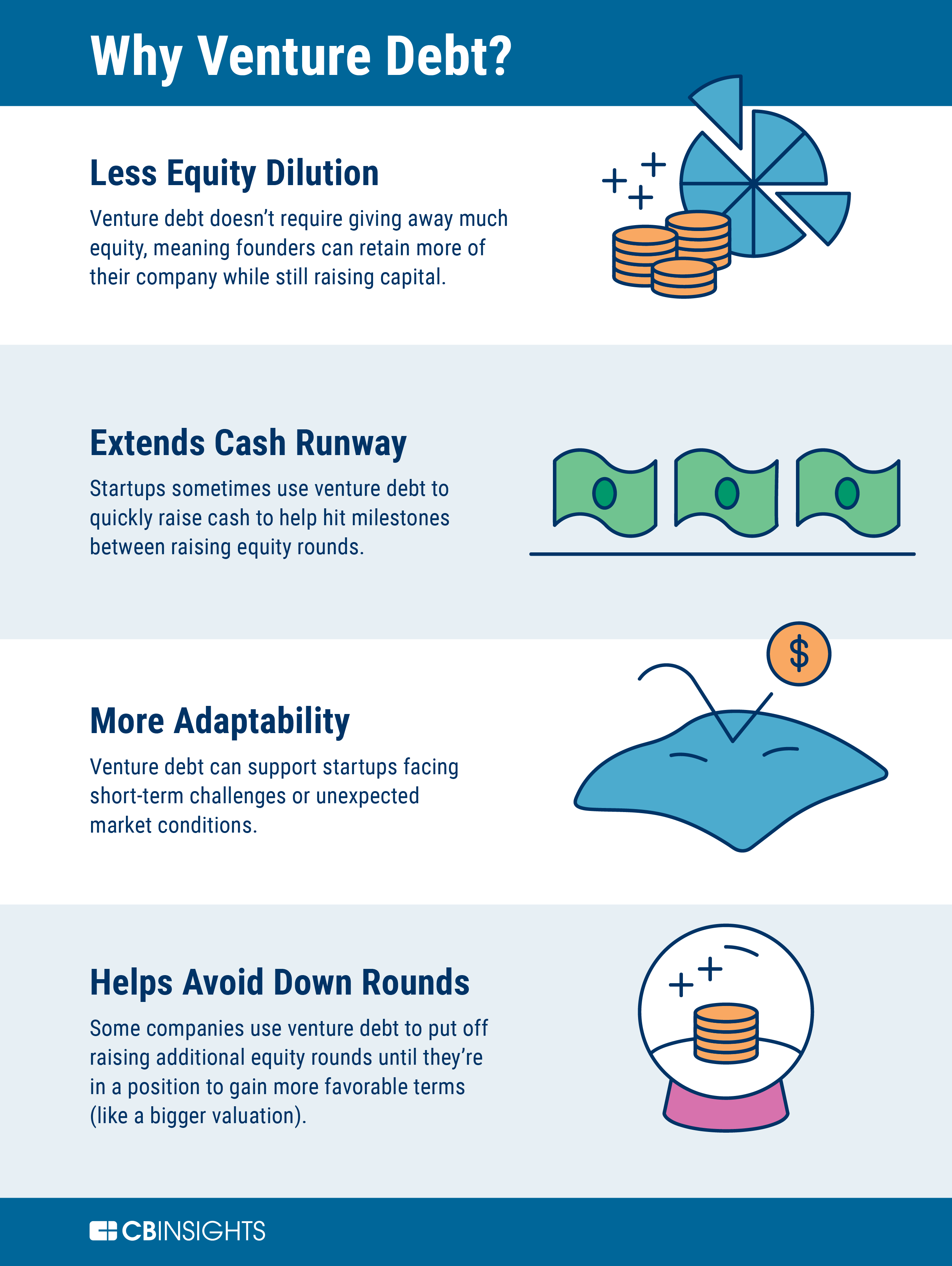

Venture debt financing is a type of debt financing that is provided to startups and high-growth companies. It is an alternative to equity financing and is typically provided by specialized lenders. Venture debt is often used to bridge the gap between equity rounds or to finance growth initiatives. In this article, we will explore the situations in which a company should consider venture debt financing.

1. Funding for Growth Initiatives

When a company is experiencing rapid growth, it may need additional capital to fund new initiatives, such as expanding into new markets or developing new products. Venture debt financing can provide the necessary capital to fund these initiatives without diluting the ownership of the company. Additionally, venture debt can be used to finance capital expenditures, such as equipment, that are necessary for growth.

However, it is important to note that venture debt financing is typically more expensive than traditional debt financing. Companies should weigh the cost of financing against the potential benefits of growth initiatives.

2. Extending Cash Runway

A company’s cash runway is the amount of time it has until it runs out of cash. Venture debt financing can be used to extend a company’s cash runway, giving it more time to achieve profitability or secure additional funding. This is particularly useful for companies that are close to achieving profitability but need more time to get there.

It is important to note that extending a company’s cash runway through venture debt financing should not be seen as a long-term solution. Companies should still work to achieve profitability as soon as possible to avoid becoming over-leveraged.

3. Complementing Equity Financing

Venture debt financing can be used to complement equity financing. For example, a company may use venture debt to bridge the gap between equity rounds or to finance a growth initiative while it waits for the next equity round. This can help the company avoid diluting the ownership of the company while still obtaining the necessary capital.

However, it is important to note that venture debt financing is not a substitute for equity financing. Companies should still aim to raise equity financing to fund their long-term growth initiatives.

4. Improving Valuation in Future Equity Rounds

Venture debt financing can improve a company’s valuation in future equity rounds. This is because venture debt financing can help a company achieve its growth initiatives, which can lead to higher revenues and profits. Higher revenues and profits can lead to a higher valuation in future equity rounds.

However, it is important to note that venture debt financing can also lead to a higher debt-to-equity ratio, which can make the company less attractive to potential equity investors. Companies should carefully consider the impact of venture debt financing on their future equity rounds.

5. Funding for Specific Projects

Companies may use venture debt financing to fund specific projects, such as product development or marketing initiatives. This can help the company avoid diluting the ownership of the company while still obtaining the necessary capital.

It is important to note that venture debt financing is typically more expensive than traditional debt financing. Companies should weigh the cost of financing against the potential benefits of specific projects.

6. Mitigating Dilution

Venture debt financing can help mitigate dilution for existing shareholders. This is because venture debt financing does not dilute the ownership of the company. Instead, the lender receives interest payments and warrants, which can be converted into equity at a later date.

However, it is important to note that venture debt financing can still lead to dilution if the warrants are exercised. Companies should carefully consider the impact of venture debt financing on their ownership structure.

7. Flexibility in Repayment

Venture debt financing can provide flexibility in repayment. Unlike traditional debt financing, venture debt financing typically has fewer covenants and does not require regular principal payments. This can help a company manage its cash flow and avoid defaulting on its debt.

However, it is important to note that venture debt financing typically has higher interest rates and fees than traditional debt financing. Companies should carefully consider the cost of financing against the flexibility of repayment.

8. Quick Access to Capital

Venture debt financing can provide quick access to capital. Unlike equity financing, which can take several months to close, venture debt financing can be closed in a matter of weeks. This can be particularly useful for companies that need capital quickly to fund growth initiatives.

However, it is important to note that venture debt financing typically requires a personal guarantee from the company’s founders or management team. This can be a significant risk for the individuals involved.

9. Leveraging Non-Dilutive Capital

Venture debt financing can help a company leverage non-dilutive capital. This is because venture debt financing does not dilute the ownership of the company. Instead, the lender receives interest payments and warrants, which can be converted into equity at a later date.

However, it is important to note that venture debt financing can still lead to dilution if the warrants are exercised. Companies should carefully consider the impact of venture debt financing on their ownership structure.

10. Lower Cost of Capital than Equity Financing

Venture debt financing typically has a lower cost of capital than equity financing. This is because venture debt financing is less risky for the lender than equity financing. Additionally, venture debt financing typically has a fixed interest rate, which can help a company manage its cash flow.

However, it is important to note that venture debt financing is still more expensive than traditional debt financing. Companies should carefully consider the cost of financing against the potential benefits.

In conclusion, venture debt financing can be a useful tool for companies that are seeking capital to fund growth initiatives, extend their cash runway, or complement equity financing. However, companies should carefully consider the cost of financing against the potential benefits and the impact on their ownership structure. Venture debt financing is not a substitute for equity financing, and companies should still aim to raise equity financing to fund their long-term growth initiatives.

Frequently Asked Questions

What is venture debt financing?

Venture debt financing is a type of financing where a company borrows money from a lender, usually a bank or a specialized venture debt firm, in exchange for interest payments and/or a percentage of equity. It is often used by startups and high-growth companies that need additional capital to fund their operations or growth, but do not want to dilute their ownership by issuing more equity.

Venture debt financing is typically structured as a loan with a fixed term and interest rate. It may also include warrants or other equity-like features that can provide additional upside potential to the lender. The amount of debt that a company can raise will depend on its financial and operational performance, as well as the lender’s assessment of its growth prospects and market potential.

How does venture debt financing differ from equity financing?

Venture debt financing and equity financing are two different ways for companies to raise capital. Equity financing involves selling a portion of ownership in the company to investors in exchange for cash. This can dilute the ownership of existing shareholders, but also provides the potential for investors to share in the future profits and growth of the company.

Venture debt financing, on the other hand, does not involve selling ownership in the company. Instead, it is structured as a loan that must be repaid with interest, usually over a fixed period of time. This can be attractive to companies that want to maintain control and ownership of their business, but also need additional capital to fund growth or operations.

What are the advantages of venture debt financing?

Venture debt financing can offer several advantages to companies, including:

- Lower cost of capital compared to equity financing

- No dilution of ownership or control

- Flexible repayment terms and structures

- Access to additional capital without the need to raise more equity

- Ability to leverage existing equity and funding sources

However, it is important to note that venture debt financing also comes with risks and potential downsides, such as higher interest rates, stricter covenants, and the potential for default or bankruptcy if the company is unable to repay the debt.

When is venture debt financing a good option?

Venture debt financing can be a good option for companies that:

- Have a proven business model and track record of growth

- Need additional capital to fund operations or growth, but do not want to dilute ownership or control

- Have a clear plan for how the capital will be used and how it will generate a return on investment

- Are comfortable taking on additional debt and can manage the cash flow and repayment obligations

It is important for companies to carefully evaluate the costs, risks, and benefits of venture debt financing before deciding whether it is the right option for them.

How can companies find venture debt lenders?

There are several ways for companies to find venture debt lenders, including:

- Working with a financial advisor or investment bank that specializes in venture debt financing

- Researching and reaching out to venture debt firms directly

- Networking with investors, entrepreneurs, and other industry professionals to get referrals and recommendations

- Attending industry events and conferences to meet potential lenders and learn about their financing options

It is important for companies to do their due diligence and carefully evaluate potential lenders before entering into any financing agreement.

In conclusion, venture debt financing can be a great option for startups looking to raise capital without diluting their equity. However, it is important to carefully consider the timing and circumstances in which to opt for this type of financing.

First, startups should have a clear path to profitability and a solid understanding of their cash flow needs. Venture debt financing can be helpful to bridge short-term gaps in funding, but it is not a long-term solution for ongoing cash flow issues.

Second, startups should have a strong track record of growth and a clear plan for future expansion. Venture debt financing is typically offered to companies with proven traction and a clear path to success.

Finally, startups should carefully evaluate the terms and conditions of any venture debt financing offer. It is important to work with a lender who understands the unique needs of startups and offers flexible terms that align with the company’s long-term goals.

By considering these factors, startups can determine whether venture debt financing is the right choice for their business and set themselves up for long-term success.