Venture debt is one of the most popular forms of financing for startups. It provides a way for companies to raise capital without diluting equity, and it can be a great alternative to traditional bank loans. However, as with any form of debt, there may come a time when it makes sense to refinance. In this article, we’ll explore when it might be a good idea to refinance your venture debt and what factors you should consider when making that decision.

While venture debt can be a great way to fund growth, there may come a point where the terms of the debt are no longer favorable for your business. Market conditions, changes in interest rates, and a variety of other factors can all impact the cost and terms of your debt. Refinancing can help you take advantage of more favorable terms and improve your company’s financial position. Let’s take a closer look at when it might make sense to refinance your venture debt.

When to Refinance Venture Debt: A Comprehensive Guide

Venture debt is a popular financing option for startups, particularly in the early stages of their growth. However, as a startup grows and its financial situation evolves, it may become necessary to refinance the venture debt. In this article, we will explore the key considerations for when to refinance venture debt.

1. Evaluating the Current Debt Situation

The first step in determining whether to refinance venture debt is to evaluate the current debt situation. This means assessing the interest rate, maturity date, covenants, and other terms of the existing debt. It is important to understand the current debt structure and its impact on the company’s financials and operations.

One way to evaluate the current debt situation is to create a debt amortization schedule. This schedule will help identify the principal and interest payments over time, and when the debt will be fully paid off. It will also help determine the total interest paid over the life of the debt.

2. Assessing the Company’s Financial Position

Another key consideration when deciding whether to refinance venture debt is the company’s financial position. This includes assessing the company’s revenue, profitability, cash flow, and other financial metrics. It is important to have a clear understanding of the company’s financial health and its ability to service the debt.

One way to assess the company’s financial position is to create a financial forecast. This forecast will help project the company’s revenue, expenses, and cash flow over time. It will also help identify any potential financial challenges and opportunities.

3. Evaluating the Current Market Conditions

Market conditions can also impact the decision to refinance venture debt. This includes assessing the current interest rate environment, as well as any changes in the market that may impact the company’s ability to secure financing.

One way to evaluate the current market conditions is to research the interest rates for comparable debt offerings. It is also important to stay up-to-date on any changes in the market that may impact the company’s financial situation.

4. Identifying Potential Refinancing Options

Once the current debt situation, financial position, and market conditions have been evaluated, the next step is to identify potential refinancing options. This includes assessing the various debt offerings available, such as term loans, lines of credit, and convertible debt.

It is important to compare the terms and interest rates of each potential refinancing option, as well as the impact on the company’s financials and operations.

5. Assessing the Impact on Equity Holders

Refinancing venture debt can have an impact on equity holders, particularly if the refinancing includes a conversion of debt to equity. It is important to assess the potential impact on equity holders and ensure that the refinancing does not dilute their ownership stake.

One way to assess the impact on equity holders is to create a pro forma capitalization table. This table will help identify the impact of the refinancing on the ownership and equity value of the company.

6. Ensuring Compliance with Covenants

When refinancing venture debt, it is important to ensure compliance with any existing covenants. This includes assessing the impact of the refinancing on the company’s ability to meet its covenant requirements.

One way to ensure compliance with covenants is to create a covenant compliance calendar. This calendar will help track the timing and requirements of each covenant, as well as any potential issues or challenges.

7. Negotiating the Refinancing Terms

Once potential refinancing options have been identified, the next step is to negotiate the terms of the refinancing. This includes negotiating the interest rate, maturity date, covenants, and other key terms.

It is important to carefully review and negotiate the refinancing terms to ensure they align with the company’s financial goals and objectives.

8. Closing the Refinancing

After the refinancing terms have been negotiated, the next step is to close the refinancing. This includes signing the new debt documents, paying off the existing debt, and ensuring compliance with any closing requirements.

It is important to carefully review and understand the closing requirements to ensure a smooth and successful refinancing.

9. Benefits of Refinancing Venture Debt

There are several benefits to refinancing venture debt, including lower interest rates, improved financial flexibility, and the ability to extend the maturity date. Refinancing can also help improve the company’s credit profile and make it more attractive to future investors.

10. Refinancing vs. Paying Off Debt

When evaluating whether to refinance venture debt, it is important to consider the alternative of paying off the debt. While refinancing can provide benefits such as lower interest rates and improved financial flexibility, paying off the debt can help reduce overall debt levels and improve the company’s financial position.

It is important to carefully evaluate the pros and cons of each option and choose the one that aligns with the company’s financial goals and objectives.

In conclusion, refinancing venture debt can be a complex and important decision for startups. By evaluating the current debt situation, financial position, and market conditions, assessing potential refinancing options, and carefully negotiating and closing the refinancing, startups can make informed decisions that align with their financial goals and objectives.

Frequently Asked Questions

What is venture debt?

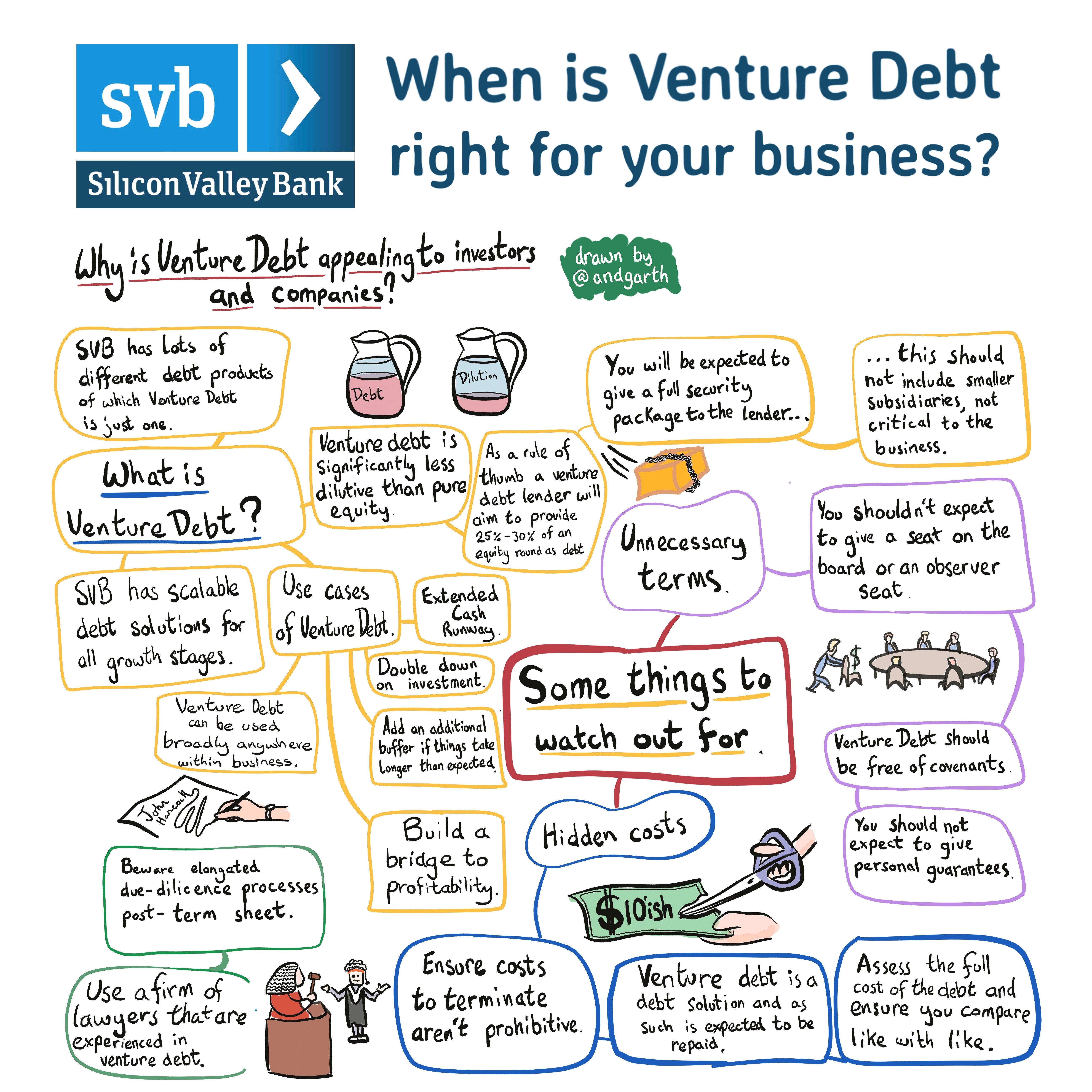

Venture debt is a type of debt financing provided by specialized lenders to early-stage companies that have already raised equity financing. It is a form of debt that is secured by the company’s assets, such as intellectual property, equipment, and inventory.

What are the advantages of venture debt?

Venture debt offers several advantages to early-stage companies. First, it provides additional capital without diluting the ownership of existing shareholders. Second, it is less expensive than equity financing. Third, it can help companies extend their cash runway and reach important milestones.

How do you know when to refinance venture debt?

When considering whether to refinance venture debt, companies should consider several factors. First, they should look at their current cash position and determine whether they need additional capital. Second, they should evaluate the terms of their existing debt and compare them to the terms of potential new debt. Finally, they should consider the impact of refinancing on their overall capital structure.

What are the risks of refinancing venture debt?

Refinancing venture debt involves several risks that companies should be aware of. First, it may result in higher interest costs or fees. Second, it may require the company to pledge additional collateral. Third, it may result in changes to the company’s capital structure that could impact its ability to raise future financing.

What should companies consider before refinancing venture debt?

Before refinancing venture debt, companies should consider several factors. First, they should evaluate their current financial position and determine whether they need additional capital. Second, they should review the terms of their existing debt and compare them to the terms of potential new debt. Finally, they should consult with their legal and financial advisors to ensure that they understand the potential risks and benefits of refinancing.

How to think about venture debt

In conclusion, deciding when to refinance venture debt is a crucial decision that can impact the financial health of your business. It’s important to keep an eye on your cash flow and analyze your debt obligations regularly to determine if refinancing is the right option for you.

Refinancing can offer many benefits, such as lower interest rates, more favorable terms, and improved cash flow. However, it’s important to weigh the costs and potential risks associated with refinancing, including additional fees, longer repayment terms, and potential damage to your credit score.

Ultimately, the decision to refinance venture debt should be based on a careful analysis of your business’s financial situation and future goals. By working closely with your lender and financial advisors, you can make an informed decision that will help you achieve long-term success and growth for your business.